Breaking A Sweat: Electrolit Sets the Pace in Sports Drinks

When Keurig Dr Pepper boss Tim Cofer said in July that his company’s partnership with rapid hydration drink Electrolit was just “scratching the surface,” he chose an apt metaphor.

Somewhere in Waco, Texas, that surface isn’t so much being scratched as it is being literally pulled out of the ground: the future of KDP’s relationship with Electrolit — a division of Mexican pharmaceutical giant Grupo PiSA — is manifesting in an under-construction $400 million production facility that’s expected to fuel the sports drink brand’s long-term growth ambitions. Its current trajectory puts that potential into stark terms: in Q2, Electrolit took more than a point and a half of market share, making it the fastest-growing scaled brand in sports hydration, per KDP executives.

Electrolit’s rise has coincided with the decline of another would-be challenger (Prime) and the rise of a flood of ambitious startups either relying on scientific argument (Cadence, LMNT) or by the charms of various celebrities or influencers (Barcode, Unwell, Mas+ by Messi). Even if the category remains mostly spoken for by Gatorade and Body Armor already, for the first time in a while, it also feels ripe for a shakeup.

Electrolit Driving Growth For Category, KDP

Electrolit may have only been around in the U.S. for roughly a decade, but its long and winding route to market is paying off.

Years before it was repositioned as a sports drink, Grupo PiSA introduced Electrolit in 1950 as an oral rehydration solution designed for children suffering from cholera. Much like Abbott’s Pedialyte brand in the U.S., Electrolit developed an organic following over several decades as a hangover-buster and sports recovery drink in Mexico, precipitating its arrival in the States in 2015. A Houston-based office for its U.S. division, PiSA USA, opened in 2021.

During that time, Grupo PiSA established a healthy business outside of Electrolit; as a private company it does not publish sales figures, however its footprint suggests significant revenues, with over 20,000 employees and 14 production sites across Mexico. Including Electrolit, the company has over 1,500 pharmaceutical brands incorporated into 17 specialty lines.

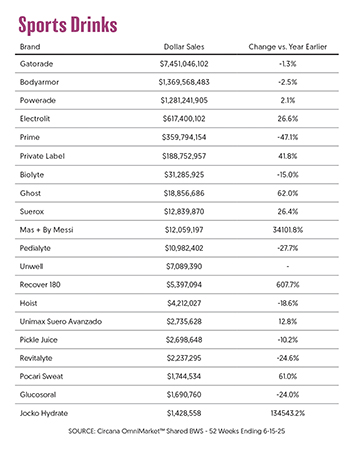

That base has allowed Electrolit to self-fund its U.S. expansion; straying from its typical practice of taking a financial stake in its partner brands, KDP is onboard strictly for distribution. And despite costing around five cents more per ounce than Gatorade, the product has found the kind of mainstream traction for its 21 oz. square bottles that other premium hydration brands have failed to achieve. Per sales data from Circana covering MULO w/ C-Store, Electrolit grew sales over 26% ($617.4 million) during the 52-weeks ended July 3, 2025.

While still less than half the share of the third-biggest brand, Coca-Cola’s Powerade, Electrolit — available in regular and Zero (zero sugar) varieties — picked up 1.22 dollar share (5.22 as of July 3) during that window, comfortably putting daylight between itself and its closest rival, the crumbling Prime (-47.1% sales). Volume soared 24.3% year-over-year, with average pricing up 1.8%.

That performance has made Electrolit an increasingly important contributor to growth in KDP’s U.S. refreshment beverages business, with the brand having registered over 30% retail sales growth in Q2 2025, KDP reported in July. That velocity is a welcome boon for KDP affiliated distributors like Seaview in New Jersey, where Electrolit’s growth has been “nothing short of remarkable” in the words of vice president Bill Butrymowicz.

“Month after month, the brand continues to build momentum, and I’m genuinely impressed by how it has evolved,” said Butrymowicz, whose trucks carry 20 SKUs from Electrolit. “What was once a niche product has now become a mainstream hydration item, and it’s commanding a premium price point without slowing down.”

Against that backdrop, the new $400 million Texas facility looks sure to be the catalyst for Electrolit’s next chapter, whatever that might be. Even before considering the current scarcity of aseptic beverage copackers, the Waco production and distribution hub is notable for its reliance on automation, with over 200 employees deployed across a 600,000 sq. ft. site.

Unlike its deals with Ghost or Nutrabolt (C4, Bloom), there’s little to suggest a direct path towards acquisition ahead for KDP, but that also depends on Electrolit’s long-term interests. The company’s Plano, Texas-based bottling division (The American Bottling Company) already operates several plants in the Lone Star State, and on a corporate level KDP has been active in building out its DSD network through acquisitions like Kalil Bottling Co. in Arizona in 2024. Acquiring a brand new, state-of-the-art facility in the heart of Texas, with access to rail infrastructure, could potentially unlock further growth for its product lines beyond Electrolit.

Science, Celebs Offer Alternative Angles

Electrolit isn’t the only brand encouraging retailers to rethink their category approach, however. For a long time, the consensus opinion has been that sports drink consumers are less interested in the nuances of electrolyte efficiency than they are about refreshment and taste. But as good old hydration has evolved into a highly scrutinized functional sub-category, there are signs that shoppers are indeed beginning to care.

As its name suggests, Unilever-owned Liquid I.V. has been heralding its credentials as a WHO-approved oral rehydration solution since it entered the market. That message, aided by fun flavor collabs with Popsicle, have pumped up sales: Liquid I.V., ranked as the fourth best-selling item on Amazon’s four-day Prime Day sales event in July. At $924-plus million in sales (52-weeks ended May 12, per Circana) — up nearly 28% year-over-year — it isn’t too far off the likes of Gatorade and BodyArmor.

Emerging RTD brands are hoping that increased attention on the quality and balance of electrolytes can open new consumers and channels in a manner similar to the way energy drink brands like GHOST, Bang, Celsius and Bloom were able to graduate from specialty nutrition outlets to mainstream retailers. That includes high-performance brands like LMNT, which packs a full gram of sodium (along with 200mg potassium and 60mg magnesium) into each 12 oz. sleek can of its Sparkling Electrolyte Water.

At retail, LMNT’s RTDs are moving through The Vitamin Shoppe, as is Cadence, a high-performance platform brand from Daring Foods founder Ross Mackay which launched its 12 oz. cans into the chain this summer. As once-niche health and wellness trends enjoy wider acceptance, consumers are looking more at how beverages fit into their lives rather than how they fit into the traditional concept of a sports drink.

“I’d say to a [grocery] buyer put this anywhere, because this will transcend into a lifestyle brand,” Mckay told us in June. “I think [modern hydration] will be agnostic to sport or to performance or to whatever you want it to be. And I think it needs another few brands to prop that category up. But you know, whether it be us and LMNT with really good nutritional profiles, I think you’ll start to see, hopefully, us actually build that category together.”

But will the category have space for celebrity and influencer backed brands? Even as Prime continues to collapse, retailers and distributors are still willing to partner up, though no brand has emerged as a clear front runner as of yet.

While still chasing glory on the soccer pitch, Lionel Messi has enjoyed a strong start to his career in the beverage business, as his Mark Anthony Brands-backed venture Mas+ by Messi landed over 27,000 stores a year since launching. MULO w/ c-store sales topped $12 million in the 52-week period ended July 3, per Circana. Also notable: Unwell, a line from podcaster Alex Cooper, jumped out with over $7 million in just six months on shelf at stores like Sprouts, Wegmans and Target.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe