Bevscape Business

Balance Water, a line of functional waters infused with tasteless herbal extracts, pulled in between $4 and 5 million in investment recently, according to co-founder Martin Chalk.

The funding came from a mix of sources: Emil Capital Partners supplied institutional cash, while famed investor Thomas H. Lee, the founder of Thomas H. Lee partners, put in money as an individual investor, as did Australian actor Hugh Jackman. Jackman had been an angel investor along with Antoine Firmenrich, a member of the family that owns the eponymous European flavor and scent company.

“Once we started to see same store sales grow steadily, we know we had a sustainable business model,” Chalk said.

The company hired Silverwood Partners to help it shop for investors. Part of the attraction for investors was the company’s growing international profile: Balance started in Australia and recently added an office in Cologne, Germany. The company owns its own supply chain to provide the floral extracts needed to create its Travel, Relax, and Mind varieties, as it started an Australian company called Wandarra to source plants from the tropical zone of northern Australia.

While Balance started in Australia, it has grown in the U.S. with a largely Northeast- and New York-focused distribution strategy. For the past three years it has gone to market through a mix of companies like broadline natural foods broker UNFI and also DSD house Exclusive. Cascadia Managing Brands has been advising Balance on route-to-market decisions.

Chalk said that the money would go toward supporting DSD operations with sales professionals.

This is the second beverage investment this a year for Emil Capital Partners, which also invested in CherryPharm, the maker of Cheribundi, in February.

Meanwhile, financially troubled energy shot maker Bazi announced that it has entered into a merger agreement with GT Beverage Company, which manufactures a line of vitamin-enhanced water drinks for kids. GT received 95.5 percent of the common shares outstanding of Bazi, which has received a line of credit from GT for up to $600,000. The merger is expected to close on or before October 15, 2012, subject to certain conditions in the agreement.

Debbie Wildrick, the CEO of Bazi, stated that the merger enables the company “to continue building shareholder value and continue to support the Bazi brand.”

After reformulating its energy shot to an all-natural mix eight months ago, Wildrick said that Bazi is now hoping to establish a stronger sales presence online, noting that because consumer education is a key component to marketing Bazi, e-commerce is a more effective way to reach new customers.

Wildrick said that she will stay on as Bazi’s CEO at least until the merger is finalized, but did not know if she would stay in the position past that point, noting that GT Beverage is the midst of building a team to run Bazi after the merger is complete. Wildrick stated the merger would likely create an overlap in positions and responsibilities between the two companies.

Finally, a letter sent to stockholders of the long-struggling Adina beverage company seemed to indicate that the new age beverage shop’s doors are about to close for good. The company indicated that it was in the midst of selling through its remaining stock but is also liquidating its assets in order to satisfy debt obligations.

The company’s financial problems came to light last year when acting CEO Norm Snyder indicated that the company was in need of about $10 million in capital to sustain long-term strategic goals. Failing that, the company instead cut its distribution radius, concentrating largely on its accounts with the powerful Dr Pepper/Snapple Group distribution network. Those accounts were largely scattered geographically, however: sales through the Ohio, Texas, Pittsburgh and some California DPSG shops proved insufficient even as the company attempted to conserve cash by furloughing employees and otherwise reducing costs.

“While we continue to seek a buyer for Adina or its assets, we need to begin the shutdown process,” noted the letter, from the Adina board of directors.

Adina had morphed over several years from a fair-trade based juice drink play run by Odwalla founder Greg Steltenpohl to one that focused on canned coffee under a “Drink No Evil” message before finally settling on a platform of herbal infusions called “Holistics.” While launching nationally through money supplied by former PepsiCo CEO Roger Enrico and several investment rounds with Sherbrooke Capital — which installed SoBe founder John Bello at the helm — the company managed to quickly gather buy-in from a national distribution network of independent DSD shops. But the brand never quite caught fire with consumers, and pricing changes and never found a niche in terms of pricing and variety.

Eventually, Bello cashed himself out of Sherbrooke, and at one point was believed to be preparing a group to take over Adina, but a deal never materialized.

Regulation: New York Bans Jumbo Sodas

Reactions to a new policy proposal by New York Mayor Michael Bloomberg that would fine stores and vendors from selling single-serve sugar-sweetened beverages larger than 16 ounces ranged from outrage to applause last month.

While the American Beverage Association reached out to members to assure them of a “full court press” from legal, communications, and advocacy channels to battle the ban, others, including Zevia CEO Paddy Spence and Q Tonic founder Jordan Silbert took advantage of the proposal to tout their own products. Zevia quickly put out a series of advertisements agreeing with Bloomberg, while Silbert (along with many other companies) quickly sent cases of its products to City Hall.

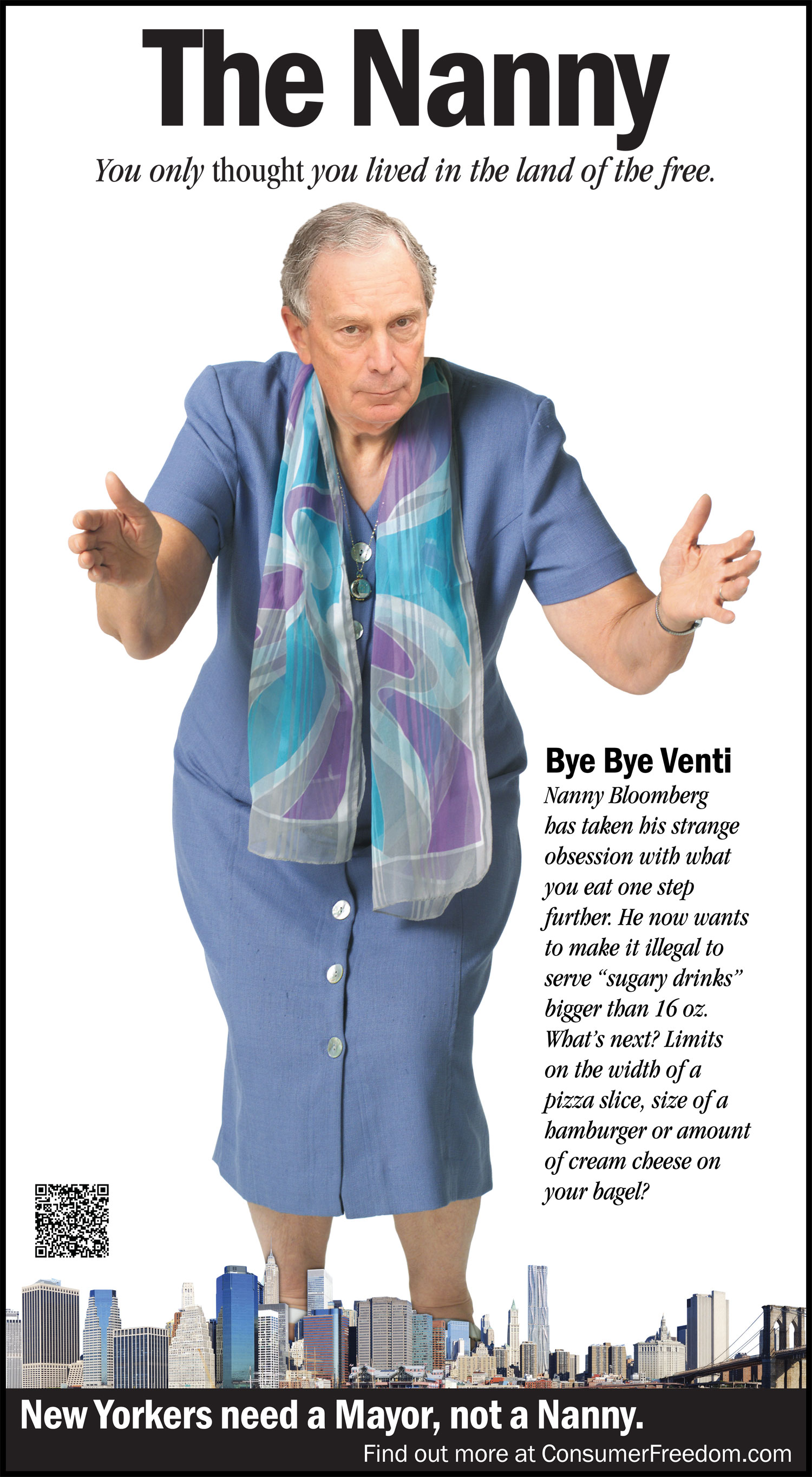

The Bloomberg ban was quickly decried by the ABA, which swore it would “challenge this latest example of government overreach.” Indeed, a related organization, the Center for Consumer Freedom (funded by the food and beverage industry), took a quick shot at Bloomberg with a full-page, movie poster-style ad featuring him in drag and bearing the tag line “The Nanny: You only thought you lived in the land of the free.”

The ban is a gambit based on an interpretation of the powers of the New York City Department of Health as a vehicle for preserving the safety of the citizens of the city. It’s a route Bloomberg followed previously in banning trans-fats from restaurants in the city.

The ban would prevent the sale of sugary beverages like CSDs, teas, and juice drinks containing more than 25 calories per 8 oz. serving in packages larger than 16 ounces. Diet drinks, drinks getting half of their calories from dairy or dairy substitutes, alcoholic drinks and 100 percent juices would be free from the ban.

The new regulation could severely remake the shelves of many key retailers for brand-building in Manhattan; for example, some of the best-selling SKUs of full-calorie vitaminwater, Coke or Pepsi are 20 oz. PET bottles that all exceed the proposed caloric threshold; so do AriZona Iced Teas, many of which come in 24 oz. pre-priced $.99 cans, as well as many other beverages.

The Department of Health oversees restaurants and other food service outlets like movie theatres, stadiums, fast food restaurants, hot dog carts, and delis; grocery stores, bodegas, drug stores and other retail channels that do not serve or prepare food would not be affected.

Members of the Board of Health announced the proposal along with the Mayor; the new regulations could take effect by March.

“It seems like it has a pretty good chance of passing, since he appointed everyone and the Chair appeared at the press conference with him,” said Justin Prochnow, an attorney who works with the beverage industry on regulatory matters.

Bloomberg said he believes that sugary drinks have contributed a significant amount to the fact that half of New Yorkers are overweight or obese. He told the New York Times that he thought the ban was “what the public wants the mayor to do.” In fact, Bloomberg has tried to act on that idea repeatedly during the past year, first supporting a “soda tax” in the New York State Legislature and then attempting to ban the use of food stamps for the purchase of CSDs, which was disallowed by federal authorities.

Members of the beverage industry itself considered the proposal to be another in a series of what have been called “nanny state” regulations enacted by Bloomberg; in addition to the repeated attempts to cut down on beverage calorie consumption, the administration has also extended smoking bans and conducted advertising campaigns against soda.

“Are we in Communist China?” said one highly-placed beverage industry executive.

Lawsuits: One Ends, Another Begins

Vita Coco Settlement

Labeling changes are on tap for leading coconut water brand Vita Coco, which is conducting a line refresh that will migrate across the country throughout the summer.

The changes are taking place for three key reasons, according to CEO Mike Kirban: to give the packaging a more updated, refreshed look, to address changes required because of a recent class-action lawsuit settlement, and to refine labeling copy to create a more transparent look at the product’s composition for consumers and regulatory agencies.

That last part reflects a change in the ingredient panel of Vita Coco to reflect the addition of a small amount of sugar to some batches of the drink to keep the flavor consistent from container to container. According to the company, the change allows standardization of sweetness level regardless of harvest, time of year, or country of origin – all variables that have become more important as coconut water companies have started to source their products from different parts of the globe to satisfy increasing consumer demand.

“We don’t have to do it,” Kirban said. “We’re leaning on the safe side, and as the category leader, we want to be the most transparent to the consumer as possible.”

One more bit of transparency came in the form of the revelation of the cut of the attorneys who argued the class-action suit before its eventual settlement

Detailed in a web site for members of the class to get their free product are the fees for the lawyers who brought the suit, Labaton Sucharow LLP and Whatley Drake & Kallas LLC, who will ultimately walk away with $750,000. The rewards for the named members of the aggrieved class of Vita Coco drinkers who claim to have been misled by some of the marketing language on the package are a far cry from that amount, however. According to a document containing the stipulations of the settlement, class members Stacey Fishbein, Katrina Garcia, Catalina Sadarriaga and Russell Marchewka each received $2000 for allowing themselves to be named as plaintiffs in the suit.

Body Armor Trade Dress Suit

Meanwhile, in a change from the typical class action fare, emerging “superdrink” brand Body Armor is facing its own legal broadside from athletic gear titan Under Armour, which filed a trademark infringement lawsuit in April claiming that Body Armor was, among other things, mimicking the Under Armour logo, and also was allegedly stepping on pending trademark applications for a number of Under Armour beverages.

Body Armor founder Lance Collins – who is a trained attorney himself – issued a vehement denial of the charges. According to Collins, Body Armor created trademarks well before the sportswear line dipped its toes into functional beverages. He also made it clear that he doesn’t think his drink’s packaging is in any way related to Under Armour.

“When all the facts come out, it will be clear that our product does not infringe or dilute or otherwise violate any of Under Amour’s rights,” Collins noted. “We look forward to the opportunity to present our case in court and expose this case for what it really is: a classic example of a trademark bully trying to intimidate an innovative company from competing in the marketplace.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe