Sales of most carbonated soft drinks (CSDs) remain on a downward trend, while bottled water brands posted their worst month in the past year, according to new Nielsen data provided in a report by Wells Fargo Securities.

The data, which covered a four-week period ending on April 13, found that CSD dollar sales declined by 4.1 percent, compared to 3.3 percent last month. The category’s equivalent unit pricing gains of 2.2 percent barely offset the equivalent unit volume decline of 6.1 percent.

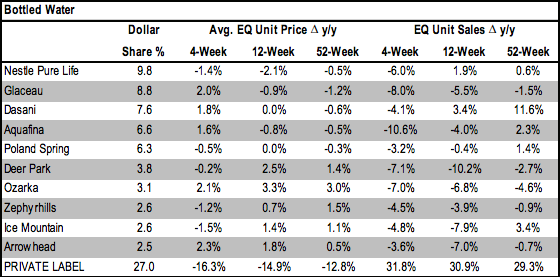

Meanwhile, dollar sales of water brands declined 1.7 percent despite an 8.3 percent reduction in pricing. Aquafina had its worst month in over a year, as dollar sales of bottled water declined by 15.7 percent over the past four weeks after an 11 percent decline last month. And amid legislative pressures, energy drinks have posted their third consecutive month of minimal growth, with only a 1.8 percent increase in dollar sales.

Coca-Cola Co. (KO) is feeling the weight of the struggling CSD category. The soda giant’s dollar sales declined 3.9 percent over the past four weeks, compared to a decline of 1.6 percent last month and an increase of 2.9 percent in the previous year. The total CSD industry, which excludes the energy category, declined in dollar sales by 5.9 percent, compared to a decline of 2.4 percent last month and an increase of 4.7 percent in the previous year. Equivalent unit sales in the category declined by 8.8 percent as the average equivalent unit price increased by 3.2 percent.

As Coca-Cola aims to rebound from discouraging numbers, Dr Pepper Snapple Group (DPS) may be encouraged by a mild uptick in sales. While the company’s dollar sales declined by 1.1 percent in the past four weeks, compared to a 1.9 percent decline last month, and CSD dollar sales and equivalent unit sales declined by 1.5 percent, DPS’ low-calorie offerings declined by just 0.7 percent, compared to a 7 percent decline in the rest of the category. Also helping lead DPS to encouraging numbers in a struggling category, Canada Dry increased dollar sales by 10 percent, with its diet offering increasing dollar sales by 6.4 percent.

Although Wells Fargo expects CSD volume trends to remain in decline, the investment bank noted that summer pricing could help Coke’s rise from the dregs.

“Despite a tough month for KO, we remain optimistic about KO’s ability to generate positive [dollar] sales growth as pricing rationalizes going into the summer months,” the report noted.

Yet as CSDs (aside from DPS) and water typically falter, dollar sales of refrigerated juices increased 6.6 percent, complemented by a 3.2 percent increase in pricing and a 3.3 percent increase in volume sales. Refrigerated juices and drinks posted an 8.8 percent increase in dollar sales, buttressed by strong performances from Tropicana, which increased its dollar share by 19.8 percent, and Naked, which has increased equivalent unit sales in the past four weeks by 51. 3 percent, resulting in a 5.9 percent increase in dollar share.