With Dirt Kitchen & CaPao, Mondelēz Tests New Launch Strategies

Last year Mondelēz CEO Dirk Dirk Van de Put tasked SnackFutures, his innovation and venture arm, with a bold mission: generate $100 million in growth by 2022. So far, the group has worked towards that goal with investments in emerging brands such as Uplift Foods and Hu Kitchen and Products and an announced partnership with Israeli foodtech incubator, The Kitchen.

But now, with the test of two new snack lines, Dirt Kitchen and CaPao, SnackFutures is dipping its toes into some of the most current entrepreneurial go-to market strategies.

“What you’re seeing is really us bringing to life [our] motto of putting the consumer at the heart of things, disrupting how we do things, and acting like [a] startup,” Brigette Wolf, SnackFutures’ head of innovation, told NOSH. “Really break[ing] the mold of ourselves to disrupt the ‘what’ and the ‘how.’”

Both brands are currently in the early stages of their respective development, without determined prices, pack sizes or even finalized names.

Dirt Kitchen is Mondelēz’s attempt to move into fruit and vegetable snacking, Wolf said, using upcycled fruits and vegetables that are either excess produce or have been deemed “ugly” (aka not aesthetically pleasing enough to be sold as-is). The group is testing two snack options: dried vegetable chips and a veggie “trail mix” of whole pieces of vegetables and nuts blended with herbs and spices.

SnackFutures is currently conducting in-store trials for Dirt Kitchen, as well as testing ads on Instagram to see if consumers like, share or follow the account.

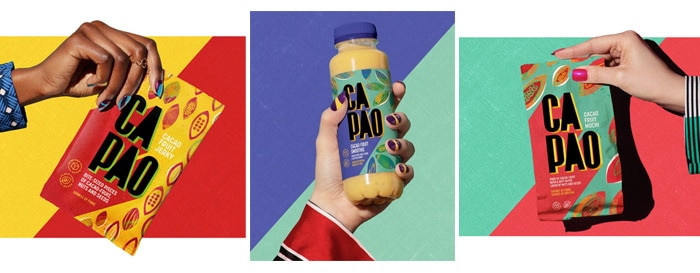

SnackFutures is running a $5,000 Kickstarter campaign for several CaPao products, including cacao-fruit jerky, cacao-fruit, nut and oat milk smoothie, cacao-fruit mochi and cacao-fruit smoothie balls. Kickstarter backers must select which product they would like to receive in exchange for their pledge, giving the SnackFutures’ team immediate feedback as to which product lines are resonating the most.

A global company using Kickstarter as a testing ground isn’t totally unheard of. Last year Tyson Foods launched its chicken chips ¡YAPPAH! on the platform, but the company already had plans to roll the products out into select markets and used Kickstarter more as a marketing platform. For SnackFuture, Wolf said, the platform is the research tool.

“[Kickstarter] is a tool for us to try out different methodologies,” Wolf said. “What it’s allowing us to do is [have] a much more agile way of testing, and responding and getting that rich insight and data from consumers [in] real time, in real life situations when they’re in the moment, looking, shopping and ready to eat their snacks.”

Historically, large strategics have launched products after engaging in more traditional research methods, such as focus groups, in-store testing, online surveys and consumer intercepts.

For both of these lines, SnackFutures wanted to explore new, more relevant ways to get feedback from shoppers. Whether this means products get to market faster, Wolf added, will be seen over the next year. However, she said, the process has helped the company get to the point of engaging with consumers faster and for less upfront investment.

The next step for these brands is also still to be determined. SnackFutures is testing both lines in select markets globally — primarily in Western Europe and the U.S. using a variety of research methods. While one or both brands may eventually land at brick-and-mortar store shelves, still others may exist only on e-commerce platforms such as Amazon or even as direct-to-consumer plays.

There’s also the risk that the concept may fail entirely. But, Wolf said, even in that case, the process will still help SnackFutures get to its $100 million goal by shaping the next product test. Regardless of whether Dirt Kitchen or CaPao becomes the next Oreo or Triscuit for Mondelēz, she added, there’s also a benefit to the wider company culture, which has been slowly shifting under Van de Put’s leadership.

“We’re building completely different muscles for the organization,” Wolf said. “We get to be that living, breathing example in helping people understand where can they push and where can they try to go faster.”