Molson Coors’ net sales increased +6.5% for the full 2021 fiscal year and +14.2% in the fourth quarter, the company reported yesterday.

The company posted net sales of $10.279 billion for the year that ended December 31. Worldwide, shipments (sales to wholesalers) declined -0.5% and brand volume (similar to depletions, which are sales to retailers) declined -1.7% over the course of the year. However, Molson Coors’ price and sales mix increased +5.2% as it continued to focus on the premiumization of its portfolio.

“This year, we grew the top-line for the first time in a decade, our two biggest brands each grew net sales and we now have a larger global above premium portfolio than ever before,” CEO Gavin Hattersley said in a press release. “These were all goals of the revitalization plan, against which we continue to make tremendous progress. While we’re proud of the steps we’ve taken, we’re even more excited about where we can go from here, having established a strong foundation for 2022 successes and beyond.”

As a result of Molson Coors’ favorable price and sales mix, the company’s net sales per hectoliter increased +3.8% for both the full year and Q4.

“Fundamentally, part of our revitalization plan is to shift our mix into the above premium and emerging growth [segments] and emerging growth is almost entirely above premiums,” Hattersley said during a conference call with investors.

For the fourth quarter, Molson Coors’ shipments increased +3.6% in the company’s Americas territory and +3.3% in the U.S. in particular. Brand volumes in the Americas declined -1.8%, driven by steeper declines in the U.S. (-3.8%). The company attributed those declines to “the decline in the economy portfolio including the de-prioritization and rationalization of non-core SKUs, partially offset by growth in the above premium portfolio.”

Other facts that contributed to declines – other than the rationalization of the company’s economy portfolio, which Molson Coors will cycle for another five months – include bar and restaurant restrictions due to the omicron variant in Europe, where Molson Coors’ business over-indexes toward the on-premise channel, and a slowdown in on-premise traffic in the U.S.

During the first quarter of 2022, the company will cycle against weeks that contained negative business impacts last year, such as the winter storm that knocked its Texas facility offline and a cyber security attack.

“We’ve got some tailwind behind us,” Hattersley said.

Core Brands’ Growth

The company’s core brands, Miller Lite (+7.6% in net sales revenue) and Coors Light (+4.4%), both grew in the U.S. during 2021. Miller Lite posted a double-digit increase in on-premise placements over the course of the year, Hattersley said. Both brands “came within a whisker” of achieving positive volume growth throughout the year, and likely would have if the omicron variant hadn’t thwarted on-premise traffic during the final weeks of 2021, he added.

Off-premise dollar sales of Miller Lite declined -5.5% for the full year (through December 26), according to market research firm IRI, which does not include the on-premise channel or independent liquor stores. Dollar sales of Coors Light declined -3%, and the brand’s dollar share declined -0.14%. Miller Lite’s share of beer category dollars declined -0.26%.

Beyond Beer… and Beyond

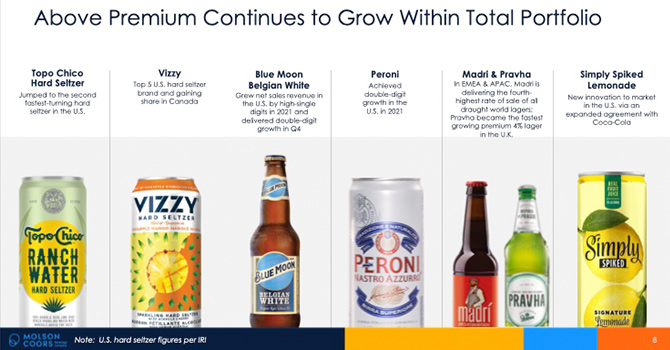

Since announcing a plan to premiumize its portfolio in 2019, Molson Coors has launched several brands in the above-premium hard seltzer segment. Those brands – Vizzy Hard Seltzer and Topo Chico Hard Seltzer, produced through a partnership with Coca-Cola, which owns the non-alc mineral water brand – were “the biggest driver” behind the +15% growth the company’s above-premium portfolio posted in 2021.

“Despite ending the year with only one nationally distributed hard seltzer brand [Vizzy], our portfolio grew triple digits over the course of 2021,” Hattersley said. “We generated the largest growth rates in this space among any of the major beverage suppliers, per IRI.”

Both Vizzy and Topo Chico, which the company launched nationwide last month, sit within the five largest hard seltzer brands, and Hattersley said Vizzy has potential to become a top-three brand.

In addition to Topo Chico’s national rollout, the brand will launch ranch water and margarita line extensions, as well as introduce a glass package, similar to its eponymous mineral water brand’s iconic bottle. Since its launch, Topo Chico Ranch Water has become “not only the fastest turning ranch water in Texas, it’s the fastest turning in the United States,” Hattersley said.

Molson Coors continues to participate in the convergence of bev-alc and non-alc brands via a second partnership with Coca-Cola. Simply Spiked, a hard version of the popular juice brand’s lemonade, is set to launch this summer. Simply non-alc products are in one out of every two households in the U.S., Hattersley said.

In addition to its bev-alc innovation, Molson Coors has also launched ZOA, an energy drink made in partnership with Dwayne “The Rock” Johnson. Since its introduction fewer than 10 months ago, ZOA has become the country’s fastest growing energy drink and the second-largest health energy drink in convenience stores.

“In 2021, we put teeth behind our talk in becoming a total beverage company beyond,” Hattersley said. “Our beyond beer products are performing very well and helping to fuel our emerging growth business, which contributed approximately $800 million to 2021 net sales revenue, tracking ahead of our $1 billion annual revenue target by 2023.”

Production Facilities Improvements

Last year, Molson Coors made more than $500 million in capital investments in facilities across its production network.

In the U.S., the company is adding hard seltzer production capacity, primarily at its Fort Worth, Texas-based brewery.

In Canada, where the Vizzy and Coors Seltzer brands have a 9% share of the hard seltzer segment, Molson Coors is investing in increased hard seltzer and spirits production in its Toronto-based facility. It also completed a new brewery in Montreal.

Across the Atlantic, Molson Coors has also made investments to increase hard seltzer production and canning in the United Kingdom.