Expo West 2022 Recap

After a two-year enforced layoff due to the COVID-19 pandemic, it was back to business at Natural Products Expo West this year, as brands, entrepreneurs and industry figures converged in Anaheim, California for the annual conference and trade show. But before the booths opened, attendees found themselves wrestling with two themes during much of the “pregame” programming — opportunity and urgency.

The latter was reflected in both the opening day’s traditional Climate Day event — something embodied by Rev. Lennox Yearwood Jr., founder and president of the Hip-Hop Caucus, an architect of Sean Combs’ “Vote or Die” movement and a longtime social justice activist, who reflected on the extreme weather conditions brought on by Hurricane Katrina in 2005 and the upheaval that was concentrated on the largely Black population of New Orleans as a disaster that created “climate refugees in our own country.”

Yearwood went on to draw a line from those events to those taking place in the ongoing invasion of the Ukraine by Russian forces. The upshot: the same ethos that has created climate change is battling for the increasingly scarce resources that continue to amplify climate change.

To the good, however, there’s opportunity: the growth of a natural products industry, alternative energy, and more important, the energy of young people who are increasingly terrified and disappointed by the inaction of previous generations. As a legacy for those to come, Yearwood urged, look at where the attendees might be able to contribute to an audience 100 years from now, and think about what they might do to improve environmental outcomes.

Wednesday’s opening convocation stressed that opportunity, while acknowledging the challenging forces that have continued to plow the way for natural, organic, and better-for-you products.

The audience gave a wildly enthusiastic welcome to a touchpoint event where New Hope Prexy Carlotta Mast, SPINS EVP Kathryn Peters and Whipstitch Managing Director Nick McCoy laid out the burgeoning sector’s economic status while folding in renewed interest in diversity, the environment, COVID, and the current crisis in the Ukraine.

As part of the intro, Mast announced that New Hope was making a $100,000 donation to Jose Andreas’ Chef’s Collaborative, an organization which has been providing meals to Ukrainian refugees during the Russian onslaught.

With so many Americans looking at their health and looking at immunity, the natural and organic industry is going to hit $400 billion by 2030, Mast announced. The industry is filling out in all the right places, Peters noted, hitting about 25% of CPG, — but providing 68% of the overall CPG industry’s growth. Food and beverage are about 70% of that category total.

Adversity is creating opportunity, as well, McCoy pointed out: even the much hyped inflation that’s been an issue in 2022 hasn’t fallen on smaller health-and-wellness focused companies quite as hard. The 7% inflation rate has been matched by 7% pricing growth for brands in the SPINS database, he noted, but that growth is highly over-indexed by the big brands. Health and wellness brands, he said, have raised their prices around 5%, leaving room for them to also take price increases to keep up, making for fatter overall margins.

But to keep those returns growing, all three speakers again echoed the challenge expressed the day before: companies with diverse leadership are outperforming those that skew less diverse, McCoy noted, and products that are part of movements like organic and now regenerative agriculture are growing ahead of conventional. In the face of environmental disaster and years of unequal wealth distribution, the speakers seemed to be saying, the stakes are high, but the crisis is also an opportunity.

Meanwhile, on the Expo West show floor, various different beverage trends were apparent, including a slate of new entrants to the rapidly developing gut health friendly functional soda space.

Brands including TEAONIC, Mortal Kombucha, Turveda and Mission Loop debuted better-for-you functional CSDs, reflecting a bigger push into this emerging space for small and mid-size brands. As well, Humm Kombucha showcased its previously announced probiotic soda and seltzer line front and center at its booth where CEO Matt Witherell said the line is already performing well online, with its seltzer offerings outpacing the sodas.

Mission Loop, a Canadian cold-pressed juice brand now making the leap into the U.S. via Sprouts stores in April, displayed its new line of probiotic sparkling sodas, available in Clementine, Ginger and Strawberry flavors. The sodas are currently available nationwide in Canada and will accompany five of the brand’s top selling juices in the U.S. retail launch.

Elsewhere, wellness beverage brand Turveda showcased a comprehensive rebrand as the company pivoted its entire line from glass bottled tonics to become a canned “Prebiotic Super Soda.” President and co-founder Dev Chakrabarty described the new products as if “Olipop and VIVE Wellness Shots had a baby,” while citing Asian-inspired sparkling water brand Sanzo as a point of reference for its focus on Indian and Asian ingredients. The new functional line moves the brand past turmeric exclusivity and now features three SKUs: Zesty Lemon Spicy Ginger with turmeric and cinnamon, Blood Orange Passion Fruit with amalaki, and Lavender Vanilla with ashwagandha.

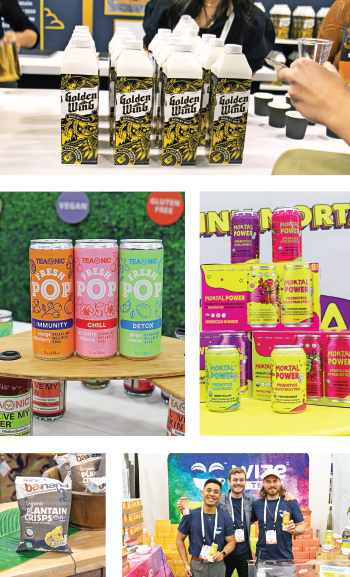

Following a familiar naming convention, TEAONIC debuted a new line extension dubbed Fresh Pop, but moved away from gut health to offer three flavors with immunity, detox and “chill” functions. Startup brand Mortal Kombucha also introduced Mortal Power, a soda line made with prebiotics and varying functionalities including caffeine, collagen and electrolytes. Longtime kombucha maker The Bu is also getting in on the trend, introducing a four-SKU line of 5 calorie, zero-sugar sparkling probiotic waters in new 12 oz. slim cans.

While Expo West is a critical launching pad for new brands, it’s also a venue for established companies to showcase new natural innovations. After digging into non-alcoholic beverage categories like energy drinks and probiotic sodas in recent years, Molson Coors is looking a little bit closer to home with the launch of Golden Wing, a single-SKU line of barley milk set to launch this summer.

The concept itself isn’t novel: recall that Anheuser-Busch has links with Take Two Barley Milk via use of the beer company’s proprietary spent grain ingredient platform, EverGrain. However, that’s not the case with Golden Wing, which boasts a different type of sustainability angle through its use of barley grown at 7,500 feet above sea level in Colorado’s High Country, where natural irrigation through snow packs means the crop requires no additional watering to cultivate. On-pack, the company is also highlighting the 75-year-plus history of working with American barley farmers to protect harvests and create sustainable growing systems.

As for the drink itself, shelf-stable Golden Wing ticks some important boxes for natural consumers and retailers: the drink has four ingredients – barley, sunflower extract, sea salt and shitake mushrooms, the latter to boost nutritional content – and is designed to pair well with coffee. Golden Wing is set to launch in 32 oz. cartons later this spring, starting in California with Whole Foods (SoPac region) and with Sprouts via L.A. Libations’ incubation program across 50 stores in San Diego, San Francisco and Los Angeles. The suggested retail price is $5.99.

Along with its unique sourcing and straightforward single-SKU approach, Golden Wing is also leaning into a more overtly masculine positioning than some of its plant-based milk competitors, according to reps at the booth. The package itself features classic Americana iconography against a dark blue background.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe