Sober & Sparkling: Alcohol moderation is enhancing – and challenging – the idea of what a sparkling water can be.

Over the past decade, conventional wisdom suggested that the rising popularity of zero-calorie sparkling water was a result of consumers’ slow pivot away from sugary sodas. But could alcohol moderation prove an even more powerful influence on the category?

There’s reason to think that might be the case: along with ditching CSDs, young Milliennial and Gen Z (aged 18-34 in 2023) disinterest in alcohol has been well-documented, with interest levels falling 10% over the last 20 years, according to recent data from Distill Ventures. Those consumers are looking for more and better non-alcoholic options, including sparkling waters. Yet in opening the door for enterprising brands to fill that void with fresh takes on non-alc beer, sophisticated mocktails and other carbonated innovations, sparkling brands face a raft of adult non-alcoholic (ANA) competitors, some of whose unique attributes can render fizzy, flavorless water uninspiring in comparison. According to a recent survey by Distill Ventures, in 2023 just less than half (44%) of ANA consumers switched to the loosely-defined space from “traditional” non-alc like soft drinks and water.

Squeezed between the surging RTD alcohol space and the moderation movement, where can sparkling water find its sweet spot? In a world where hard seltzer king White Claw is touting “non-alcoholic premium seltzer” as its latest big release, it’s a question worth exploring.

(Zero) Proof of Concept

With rising interest in non-alcoholic beverages and sobriety, sparkling water brands are looking to ride that wave to growth — some through explicit appeal to beer or cocktail culture, and others by simply offering more complex flavor experiences that can acquit themselves well when judged against a full-strength libation.

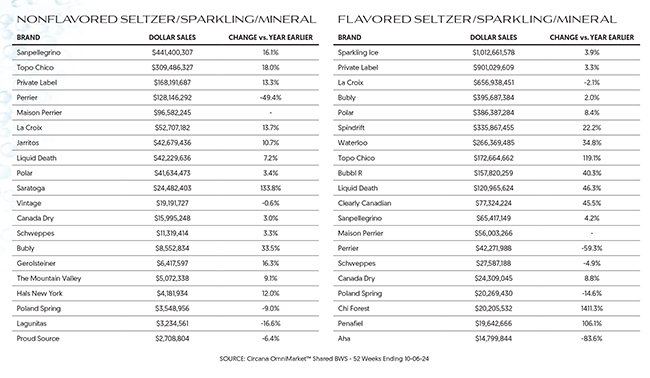

For Coca-Cola, there’s finally a sense of clarity in the category. After several attempts to work sparkling waters through its Dasani and the now-defunct AHA banners, the soda has reoriented its category presence firmly around Topo Chico. In response, the brand has continued to deliver strong performance with its core sparkling mineral water — +18% sales growth year-over-year through Nov. 6, good for a 21 share of the unflavored category – and flavors (+119% year-over-year) while also proving its potency as an innovation platform that can play on either side of the alcoholic divide.

That range of products includes Topo Chico Hard Seltzer, distributed by Molson Coors, and a line of staple mixers (Ginger Beer, Tonic Water, Club Soda) in 7.1 oz. glass bottles that arrived in February. But sub-brand Sabores, introduced in 2023, reflects how Topo Chico is subtly tapping into the movement away from alcohol. Pitched as a versatile, premium CSD flavored with real fruit juice, the three-SKU line has given the brand license to extend into more lifestyle marketing — think trendy drink collaborations with Kith Treats or a Sabores-themed short video series with comedian Rob Anderson — that help bolster its credentials as a sophisticated ANA or cocktail mixer. Coke is backing Sabores’ early success with two new flavors early next year: Raspberry with Lemon and Mango Tangerine.

The idea is to keep consumers within a brand ecosystem whether they are drinking or not. It’s a strategy also being deployed by Mark Anthony Brands, the Chicago-based maker of White Claw hard seltzer, through the 4-SKU zero-proof line it revealed last December. It may have inspired some curious looks upon its debut, but the product clearly reflects the company’s belief that White Claw’s brand equity can extend to other kinds of occasions, as evidenced by a packaging update and new flavors this year. In proclaiming itself “the first non-alcoholic hard seltzer” thanks to the use of a proprietary sweetener that creates flavor “complexity,” Mark Anthony Brands is attempting to craft a similar-but-different positioning. It’s an approach that former Mark Anthony executive Anthony Spina is also employing at his venture System Seltzers, which bills itself as the “first inclusive drinking system” by offering canned alcohol-free sparkling waters alongside 5% ABV and 8% ABV versions.

Weakness in the beer market has also provided an avenue for sparkling brands to peel off consumers. Non-alcoholic brews from both independents and large strategics are flooding the market, but hop-infused seltzers are also having their say. Earlier this year, HOP WTR landed investment from BTomorrow, the venture arm of British Tobacco that has been taking an increasingly active role in supporting emerging beverage brands. Another non-alc beer maker, Hoplark, added a couple of new flavors (Vanilla Bean + Simcoe Hops and Lemongrass + Lemondrop Hops) to its range of hop-infused sparklers in March. Elsewhere, Heineken-owned brewery Lagunitas has made inroads for its non-alcoholic Hoppy Refresher seltzers at chains like Whole Foods and Sprouts in California, to complement its presence at booze outlets like Total Wine and BevMo.

But as the scope of brands that could be non-alcoholic alternatives widens, it could also make sparkling water less unique. Within the context of replacing alcohol, zero-calorie waters like LaCroix and fizzy cocktails like Tost are competing on more or less equal terms, and consumers may be more permissive of sugar or other ingredients they otherwise avoid.

Aura Bora has found ways to dabble in non-alcoholic trends without steering too far away from its core principle of creating sparkling waters with compelling, elevated flavor profiles. Without messaging directly around zero-proof lifestyles, the brand attracted consumers simply looking for something to drink at the end of the day that doesn’t have booze.

That appeal has helped Aura Bora land placement at non-alc bottle shops and online boutique retailers like Sechey, where it sits alongside zero-proof canned cocktails and faux spritzes. But co-founder and CEO Paul Voge noted he’s just as committed to gaining more shelf space at liquor stores, a difficult task with respect to the three-tier distribution system. Instead, he’s developed the sub-line Dry Guys – a BevNET Award winner last year for its non-alcoholic olive oil martini in partnership with Graza – as a platform to explore more dedicated ANA releases.

Cocktail-inspired flavors have also been a boon to Spindrift. The Massachusetts-based brand has made the use of fresh fruit juice its calling card, and its adoption by non-drinkers has encouraged it to push further into the space, starting with Nojito introduced for Dry January 2023; it also introduced Spindrift Spiked hard seltzer in 2021. The positive response sparked the creation of another two SKUs – the bellini-esque Island Punch and Peach Strawberry – and will continue with the release of Cosmo early next year.

“In general, people have looked at the category as an alternative to alcohol,” explained Sue Kim, VP of marketing at Spindrift. “For us it’s just a trend that we are a little bit ahead of.”

Finding A Home

As any real estate agent will tell you, location is everything. That’s also the case for sparkling brands as they are recontextualized as alcohol alternatives: see Liquid Death, whose awareness has been boosted by its presence in venues where drinking booze is the norm, like bars and concert halls.

As HOP WTR co-founder Jordan Bass recalls, his original intention was to market the product primarily as a beer alternative, but consumer usage shifted that calculation.

“We’ll play in the craft NA beer section, and we’ll also have singles in the sparkling water/functional section and we’ll see that works super well, too,” said Bass, noting that data firms NielsenIQ and Circana track HOP WTR as “non-alcoholic beer” and “sparkling water,” respectively. “That’s one of the unique things about developing a new category: it gives us an opportunity to play in multiple areas of the grocery store and we see that as amazing for the brand, gives us multiple points of interruption to gain new consumers.”

Entrepreneur Dillon Dandurand is pushing that concept even further with his first beverage venture: Not Beer, which debuted in April and markets its canned 16 oz. sparkling waters as “0.0% Alc/Vol.” It’s an approach that may have some validity: according to a recent survey from NCSolutions, over one-third of Gen Z consumers (34%) say they’re more likely to try a new beverage product if it’s aligned with the sober curious lifestyle, compared to 17% of all Americans.

“We don’t drink booze for the taste, we drink it for the feelings, and not just the feeling of being drunk,” Dandurand told BevNET this spring. “The alcohol companies sell us that fantasy world and I think one of the most important things in that is inclusion. It’s taking that alcohol marketing and applying it to an everyday drink.”

Those sections are worlds unto themselves, however; a sparkling water might be considered expensive or affordable depending on what shelf it sits on. Just getting a place in the set, though, is a big part of growing the story.

“I think in the sparkling water set there’s a lot of discovery, and consumers are typically buying singles for that grab-and-go occasion,” Bass noted. “Especially in the natural channel, where you have these beautiful, cold open coolers with singles and consumers are discovering new brands and grabbing something for their lunch, etc. And when you look at the NA beer set, it’s much more repeat, destination purchases.”

It remains to be seen if consumers will do the same in c-stores, a big channel for beer but also a venue where NA beer adoption has been limited. Bass, citing 71% of consumers who report discovering new brands in convenience stores, is betting that HOP WTR can find a following there: this summer the brand introduced three flavors in a new 16 oz. can created specifically for the channel, and which are marketed alongside other sparkling waters in singles for around $2.29 to $2.99 each.

Yet even amidst all the evidence of growth, it can be easy to forget that the ANA movement remains in a relatively early stage. As attitudes change and products respond to those shifts, there will be more opportunities to present non-alc drinks in settings and contexts that best reflect their unique appeal. Take the example of Alaska Airlines: a generic seltzer is free on all flights, but Lagunitas Hoppy Refresher, introduced as part of a beverage menu revamp this fall, is only available for purchase in economy class.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe