NOSHscape

Kickstarting For the Shoeless Runner: Health Warrior

Superfood snack brand Health Warrior is moving into its next phase of growth with the launch of a new line. But with this expansion, the brand is not forgetting its core mission. Simultaneously, the company is doubling down on the values that were intrinsic to its formation with a new flavor of its current chia bar.

The brand’s latest chia bar, Mexican Chocolate, actually will touch on the company’s roots, says founder and CEO Shane Emmett, who cites two books as part of company lore: Born to Run and The Omnivore’s Dilemma.

The former chronicles some of the world’s great ultramarathoners, the Tarahumara people of Mexico. The book was also partially responsible for raising awareness around chia, as the Tarahumara are known for consuming them.(While the Tarahumara reside in one of the most beautiful areas of Mexico, the Copper Canyon, the region is currently plagued with a drought. As a result, it’s facing economic turmoil.) Emmett and his team recently became aware of the issues surrounding the region and wanted to help.

“That’s what you have to do as a startup. It’s about making sure your roots are deep…the plants with the deepest roots grow the fastest. So that’s what we did. We went back to our roots.”

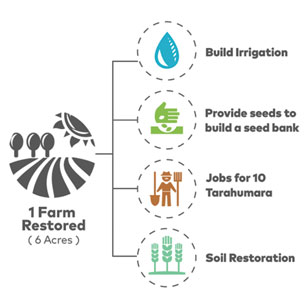

Six months ago Health Warrior put $15,000 towards one Tarahumara farm for soil restoration, land clearing, irrigation equipment, planting, harvesting and growing chia seeds. The family that grew the seeds also has a guarantee from Health Warrior to buy the end crop.

The one farm a success, Emmett is now thinking larger. “Around Health Warrior we like to say ‘nail it before you scale it,’” he told NOSH. “On its face, what we’re doing is simply launching a new flavor, just with a really interesting supply chain.”

To that extent, the brand is now launching a new Mexican Chocolate chia bar and “Operation Farm and Run.” As a way of launching the bar, Health Warrior created a Kickstarter campaign to generate awareness of the bar and cause. All of the proceeds from the Kickstarter will go towards the farms and backers can not only can essentially purchase bars, but also receive other benefits.

Whole Foods Market has committed to placing the bar nationwide and 10 percent of store sales will also be donated to Operation Farm and Run.

At the same time, in a look toward the future, Health Warrior is also launching a new line of pumpkin seed bars in Wegmans. It’s brand’s first exploration beyond chia as a main ingredient.

“We were very focused, after launching the chia bar, on going narrow and deep, like everyone advises you to do,” Emmett told NOSH. “When we looked at the truly awesome, historic, brands that have been able to become platform brands, like Kashi and KIND, they really go deep before they go wide. It’s been hard to control ourselves and not do more innovation over the course of the last four years. But now is really the perfect time to be making more radically convenient real food.”

The newest addition to the Health Warrior lineup is made of roughly 70 percent pumpkin seeds, a teaspoon of organic wildflower honey, quinoa, coconut oil and spices for flavor. There are no natural or artificial flavors involved.

Each bar will retail for roughly $1.79 on shelf in the natural channel and with about 170 calories and eight grams of protein, they fall in the middle of the brand’s other chia and protein bars.

“The superfood protein bar is sort of a mini meal replacement,” Emmett said. “The chia bar is the perfect, quintessential snack and I like to think of this one as for the 3 p.m. slump.”

Going forward, Emmett hopes to continue to focus on the snack, and in particular, bar category. No matter what direction the company takes, Emmett said it will always come back to creating clean, plant-based foods that are easy for consumers to have as part of their busy lives.

“Our thesis is that fads will come and go,” he said. “Weight loss diets will come and go but there’s some foods that have been celebrated for thousands of years and making those easier for people to take them on the go is a pretty fun mission.”

Renaming Mamee: Going after Pringles

Mamee, one of Australia’s most recognizable chip brands, is hoping their product will resonate more with U.S. consumers under its new moniker, The Good Crisp Company.

South Australia-based ABC Sales & Marketing bought the rights to sell Malaysia’s largest snack brand, Mamee Snacks, in Australia over 30 years ago. This year, the company decided to expand its reach again beyond the “land down under” by bringing its version of a “healthier Pringle” to the U.S.

The transition was not without its growing pains. Matthew Parry, COO of ABC North America LLC, told NOSH that feedback from the brand’s first nine months on shelves showed that U.S. consumers and retailers were not connecting with the brand’s original name, Mamee, or its packaging.

“A lot of the comments that came in early on were ‘love the product, love the idea, love the taste, but it looks too healthy, it looks a bit boring, it looks a bit private label,’” Parry said. “Our brand wasn’t transferring well to the U.S. And now that we think about it, it makes sense. It doesn’t stand for anything; it doesn’t represent anything. I think we were a little bit in love with our own brand in that we thought we could take that brand and make it big in the U.S.”

So Parry and his team went back to the drawing board and The Good Crisp Company was born. Parry said the new name is intended to reflect not only the crisp’s good taste but also its “good ingredients.” Mamee packaging is currently still on shelves, but will be swapped over by the end of the month. The Good Crisp Co. previously sold its crisps in 5.6 oz cans for $3.49, but Parry said the brand is also launching a 1.6 oz can geared toward convenience stores and food service.

Under its new name, the brand is hoping its extensive experience in the Australian market coupled with the energy behind its new venture can help it take on one of the biggest salty snack players in the U.S.: Pringles.

“While we are a start up in the U.S. essentially, we’re a startup with 30 years of experience,” Parry said. “We’re able to use our experience to create healthier alternatives.”

Pringles, meanwhile, may be trying to play to those notions of healthier with its newly announced LOUD line, debuting nationwide this month. The new chips are advertised as “vegetable-based,” with a base of corn or a “vegetable-grain” combination for the actual crisps. This may suggest a healthier alternative, but its caloric content is the same as its standard potato-based chips. The Good Crisp’s products, meanwhile, are gluten-free, GMO-free, and made with no artificial colors or flavors.

Whole Foods: No Junk Extends to Probiotics

Whole Foods Market took aim at a class of products who position themselves as “healthier” options due to their use of added functional ingredients recently, announcing to suppliers that GanedenBC30 and LactoSpore (two popular strains of the probiotic bacillus coagulans that are often added to food) would no longer be permitted in certain categories of products. No other strains of bacillus coagulans are permitted in Whole Foods products.

The store told suppliers that the new rules were being issued due to concerns about certain product categories. “By making health claims for a snack product,” the statement reads, “there is the underlying assumption that it should be eaten on a regular basis, which Whole Foods Market does not support from a philosophical standpoint.”

Going forward, nutrition or protein powders, smoothie mixes, nutrition bars, dietary supplements, kombucha, tea, unsweetened (no added sugar) beverages, nut butters and soups that include bacillus coagulans are acceptable.

On the unacceptable list is “junk food” including chips, beverages sweetened with added sugars, baked goods, trail mix, granola, granola bars, frozen yogurt, candy, chocolate and pizza enhanced with bacillus coagulans. Those products will be unacceptable unless, for the first six categories listed, they meet certain nutrition criteria.

For some the new rules are a step in the right direction. “It’s very altruistic of them to come out and basically say ‘we will not be selling products that will intentionally mislead people into purchasing them because there’s some marketing gimmickry going on by using some functional ingredient,” Greg Fleishman, co-founder of baking mix brand Foodstirs and marketing agency Purely Righteous, told NOSH.

However, there are still grey areas in the document released to suppliers. Certain categories, such as ice cream, frozen foods and dips were not mentioned at all. Whole Foods did not respond to requests for a comment.

One category notable in its absence was yogurt. The dairy category staple is one of the biggest groups of products to contain probiotics, Michael Bush, President of Ganeden, told NOSH. At the same time, he said, some yogurts contain more sugar or fat than granola bars or even frozen yogurts, which tend to be substitutes for ice cream.

“If they have a yogurt sitting next to a granola bar and the nutrition profiles show more sugar in the yogurt then the granola bar,” Bush said to NOSH, “I’d certainly ask someone ‘why it is okay to eat this every day but not that?’”

To some, the solution is a set of guidelines for each category with specific nutrition criteria that products using bacillus coagulans must meet. Fleishman believes that this process would help Whole Foods further cement itself as a “safe zone” for consumers. “To really validate and to legitimise this new standard, you have to really look at what categories are being excluded [from the guidelines],” Fleishman said.

One product that will be affected by the new rules is Farmhouse Culture’s Kraut Krisps, a line of probiotically enhanced chips made from fermented ingredients. The company created the product as part of a strategy to make probiotics accessible to consumers at many points during the day.

“We added Kraut Krisps to our existing offerings of Krauts, Kimchi, Gut Shots and Fermented Vegetables because we believe it’s important to get probiotics in a variety of ways,” Farmhouse Culture Marketing Director Marc McCullagh told NOSH. “We’re excited to provide a probiotic-rich option that will satisfy the consumer desire for crunchy snacks, while adding the clinically studied benefits of GanedenBC30.”

Probiotics have grown to be used across a variety of product types in recent years. Bush said approximately 700 food and beverage products using Ganeden BC30 can be found in over 100,000 retailers including club, mass, other natural stores and even convenience channels. This leaves the door open for consumers to purchase these products elsewhere.

Brands that choose to not reformulate their “junk food” and keep bacillus coagulans in them now have far more options in terms of a path to retail success. Bush noted that Ganeden’s (now discontinued) line of supplements was never sold in Whole Foods but still did well in the 60,000 other retailers that did carry them.

“If you look at Whole Foods, they are a fantastic retailer and they do a great job,” Bush noted. “But there’s still a very large market out there outside of Whole Foods.” Rather than give up their probiotic ingredient, he noted, companies may choose to double down on efforts with other retailers such as Kroger or Costco or Sprouts.

One question that remains to be seen is if consumers will agree with Whole Foods’ choice or feel the retailer has overstepped in telling them what they should or should not eat. It’s important to remember, said Bush, that “one man’s junk is another man’s fortified functional food.”

Center Store: Simple Mills Set to Grow

Grain-free baking and snack brand Simple Mills has expanded its gluten-free, clean-ingredient line to include sprouted seed crackers and grain-free, low-sugar cookies.

With the two new products, as well as the recent close of a $3 million cash raise, the brand is moving into 2017 after a year of strong growth, cementing its place as part of the next generation of brands shaking up center-store. Founder and CEO Katlin Smith told NOSH that in 2016 the brand grew from being in 1600 stores to 6500 doors and saw 3.6x growth in sales. Retailers including Target, Whole Foods, Sprouts, Safeway and Albertsons now carry the brand’s almond flour crackers, grain-free baking mixes and low-sugar icings.

A former consultant, Smith said she was motivated to start the company, and now expand its offerings, in order to disrupt the sleepy staples at the center of the store.

“Thinking about the grocery store as it stands today there’s a good amount of information out there about how people have been migrating to the perimeter of the store, and the center store has been in decline, especially in a number of traditional categories,” Smith told NOSH. “What we’ve done as a brand is look at the root causes and the dissatisfiers in those categories and in the center of the store to determine exactly what is causing people to opt out of those categories or decrease the frequency of which they purchase in those categories.”

A main point of contention, says Smith, are the long lists of complicated ingredients with gums and stabilizers, as well as too much sugar, particularly in the categories the brand targets, like baking, crackers and cookies.

Across all of its products, Simple Mills offers a price point that is towards the more premium end of the category. Smith said that she hasn’t encountered much resistance from consumers as she feels they understand they are paying for quality. As the company scales, Smith doesn’t plan to dramatically drop the price but rather reinvest in using higher quality or organic ingredients.

Smith plans to launch more new products but hasn’t yet decided what they’ll be.

“We haven’t committed to any particular direction for the future,” Smith said, “but I will say that in general it will always be places where people are looking for simpler ingredient lists, less sugar, less carbs and more nutrient value.”

But she said she’s bullish on 2017. “Momentum builds more momentum,” Smith said. “Each additional thing builds on itself and it attracts more partners, it attracts better employees, it attracts more attention, it attracts more retailers.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe