Suntory RTD Company North America president Satoru Shimizu and chief growth officer Christian McMahan laid out plans for the platform and the roll out of Maru-Hi, a 5% ABV flavored malt beverage (FMB) inspired by Japan’s chu-hi sparkling cocktail, during the Brewbound Live business conference today in Marina del Rey, California.

Citrus-flavored Maru-Hi will be available in California retailers statewide via the Reyes Beer Division next month.

The formation of the malt-focused business unit and Maru-Hi launch are part of Suntory’s larger ambition to be the No. 1 global RTD company by 2030, a market that is projected to reach $50 billion in the next five years. Suntory is already the top RTD company in Japan, the No. 2 RTD market in the world, second only to the U.S.

The 2020 acquisition of ready-to-serve brand On The Rocks and the launch of Japanese vodka-based RTD -196 (Minus One Nine Six) earlier this year play into the company’s larger aspirations. However, with the U.S. being the No. 1 RTD market in the world and a regulatory environment favoring malt-based products, Suntory saw FMBs as a key piece in delivering on its goal.

“You can’t be a leader globally without having a massive business in the U.S.,” McMahan said in an interview before the conference. “And you can’t really be a strong player in the U.S. without a proposition in malt given that two-thirds of the alcohol-beverage licenses are beer-wine only, versus spirits.”

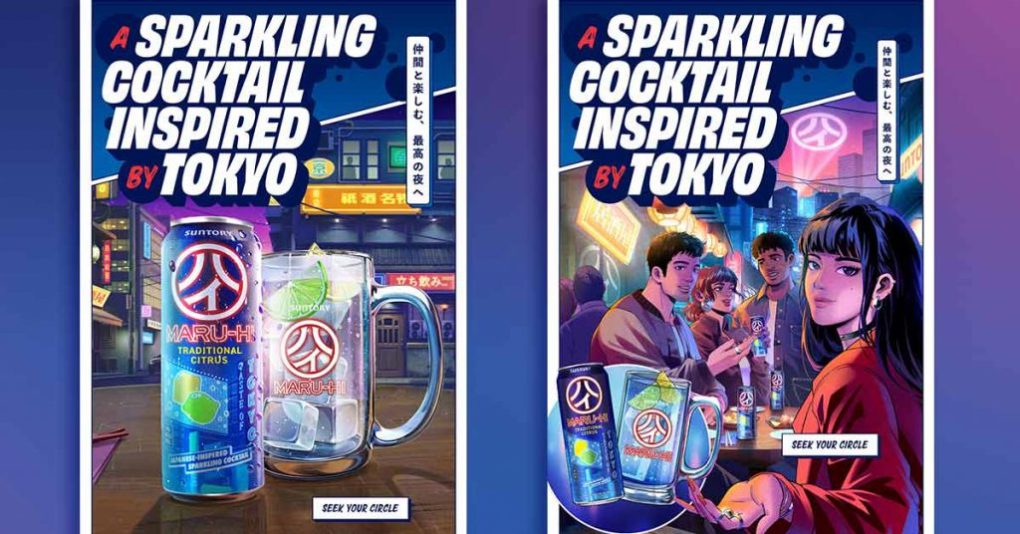

Maru-Hi is the first product aimed at filling that void. The FMB will be sold in 12 oz. sleek can 6- and 12-packs, as well as 24 oz. single-serve cans.

Shimizu told Brewbound that Maru-Hi taps into 70 years of Japanese bar culture created by the chu-hi cocktail. He views Maru-Hi as a unique proposition targeted to an untapped sub-segment of FMBs, as opposed to a challenger brand in the already dominated hard seltzer, hard tea and hard lemonade sub-segments.

He also pointed to Suntory’s history of producing spirits and its strong soft drink business as components of building the know-how in flavor creation that will fill the new business unit’s innovation pipeline.

“There is no other company that has both capabilities together in the world,” he said.

Partnering with Reyes for the California market is phase one of a three-phase roll out strategy.

“This is a melting pot of many different markets, many different consumers,” McMahan said of California. “So if we make our stand here and prove out this model, it’s going to be something people are going to be interested in hearing about and getting excited about when we come to their markets in those future years.

Included in those plans is a blueprint to get Maru-Hi into bars and restaurants.

“The drink is based off a very popular on-premise drink, a chu-hi cocktail, which is a real, common drink in the izakaya bars of Tokyo and around Japan, at night, with food, very versatile,” McMahan explained. “A lot of the RTDs don’t have a clear role or reason for being in the on-premise. Maru-Hi will have a very clear pathway to being an on-premise brand.”

Phase two of the plan will place Maru-Hi in around 50% of the U.S., with the addition of new flavors to create a variety pack. In phase three, Suntory expects to nearly finish Maru-Hi’s national distribution footprint.

Although Suntory is creating a new product inspired by a traditional Japanese bar cocktail, the company is targeting the product to the “general American consumer,” Shimizu said.

McMahan added that the product will be aimed at younger legal-drinking-age Gen Z and millennials with digital and social campaigns, including influencer marketing.

McMahan described Suntory’s U.S. platform for RTDs as one that acts like a startup.

“We’re nimble, we’re entrepreneurial, we’re literally going through all those things like a lot of entrepreneurs do,” he explained.

“I love it that we can act like a speed boat,” he continued. “We can move, we can turn, we can make decisions and really go and yet feel the support level when needed of one of the largest beverage companies in the world. It’s one of those projects that’s a once in a lifetime opportunity to be a part of.”

As the platform builds its portfolio, new-to-world brands and mergers and acquisitions will both be in play.

“We don’t have a preference which is better,” Shimizu said. “We have the ambition to achieve $1 billion U.S. dollars in the U.S. by 2030, so to make it happen, we won’t exclude the opportunity for M&A in the future. But at this moment, we don’t have a specific target.

“We really want to build Maru-Hi for the next year, and we’re planning to launch a new brand in the next few years as we grow the platform of FMBs in the U.S.,” he continued.