Ocean of Opportunity: Why Strategics Still Want Water

In February, Gatorade set sail into one of the largest yet on-the-surface simplest beverage categories in the market: water.

Gatorade Water made its national debut with a line of 7.5 pH, electrolyte-infused waters intended to play to the brand’s core audience of athletes and active consumers seeking hydration. As Gatorade’s chief brand officer Anuj Bhasin told AdAge at the time of the launch, the company had identified a white space in the existing market for bottled water where a large section of athletic-minded consumers “don’t feel like someone has created a water for them.”

“Water is more than a $25B category today, but we also know that there are tens of millions of consumers not reaching for enhanced water at the store shelf,” Emily Boido, senior director of marketing for Gatorade enhanced waters, told BevNET in an email. “As a brand with longstanding consumer trust and credibility within hydration, we see a strong opportunity to incrementally grow the category in a meaningful way. The water aisle has been missing Gatorade swagger and we’re changing that with our first unflavored water.”

Of course, there’s been no shortage of hydration beverages on the market, as Gatorade’s home set in the sports drink category has seen rising competition from brands like Electrolit and PRIME, while the bottled water category has become a go-to space for consumers seeking healthy hydration to flock to.

According to NielsenIQ, in the 52-week period ending February 24, retail dollar sales of bottled water in the U.S. rose 3.5% to over $19.3 billion. Much of that growth, however, came from a 3.6% average pricing increase across the category as volumes in the period were flat. Measuring the two-week period, however, sales declines were accelerating, down 1.8% while volumes dipped 2.2%.

It’s a trend that Gatorade’s parent company, PepsiCo, is well familiar with. Gatorade Water, packaged in a clear rPET bottle with stark orange labels, comes in 1 Liter (SRP $2.39-$2.99) and 700 mL sports cap ($1.99-$2.69) varieties, is only the latest addition to a rising premium water category from Pepsi, which already competes in the segment with its LIFEWTR Brand and also owns and operates the more value-positioned Aquafina brand.

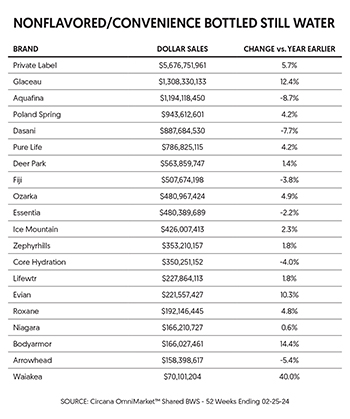

But water is also a place where PepsiCo is losing ground to chief rival Coca-Cola, whose Smartwater brand has rapidly seized share over the past year. According to Circana, Glaceau – Smartwater’s parent brand – grew retail dollar sales by 14.1% to over $1.3 billion in the 52-week period ending December 31, 2023, representing an 8.29% dollar share of the bottled water category in U.S. MULO and c-store accounts. LIFEWTR, in comparison, grew just 3.3% to around $230.4 million in the same period, a 1.47% category share.

That rise in premium waters coincides with stark declines for each conglomerate’s respective standard water brands, Aquafina and Coke’s Dasani, both of which saw dollar sales shrink 6.9% last year. Using Gatorade for this new launch also chases Coke’s top sports drink BodyArmor, which reported 14.6% growth for its water line last year even as sales of the core hydration drinks have struggled.

According to Neil Kimberley, the former VP of strategy and brand development at alkaline water brand Essentia, rising demand for bottled water has consistently been one of the strongest trends in the U.S. beverage industry for over a decade, suggesting the strategics are right-minded to be focused on growth and innovation in the category.

“The reality is that water is casting a very wide berth and a very long shadow across just about everything now,” Kimberley said. “There are two needstates that are really driving everybody’s growth, and that’s hydration and energy. And so those are the two overarching things, and the traditional benefits of fun and sociability that carbonated soft drinks have delivered are becoming less valued as people become more functionally oriented.”

A report from Beverage Marketing Corporation found that in sheer gallons of liquid sold, between 2012 and 2022 bottled water grew more than nearly every other liquid beverage category combined at 6.3 billion gallons gained with a 10-year CAGR of 5.3%, versus nearly 6.2 billion gallons for all other categories. Meanwhile, sports drinks grew volumes in the period by around 461 million gallons, a CAGR of 3%.

Beyond Coke and Pepsi, bottled water has been the subject of some serious disruption post-pandemic, from the rise of aluminum-packaging formats to the aftermath of major M&A deals. Over the past year, the results of Nestlé’s 2021 acquisition of Essentia has led to an exodus for much of the team behind that brand’s rise, with many former Essentia executives now boosting independent brands like Eternal Water (which saw its bulk products business grow 50.1% last year).

Other independent brands, such as Hawaii-based Waiakea, have also experienced significant growth – its single-serve offerings were up 44.8% in retail to over $68.6 million in 2023. In an email, Waiakea president and CEO Ryan Emmons credited the growth to “limiting innovation distractions” and prioritizing the brand’s core set, however he suggested the brand needs to “get better” on trade marketing execution, a priority for the next 12 months.

But not all premium players are thriving, particularly imported brands like The Wonderful Company’s Fiji, which was down -2.9% in 2023. Norwegian import VOSS welcomed back former CEO Jack Belsito as chief executive in Q1 this year, as the brand’s U.S. business suffered during the pandemic.

Then there’s category leader BlueTriton, owner of the former Nestlé Waters regional portfolio, which is now innovating in that aluminum format with a new line of 25 oz. bottles for each of its core brands, including Arrowhead, Poland Spring and Deer Park. The company is also expanding its distribution offerings with brands outside of its ownership, adding L.A. Libations-backed Hawaii Volcanic to its DSD network and ReadyRefresh home and office delivery system this year.

While the advent of aluminum packaging – be it bottles or cans – has been among the most disruptive trends in the category in recent year, from the “Death to Plastic” touting Liquid Death to reusability-minded brands like PATH, plastic has remained the king of the category as the top performers hold to the format.

“I think that the world of aluminum water has promised a lot but hasn’t really delivered anything just yet,” Kimberley said.

However, BlueTriton’s unveiling of its aluminum line at Natural Products Expo West 2024 in March provides some top-down approval for the format. At the show, CEO Joey Bergstein told BevNET that the company views sustainability as vital to its business, and is also working to increase the amount of recycled plastic in its plastic bottles. It’s also partnering with charities such as 1% for the Planet to improve its environmental bonafides, while reaching out to consumers concerned about the carbon footprint of bottled water.

“We’re really trying to give people options,” he said, adding that aluminum also provides the company with a new way into accounts and regions that have instituted single-use plastic bans.

Nicole Doucet, founder and CEO of aluminum brand Open Water, said she is seeing consumers today embrace her 10-year-old startup not just for environmental reasons, but also for health concerns, citing growing awareness and fear of microplastics present in bottled water.

Open Water produces unflavored still and sparkling waters in aluminum bottles and cans, and has recently made deeper expansions out of on-premise channel accounts and into retail via partners like Whole Foods and Kroger, going from six divisions of the latter retailer to 21 in April. Open Water also recently received an exposure bump on the red carpet with a presence at the Academy Awards in March and is preparing to increase marketing efforts this year to support a broader mainstream push.

Between startups and giants, Doucet said she’s still confident water is a category where multiple brands can thrive, especially as Gen Z has embraced water as a healthy beverage option across formats, from reusable bottles (see the Stanley Cup boom), home delivery (where BlueTriton remains focused) and the metal market.

For Doucet, she said she’s not overly concerned that consumers are still buying plastic bottled products from strategics, arguing that the growing aluminum set is differentiating itself in stores and gaining a larger presence in conventional retail as grocery chains look to embrace sustainable options. Nor is she worried about competition from conglomerates in the aluminum category, suggesting that smaller brands building the aluminum set will have more ground to stand on when it comes to messaging around the key reasons consumers adopt the format.

“These are brands that, in my opinion, do not translate to this type of package,” Doucet said. “I think consumers are craving authenticity, and it is very hard to claim to be sustainable when you build a brand selling billions of plastic bottles.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe