Powder Up: Strategics and Investors Lean Deeper Into the Functional Powder Set

Once a category that had appeared stagnant, an influx of functional innovations has turned powdered beverages into a fast-growing space and a hotbed for M&A and investment activity.

In just the last few years, strategics have made moves on the functional powder space; in 2020, Unilever purchased single-serve hydration powder brand Liquid I.V., while Nestlé has acquired a number of players in the category, including majority stakes in collagen-based Vital Proteins and plant-based protein brand Orgain, and an outright purchase of hydration tablet producer Nuun.

Recent dealmaking doesn’t mean the powder category is all wet, either, notes Timothy Sousa, director at investment bank Whipstitch Capital. The powder beverage category – which ranges from simple flavor modifiers to innovative functional products – has undergone a renaissance in recent years, driven by the convenient single-serve stick form factor and consumer demand for better-for-you, on-the-go beverages, he said.

“Net category dynamics are positive for the category,” Sousa added. “I think the mega-strategics have made their near term bets, but I do expect M&A volume to pick up over the next coming years.”

Once thought of as so much Kool-Aid, by focusing on the science of hydration, brands like Liquid I.V. and Nuun have provided a stronger health halo around the format.

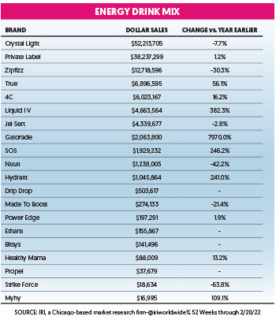

Both companies have continued to gain momentum in mainstream channels: According to SPINS data, Liquid I.V. has been a significant growth driver at Unilever, with the brand up 350% to $137 million in the 52-week period ending February 20, mainly driven by improvements in MULO (98.1% of retail revenue). Nuun, meanwhile, has grown 21.5% in the same period to $29 million in retail, with 81.6% of retail revenue derived from MULO (up 23% year-over-year) and 18% of sales from natural (up 14%).

At Natural Products Expo West 2022 in March, functional powder drinks were prominent on the show floor. Startup brands like Protein2O, Reneva, MANTRA Labs, Sunwink and Cure Hydration displayed new or re-branded powder-format products at theshow, while Orgain – known primarily for protein – introduced a new hydration powder line rolling out to stores this year. Meanwhile, companies like CELSIUS and LIFEAID, which introduced powder stick lines within the past two years, have continued to move forward with those products in mainstream retail.

Sousa said that the category’s expansion and the top-down influence of Nestlé and Unilever’s acquisitions provide an optimistic outlook for future investment in powder-focused brands as well.

“In terms of pure play hydration, we do expect an increase in investment activity within the space, and that really correlates to what the strategic buyers are doing,” Sousa said. “At the end of the day, if you’re a private equity professional, you’re monitoring the strategics for what areas you should be putting your dollars in, because they’re going to give you the highest multiple on your cash.”

Innovation Creates Opportunities

Health and wellness focused private equity firm WM Partners has invested heavily in the powder category: the group has acquired a portfolio of powder beverage producers, including hydration brand Ultima Replenisher, in 2019, collagen products maker Great Lakes Wellness in 2020 and protein drinks company Vega in 2021. Vanessa Gabela, managing director at WM, told BevNET that the firm did not initially set out to focus on powder brands, but the portfolio grew naturally as WM targeted functional food and beverage brands with high growth metrics. As well, subcategories like hydration and collagen, she said, have similarly seen double-digit growth in recent years, making Ultima and Great Lakes attractive targets.

“All of the sectors that [we focus on] – natural personal care, functional foods, natural remedies, pets – are high growth categories and they’re highly fragmented, so there’s an opportunity for consolidation,” Gabela said. “They’ve shown to be defensive, certainly in the last financial crisis and certainly during COVID, and they’ve grown.”

Ultima, which was founded in 1996 as an athlete-focused brand, is now among the stronger brands in the hydration powder set thanks to mainstream consumer adoption. According to SPINS, retail sales of Ultima were up 37% in the 52-weeks ending February 20. The brand is still mainly positioned in the natural channel where it is among the leading products in the category; natural accounts for 82.5% of Ultima’s retail revenue, compared to 17.5% from MULO. Ultima SVP of sales Skeet Freeman told BevNET that the brand’s total points of distribution are up double digits in mass and natural over the past year, and the brand has now added over 1,400 Walmart stores nationwide.

Gabela cited innovation as a key pillar of the powder renaissance, noting that a focus on flavor and variety has helped Ultima break out of the limited high-performance athlete segment and position itself as an everyday product. Ultima is also differentiated as a sugar free product – a trait that the brand has increasingly emphasized in its messaging. According to Ultima VP of marketing Loretta Reilly, the company is now rolling out a new visual system that uses “splashes of contrasting colors” to convey the brand’s zero sugar, calorie and carbs position.

Sousa noted that despite leading the new wave of functional powder brands, Liquid I.V. still contains sugar, which leaves room for competitors like Ultima to build around healthier positioning. Although the sugar in Liquid I.V. is a key part of its rapid hydration functionality, health-minded consumers may still gravitate towards zero sugar alternatives.

Meanwhile, Great Lakes is competing against another Nestlé investment – Vital Proteins – which has been front and center in the collagen trend. Similar to Ultima, under WM, Great Lakes rebranded from Great Lakes Gelatin Company to Great Lakes Wellness last year to help mainstream the brand. The company is now launching a “Benefits” line with additional functional attributes.

“I think with many of these large strategics, from an M&A perspective, some of [their acquisitions] are brands that are definitely growing, have high velocity, and some of which have been stronger in certain channels like Amazon or retail, but there’s definitely white space,” Gabela said. “So I think that as we see some of the same trends, we just need to continue to differentiate our brands by their positioning, their formulation, their branding. And innovation for us is definitely key.”

Looking at the broader powder category there is one key place, at least within hydration, where Sousa sees notable room for growth: ultra-premium positioning. While Ultima, he said, is currently performing well as a healthier product, there’s still opportunity for companies to build on zero sugar and improved technology over “category captains” like Liquid I.V.

“Whether that’s some sort of different hydration technology, where maybe they’re using different different mechanisms to hydrate the body more efficiently, rather than just pure-play sugars, a brand would probably have a chance to supersede the category and become mainstream there,” Sousa said. “I think the science is just lagging within this category and I think the marketing is just coming into play and kind of getting consumers over the shelf with a Liquid I.V.-like product.”

Channeling Growth

At Expo West, ready-to-drink protein water brand Protein2O introduced an expanded line of functional single-serve powders containing 20 grams of whey protein with additional benefits varied by SKU. The flavors – which include Orange Mango and Mixed Berry (electrolytes), Orange Pineapple (energy) and Black Cherry (immunity) – are sold in 6-packs online and will launch in 20-count pouches for Costco stores. The company’s president, Andy Horrow, noted that the expansion into powders should make Protein2O more retail format agnostic. The brand can open and grow new retail channels, including gyms, food service and hospitality where limited cooler space demands high premiums for RTD products, he said, and the versatility of powder allows for more placements.

One issue: distributors, Horrow said, have also become more interested in powdered products thanks to high velocity, strong margins and the rising retailer interest, but in conventional retail, some stores are still figuring out how to merchandise the functional powder category.

“I think for us, powders are still – outside of a gym or GNC environment – a little bit of the Wild West,” Horrow said. “And you could say that because retailers are trying to figure out right now where they should be shelved … they’re scratching their heads saying, ‘Wait, should this be in the nutrition section? Should it be in a powder section? Should it be in the beverage section? Should it be a new section? They’re still figuring that out.”

Of course, the other important retail channel that powder formats allow brands to sell in is ecommerce. In particular, Sousa noted the high cost of freight in recent months has made the low weight and production costs of powders more appealing, and the format has long been strategic for online-focused businesses.

As mainstream consumers catch on, however, some smaller brands are preparing to focus on retail as the influx of brands sold online has made cyberspace more competitive and costly.

Paul Janowitz, founder and CEO of Mantra Labs – a maker of functional powdered beverages built around daypart use occasions – said that expanding into retail has become more important for startup brands in all CPG categories over the course of the pandemic as the influx of ecommerce products has lead to a more competitive space for online ads. Citing customer acquisition costs and lifetime value as metrics for digital marketing spend, some entrepreneurs Janowitz has spoken with told him they have seen the price of ads rise between two to four times their pre-Covid costs and, as a result, retail launches no longer feel like an imposing cost-intensive strategy.

As well, other changes to the social media landscape have impacted the ability of startups to break through the white noise. Janowitz noted that Apple’s decision to allow consumers to opt out of app tracking with its latest iPhone operating system update has had a significant impact in brands’ ability to target new consumers and a rise in spam and clutter from political actors has only added to the clutter on users’ social feeds.

“You’re having stuff dumped into people’s news feeds that they’re trying to clean out whether it has to do with real news or misinformation news,” Janowitz said. “It’s just become a very routed feed, and you’ll see it in your Instagram, Facebook and everywhere in between. So it’s just become a bit of a convoluted marketplace that’s not nearly as targetable or actionable as it was, say, five, six years ago.”

But that doesn’t mean ecommerce isn’t still growing, it’s just more challenging, Janowitz said. The control of data, relatively light shipping costs for powders, and discovery opportunities continue to make online a key channel for Mantra and other startups, even as the company, which last year raised $1.5 million in a seed funding round, is slowly stepping into the retail space via independent accounts with a focus on sporting goods stores and other outdoors retailers.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe