The following is the first of a two-part BevNET series on the ways emerging innovation is changing the dairy aisle. Today’s story introduces the setting, the players and the opportunity for alternative products in the dairy space.

Beneath the fluorescent supermarket glow, hardly decipherable amid the cart-pushing stupor, two aisles, typically located on opposite sides of the store, once manifested the shopper’s dichotomy.

For the past 10 or so years, innovation has sprouted from the produce aisle as if from the same soil as the nearby kale. This aisle, lush, fecund, embracing, has nurtured beverage pioneers POM, Naked and Odwalla, Bolthouse Farms and Evolution Fresh, as they’ve matured from neophytes to sourdoughs. Roll your wheels to the other side of the store and you’d find the dairy aisle, so insipid you’d have a hard time deciding what’s plainer, the aisle itself or the hue of the milk that dominated its shelves.

Yet as the days pass, the gap between the two shrinks. Beverage companies continue to form novel takes on dairy products and consumers translate their interest into acquisition. By adapting to the demand for nutrition, versatility of occasion and portability, alternative dairy brands have made headway in a former no-fly zone. That’s not to say that we’ve reached any kind of innovation boom in the dairy aisle. Most mainstream retailers and consumers prefer cereal and coffee paired with milk from the udder. And that won’t change too soon, so for peddlers of almond milk or ready-to-drink coffee, know that you’ll have to walk to the negotiating table strapped (with a bulletproof argument) or equipped for a pay-to-play scenario.

If that binary seems too daunting for your business plan, don’t get any funny ideas about the produce section. Greg Steltenpohl, the founder and CEO of Califia Farms, a marketer of citrus juice, almond milk and cold brew coffee with almond milk, said that you’re not stealing a shelf by the fruits and veggies. We’re talking about products owned by Coca-Cola, PepsiCo, Starbucks. The juice brands make deals. The juice brands have pull. And the crowds are chasing leftover space.

“That’s turned brutal,” Steltenpohl said. “So where do you go?”

The Dairy Frontier

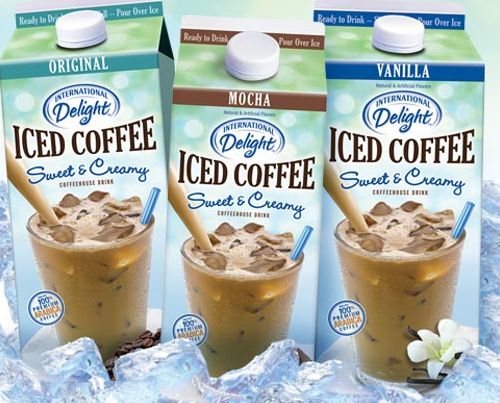

The alternative dairy products have made their rounds in the market, even if they haven’t always sat next to the jugs and cartons of milk. Take WhiteWave Foods, an agglomeration of food and beverage companies, which owns left-field dairy producers Silk and International Delight.

Silk has served as one of the leaders in the non-lactose dairy movement with its line of almond milk varieties, ranging from Unsweetened Original to Vanilla Protein+Fiber, along with another 11 varieties of soy milk and three types of coconut milk. As one might suspect from any strong-selling, innovative beverage company, Silk boasts about low sugar and calorie counts and its commitment to the Non-GMO project. The company also happily compares itself to dairy milk, stating that its products contain 50 percent more calcium, less saturated fat and no cholesterol.

“It’s interesting,” Carlson said, “where we’re going to get our ideas from.”

The coffees took off right out of the gate, he said, but not because of the product alone. It was the multi-serve format that influenced retailers, according to Carlson. Most dairy aisles are assembled to stock multi-serve products. This innovation opened the field for a stream of coffee products that are compatible in more than just the coffee, juice and tea aisle.

Targeted toward a different function, Lifeway Kefir debuted in 1986 with its yogurt-like smoothie and has since expanded its portfolio to include a wide and growing range of probiotic drinks. While the company in many ways started the probiotic wave that GoodBelly, KeVita and the multitude of kombucha makers are riding, its dairy base often reserves its place not far from milk, while its functional properties (digestive health) deliver an atypical element to the aisle.

Comparable to probiotics only in trendiness, cold brew coffees represent another of the few beverage categories that have caught fire in recent years. This has opened the gate for companies such as Stumptown Coffee Roasters to expand its portfolio beyond the flagship cold brew in the dark amber “stubby” and make a push into the dairy aisle. Stumptown started 2014 by launching “Cold Brew Coffee With Milk.” President Joth Ricci said that about 80 percent of the patrons at Stumptown’s 10 cafes in New York, Los Angeles, Seattle and Portland, Ore., were already adding milk, cream or sugar to their cold brew. Now, Stumptown is adding the milk.

The cold brew coffee trend has also welcomed the arrival of Chameleon Cold-Brew, a handcrafted coffee maker in Austin, Texas, that sells its products in sleek, apothecary-style bottles, along with Grady’s Cold Brew and a growing cadre of other brands.

Bhakti Chai, which founder Brook Eddy said accumulated $3.5 million in sales last year, also landed her products in the dairy aisles of certain accounts. Eddy’s core products are quart and half-gallon chai concentrates, which include Original, Coffee Blend and Unsweetened. She said that the dairy aisle makes for a natural fit because the concentrates mix well with all kinds of milk — cow’s, soy, almond and hemp.

“It just makes sense to be next to the very product that someone has to purchase to make our product full and whole,” Eddy said.

Considering that the aforementioned brands represent just a portion of the alternative dairy foothold, emerging brands don’t need glue and grit to form something new. They need only their form of evolution.

“We’re coming to the category,” Steltenpohl said. “We’re not asking anybody to think about it differently.”

Califia’s Case

When you work in the beverage industry for long enough, it can be easy to forget that most people don’t actually care about BPA-free bottles, questionable labeling claims, whether chia seeds are ground or whole.

“That’s what all of us beverage nerds forget about,” Steltenpohl said. “The rest of the world doesn’t quite care as much.”

So while it’s true that cold brew coffee has generated a rhapsodic following, a company intending to spread its footprint to more than the hipper parts of the coasts must remember that the masses don’t yet share this ardor. As Steltenpohl tries to grow Califia, he does his best to keep this in mind.

“There’s a still a big chasm between the hipsters and everybody else on cold brew,” he said.

Minding this gap, Steltenpohl omitted the words “cold brew” on the initial labels of Califia coffee for its launch in March 2013. Sure, part of holding back was rooted in his uneasiness with the claim, but it was also a marketing idea. Yet as cold brew has become as hip as 50s haircuts, Steltenpohl’s opinion has since shifted. He proudly adorns the words on the neck of the 48 oz. bottles for three coffee products — Café Latte, Double Espresso and Mocha.

Even with the presence of the modifier, Califia’s model hasn’t radically shifted. Steltenpohl is aiming to bridge the divide between the health-seeking, urban consumers and middle America. He wants the whole cake. His strategy is rooted in a simple idea that could connect with just about anyone in this country: less sugar, great flavor.

He doesn’t want consumers to pair Califia coffee with another product. It’s all there. He also doesn’t want to limit the compatible occasions for the coffee. He said that while Silk and Blue Diamond, another key competitor in the iced coffee and almond milk categories, offer indulgent products that have dessert-like elements, his coffee can be consumed throughout the day. He added that while Califia coffee is richer than your standard iced coffee, it contains either the same or fewer calories than coffee with whole milk or half-and-half.

Steltenpohl maintains this multi-occasion philosophy with the almond milks — Unsweetened, Vanilla, Original and Coconut. He said that fewer than 40 percent of almond milk consumers are drinking the product by itself. The more common uses: smoothies and cereal. By opening up the usage occasions, the almond milk category is expanding its dimensions and influence throughout the day. According to IRI, a Chicago-based market research firm, as of Dec. 1, 2013, Califia’s almond milks accumulated more than $2.6 million of the approximately $1.1 billion in sales of the kefir, milk substitutes and soy milk category. That’s not bad for a product that launched last spring.

Amy Cramer, the owner of Dairy Delivery, a distributor in Penngrove, Calif., a town about 45 miles of San Francisco, also carries Silk products. However, she said that Califia has the best flavor when compared to any other almond and soy milks.

“[Consumers] are constantly looking for good alternatives that they still feel are very healthy for them,” Cramer said, “but they don’t want to lose taste, they don’t want to lose quality.”