Squeezing All They Can: Juice Companies Search for Efficiency and Growth

Juice has a fruit problem and the solution might be picking something new for the bottle.

The juice business has been challenged for years as climate change and weather events exert a headwind on crop yields and supply. The more immediate hurdle posed by tariffs has only made sourcing that much more expensive. As Florida’s groves have succumbed to citrus greening, juice makers have seen demand decline as consumers find healthy drinking options in other categories.

These incumbent and more recent hurdles have influenced both how juice makers operate and how they strategize for the future. Some brands have leaned into smoothing out their operations by shoring up manufacturing or cutting costs by simplifying formulation. Other juice makers have tweaked product positioning or are growing through acquisition, picking up category-adjacent brands to diversify revenue sources.

Despite headwinds, the category is still pushing forward.

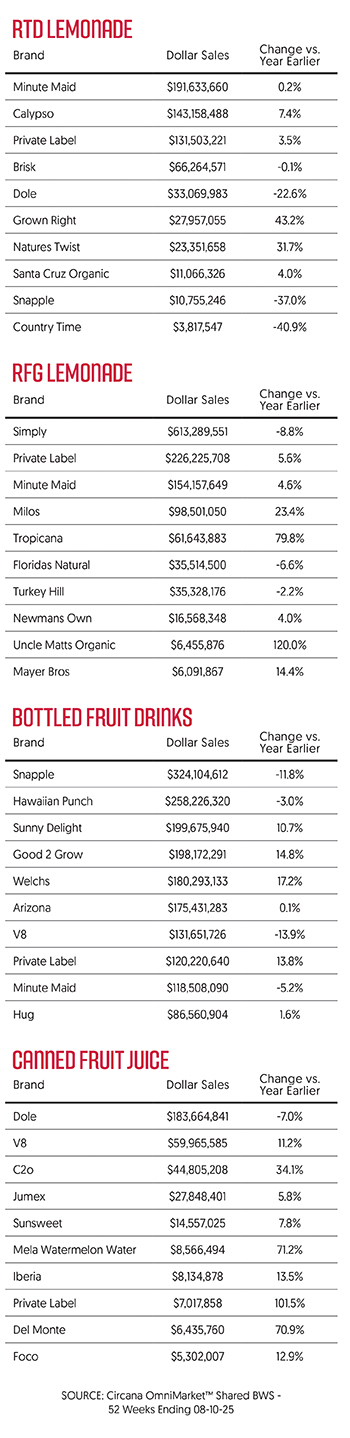

Refrigerated juice dollar sales ticked up 2.5% in the last 52 weeks ending August 10, as volume declined 3.3%, according to Circana MULO+C data tracking. In shelf-stable bottled juice, dollar sales declined 1% with volume rising 2.3% during the period.

Two long-term problems are looming over the juice category: the sugar-as-calories issue bedeviling all drink types, and the pricing issues resulting from both environmental change and from tariffs, said Howard Telford, Euromonitor International’s soft drink analyst.

Price Is Everything

While consumer prioritization of low-sugar options is the “smaller” of the two challenges, cost represents a macro issue with no clear solution, Telford added.

“Twenty years from now, how will brands be able to sell 100% juice to consumers?” Telford asked. “Where is it going to come from? Is anyone going to pay $10 or $12 for a bottle?”

While it’s not there yet, Circana reported that prices rose in the last year for both shelf-stable (3.1%) and refrigerated (6.1%) juice sets.

The cost issue stems from sourcing, where climate change has impacted yields and driven up commodity prices. Companies are offsetting these challenges by going deeper into nectars and blends, like Tropicana’s new Essentials line.

Essentials is positioning itself as more affordable than its various 100% orange juice options, blending not-from-concentrate O.J. with water, other fruit concentrates, and purees.

These “value options” are expected to grow category volume, Telford said, and deliver on the health benefits that juice has been associated with.

“It isn’t as necessary as it used to be to say ‘this is 100% juice’,” he said. “I don’t think the consumer really cares if it’s reconstituted. It has to do with the health halo of consuming X amount of vitamin C, vitamin D and vitamin B.”

About 48% of U.S. consumers are drinking less juice due to price increases, and 61% of juice drinkers say price is important to them when choosing a juice drink, according to Mintel’s 2024 Juice and Juice Drinks report.

Still, purity and quality remain key for brand success. Cold-pressed juice and apple cider vinegar shot maker SoFresco would argue that pricing is important, but not if it comes at the cost of moving away from a company’s core values.

The Portuguese brand’s guiding light is creating healthy products that reduce food waste and contain 100% juice with no additives, concentrates, or sugar.

SoFresco’s biggest affordability driver is owning its own means of production, said SoFresco senior VP of Sales Adam Litvack. The company’s sourcing of unused and unwanted fruits and vegetables, primarily from the Northeast, serves as a secondary cost-saving mechanism.

“In an economic climate where everybody is looking to save every penny and dollar, being affordable is really important,” Litvack said.

After landing in the U.S. six years ago, the company set up its North America operations (under the name Good Crop Inc.) in Malvern, Pennsylvania, where it operates its own high-pressure processing (HPP) facility.

Even though the company does “a little” HPP co-packing if it “enhances our partnerships with retailers,” Litvack said, but otherwise is not working with other brands.

Acquiring The Adjacencies

Beyond manufacturing efficiencies, some brands are looking beyond juice to other categories as a way to diversify amid challenging times.

Generous Brands started as a PE-backed refrigerated juice company, the result of a rollup of the Bolthouse Farms and Evolution Fresh brands. Last year, the company added responsibility for manufacturing and distributing the açaí brand Sambazon to its portfolio. These fresh juice brands are a good start, but rather than think of itself as just a juice company, it’s doubling down on the refrigerated set. Over the summer, it acquired Health-Ade Kombucha, the second-largest brand in the U.S.

While Health-Ade deepens Generous Brands’ footprint in the produce aisle beverage cold case, other juice companies are seeking adjacencies in different formats.

Probiotic soft drinks have become a key growth category for juice brands. After acquiring shot brand Vive Organic a few years ago, Suja Life – itself backed by PE firm Paine Schwartz Partners – added a rebooted Slice line to its portfolio in May 2024.

The nostalgic soda brand founded in 1984 has gone through three relaunches in seven years, but Suja’s Slice brings fruit juice and a pre-, pro-, and postbiotic formulation into the mix.

The Slice acquisition also followed Suja Life’s expansion into protein drinks in January 2024, positioning the cold-pressed juice and shot maker in competition with other protein smoothies like Remedy Organics, Naked Juice and Koia, among others.

The Slice deal isn’t the only one that revived a brand from suspended animation.

In January, Mexican beverage producer Grupo Jumex brought back legacy smoothie and juice brand Odwalla under a licensing agreement with the brand’s trademark holder, Full Sail IP Partners.

Jumex founder and U.S. Country manager Carlos Madrazo told BevNET at Expo West this year that Odwalla represents a recognizable brand to help Jumex develop a stronger foothold in the U.S.

The relaunch brings the brand back in a new format, 13.9 oz. glass bottles as well as 16 oz. and 34.2 oz. cartons.

Licensing agreements are one way to expand opportunities in juice adjacent drink categories, but another approach is joining forces, as represented by the California-based Perricone Farms’ acquisition (or “merger” depending on which part of the press release you read) of Natalie’s Orchid Island Juice Company last fall. The move “united” the two companies to “take advantage of bi-coastal production facilities,” the press release said.

For some, it’s not about reblending the smoothie with a new juice, but staying the course while adding in a couple of new ingredients.

Known for its brick-and-mortar juice shops, Pressed Juicery has been putting resources behind its retail endeavors. Since taking over in June 2023, CEO Justin Nedelman has nudged the company toward a more even split between storefronts and retail. Pressed added former Health-Ade CFO Gary Cooperman, who has helped expand its presence in ecommerce and grocery as the company’s hybrid CFO and COO.

Along the way, Pressed has lined up partnerships in Costco and Target, offering recognizable formats like cleanses and shots from its storefronts but now available in club, mass and grocery channel retailers.

Finally, sometimes a makeover is all a brand needs.

WTRMLN WTR (which was acquired by cold-pressed, Caribbean juice brand Caribé in 2020) recently rebranded as WTRMLN Lemonade over the summer. The refreshed packaging removed callouts to electrolytes and “ultra-hydrating” and moved those callouts to the back label, giving more prominence to the “no sugar added” and “cold-pressed” differentiators.

The “better-for-you lemonade” positioning appears to be working because it “still owns functionality, but less in your face,” said Caribé founder Luis Solis.

Since rebranding, WTRMLN Lemonades are up 47% in dollar sales over the 12 weeks ending August 30, according to Nielsen data shared with the brand.

WTRMLN Lemonade might not emphasize watermelon’s functional benefits, but the four other WTRMLN WTR varieties have benefited as well. Sales across both lines were up 44% in the 52 weeks ending August 30.

The brand has drilled down on messaging that explains the hydrating credentials of watermelon juice, a story that is easier to tell when other naturally hydrating options like Harmless Harvest coconut water sit on the same shelf, Solis said.

“Time has been our friend for that because it’s really hard to explain functionality to consumers when you’re a smaller company with limited budgets,” he said.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe