Power Up: Protein Is Going Bigger and Wider, But How Much is Too Much?

Be it from wellness influencers, the nutritional needs of Ozempic users, or the pseudomedical approach to wellness infiltrating the political sphere, of late, the push for high protein products has supercharged the CPG business.

Consumers are seeking out higher doses of protein throughout their day and many are willing to go out on a limb to try it in new formats, from chips and ice cream to more unproven territory like soda.

But in the tried and true protein shake and meal replacement category, the trend is clear: more. More protein – as much as you can get.

Entrepreneurial CPG brands are wasting no time in innovating for that demand, pushing the boundaries of how much protein you can fit in a single bottle, with drinks easily surpassing 30 or 40 grams of protein per serving.

It’s not just startups either. Danone introduced a 30 gram shake under the Oikos brand in May, Coca-Cola’s Fairlife Core Power has a drink with 42 grams per bottle, and Quest Nutrition goes so far as to make a milkshake with a whopping 45 grams of protein in a mere 14 oz. package.

It’s pretty easy to see the reason for the muscle-building-block bonanza.

“Protein is winning in most places in the store,” said Scott Dicker, senior director of market insights at market data firm SPINS.

Whether it’s yogurt, cottage cheese, eggs or meal replacements and shakes, the data echoes the word on the street that high protein diets are in. While the influence of GLP-1 drugs “can’t be understated” as a driver, Dicker noted that protein also benefits from one of the strongest health halos in nutrition; while carbohydrates may be an on-again, off-again health villain, protein has always been accepted as “good for you,” which naturally behooves a trend that encourages consumers to eat and drink more of it.

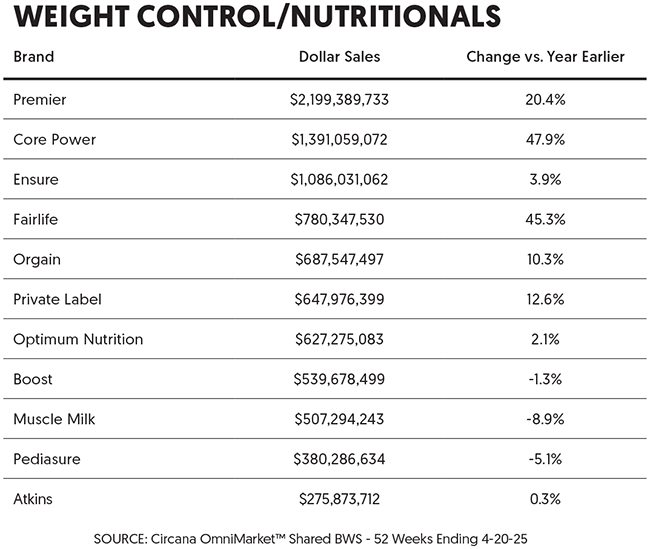

According to Dicker, ready-to-drink protein shakes and meal replacements containing 25 grams of protein or more grew dollar sales by 25% in the 52-week period ending April 20, 2025 in natural, conventional and convenience retail channels. Equally indicative of the ramp-up trend? Drinks containing 20 grams or less actually declined in the same period.

While the powder and supplement space has seen consumers shift back towards whey protein from plant-based alternatives, when it comes to RTD the source of the protein doesn’t appear to be a major concern for consumers: all drinks containing animal-based and plant-based protein each grew 32% in the same period (although Dicker noted that plant-based is starting from a significantly smaller position).

Broken down by channel, protein drinks grew 28% in natural, and 14% each in convenience and conventional stores in the same period.

“My barometer is always protein powder, because it’s such a core category for how people are purchasing for protein content, and that has been growing in the high single digits for most of the past few years,” Dicker added. “If the core category continues to grow, the barometer of interest is there for it in other categories.”

Beyond Pharmacy

When functional milk and coffee brand Slate launched in 2019, co-founder Manny Lubin said the company simply wanted to make a better-for-you chocolate milk. Over time, the brand has now “organically evolved” into an overall a better-for-you protein brand, Lubin said, as it became clear that’s where the demand was coming from.

Now, Slate has gone full throttle with an Ultra Protein line of milk shakes, made with 42 grams of protein and 2 grams of sugar in a 15 oz. can. Slate’s not alone in pushing the ceiling higher for shakes, though. Coca-Cola’s Fairlife also offers a 42 gram protein shake in its Core Power line and Quest Nutrition has gone as high as 45 grams in a single 14 oz. bottle.

But Slate’s not just trying to up the protein count for the flex of it. Lubin says the Ultra line was a direct response to customer and consumer demand.

“I think every brand should be driven by giving customers, whether existing or new customers, a solution to a problem,” Lubin said. “I think the problem that customers are continuing to see is a way to efficiently hit their protein goals without increasing the calories through a better-for-you product. We saw an opportunity for Slate to be that solution.”

Slate’s core business focus has been on wholesale retail and Lubin said the Ultra Protein line is one more way for the brand to “go deep” with existing partners and take a product format that has historically been thought of more like a supplement than a beverage and relegated to “4-packs in the pharmacy section,” and reposition it as a mainstream drink.

“When we think about Slate, we want people to think about our products as indulgent beverages and building that brand and making sure that we work with our retailers to find ways to build that messaging into stores,” he said.

While protein shakes have been gaining across the board – be it established names like Coke’s Fairlife, Quest Nutrition and Premier Protein, or maturing brands like Koia and Remedy Organics – the growth of the trend is also now pushing protein in new and sometimes unexpected categories.

Energy drink brand Bucked Up has added a line of “lightly carbonated” protein drinks, functional startup VUUM is blurring lines between categories, and RTD tea brand Protean has a name that’s fairly self explanatory (15 grams per 12 oz. can).

There’s also a wave protein sodas, with companies like nutrition and wellness brand Don’t Quit! coming out with a sparkling line after TikTok users began making their own homebrewed “Dirty Protein Sodas” last year.

U.K. startup Feisty Soda, which is preparing for a U.S. rollout that could come as soon as this fall, also makes a line of 12 oz. sodas made with 10-12 grams of protein each. Founder and CEO Vy Cutting said that the U.S. is “about five years” ahead of the U.K. on the protein trend, but that the wave is beginning to resonate overseas and in particular is having a big impact on the gender divide, with social media trends and early stage brands able to appeal more to female consumers.

“I think a few years back, [protein] was still a product which the sort of gym bros and athletes took,” she said. “Now you go on TikTok and all these ‘girlies’ are putting cottage cheese in absolutely everything.”

Dicker noted that soda is also rising up as a space for protein as a response to the success of gut health sodas like Poppi and Olipop, with protein providing another frontier for innovation as the better-for-you CSD space becomes saturated with pre- and probiotic drinks.

The trend also has some echoes of the better-for-you energy drink wave, both with the competition to boast higher ingredient content, as energy drinks pushed the upper limits of safe consumption with 300 mg or more of caffeine per can, and with the broadening appeal to women that brands like Celsius and Alani Nu helped to spearhead.

But just as energy drinks found their ceiling, not everyone is confident the numbers will rise forever.

Arms Race

Investor Kiva Dickinson, founder and managing partner of Selva Ventures, is very bullish on the protein trend, so much so that in a January 2024 article he predicted that high protein diets would be “one of the largest consumer shifts in the next decade.”

A year and some change later, Dickinson stands by that assessment, with the new conventional wisdom that consuming one gram of protein per pound of total body weight per day will be an increasingly common health goal and mindset among American consumers going forward.

But he still has his concerns, both as an investor and as a health-conscious individual.

Dickinson said he believes the brands best positioned to succeed in this environment are those that can offer “convenient, calorie efficient” ways of increasing protein consumption, and he pointed to food brands such as Overnight Oats and meat sticks maker Chomps as effective examples of companies that were performing well before the protein craze started and now have been able to ride the wave to accelerate sales.

Dickinson is wary when it comes to products and brands solely built around high protein occasions, however, which are likely to remain niche even in a macro environment where “protein maximalism” is the standard.

“I think the product should have a value proposition to the consumer beyond needing to have so much protein,” Dickinson said. “It could be the new normal, or it could be a fad where people need a lot of protein. It’s not clear to me that this is going to last forever.”

From an investor’s point of view, Dickinson said he’d be concerned that a company playing solely to the craze without a grander raison d’être “might be overearning” at the moment. From a health standpoint, he pointed out that we still don’t know what long term impacts widespread, higher consumption of protein might have on people – especially if they’re not matching it with appropriate levels of exercise and strength training, he said.

“I think if somebody’s trying to consume more than 120 grams of protein in a day, having a 40 gram protein shake could be quite helpful – I will often make a protein shake for myself that has 40ish grams of protein in it,” he said. “The problem is, is the packaged protein shake bio-available? Is it going to create other health issues if you consume it regularly? I think those are some of the dynamics that I don’t know that the consumer is really thinking about right now, and that they may start to think about in a year or two.”

In a March social media post, Fred Hart – a creative and design strategist who has helped develop branding for protein-forward brands like Koia – called this current wave of innovation the “Protein Arms Race Era of CPG” where brands appear to be in a mad rush to pack more grams, and thus more function, in each serving. However, Hart cautioned that from a branding perspective, this trend risks turning the “entire personality” of a brand into a dosage.

“When the only story being told is ‘we have more,’ it’s a short runway to commoditization,” he warned.

Speaking to BevNET in May, Hart said that the proliferation of protein across product categories – be it beverage or food, with protein-added ice cream, donuts and cookies filling the market alongside powders, shakes, sodas and other functional drinks – has also meant that brands will need to contend with share of stomach, especially with a product intended to fill up and satiate hunger.

“Ultimately, everyone’s gonna put protein in everything, and then there’s going to be a bubble that bursts, because consumers will inform these brands where they want it and where they don’t,” Hart said.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe