Gut Check: Can Kombucha Reclaim Its Edge Amid the Digestive Health Boom?

Just a few years ago, kombucha was on the doorstep of the mainstream, establishing a relatively strong foothold in the broader functional beverage category. Consumer interest in digestive health has continued to rise, but kombucha’s growth has stagnated as newer, trendier, and more affordable gut health-focused options have cropped up.

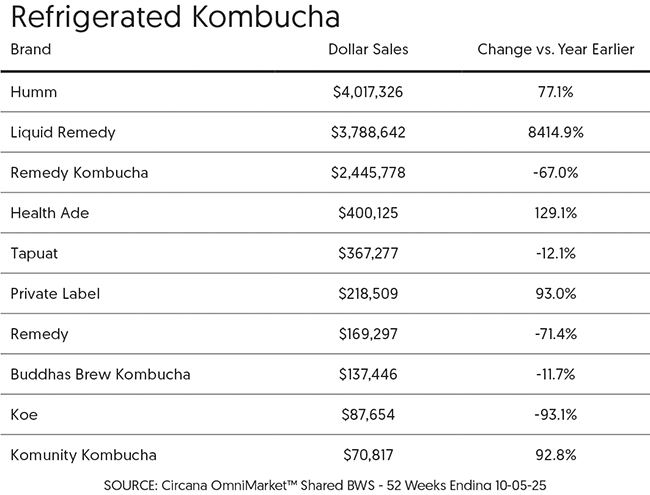

According to market research firm Circana, sales in the refrigerated kombucha category slipped 0.2% year-over-year to $756 million in the 52-week period ended October 5. Together, GT’s and Health-Ade hold more than half of the category share in MULO and c-store accounts. In the shelf-stable kombucha category, sales in the same period fell 17.3% to $12 million.

“There’s way more competition in the category with modern sodas and other functional beverages that have come out over the last few years, so [kombucha] is facing headwinds,” said Sally Lyons Wyatt, global EVP and chief advisor of Consumer Goods and Foodservice Insights at Circana. “However, I think getting in with the right value proposition and delivering on what consumers are looking for is the opportunity, whether you’re looking at refrigerated or shelf-stable.”

Howard Telford, head of soft drinks at Euromonitor International, shared a similar sentiment.

“There are a number of reasons for this, but my thesis would be that as a category, [kombucha] has been the victim of some of the growth we’ve seen in prebiotics rather than probiotics, and the explosion of fiber claims we’ve seen across food and beverage,” said Telford, adding that the fastest-growing category claim in 2024 in Euromonitor’s tracked categories was digestive health in soft drinks.

Despite the slowdown, a number of brands and retailers are confident there is still a “massive” opportunity in kombucha. From positioning as a non-alcoholic social beverage to selling at sporting events and music festivals, there are a variety of ways kombucha makers are attempting to reach a broader audience and lift the category’s household penetration – which currently stands at roughly 20%, according to Bob Nakasone, managing director of First Bev.

“There’s been a bit of a plateau for the kombucha market. Reigniting the excitement for the category can be a challenge,” said Kiara Tomirotti, co-founder of Chicago-based RMBR (formerly Komunity Kombucha). “I think the big key players have been winning in the space too long and there needs to be a new national brand that is exciting that comes into the space, or even multiple brands, similar to the craft [beer] movement.”

What will it take to return the category to growth? What are the value propositions consumers are looking for? And how can brands be the catalysts of a potential resurgence?

Re-educating the Consumer

Excitement over digestion isn’t the problem. Eighty-four percent of Americans have become more interested in products that support gut health over the past few years, according to a recent survey from Danone North America. While the rise of prebiotic sodas like Olipop and Poppi has contributed to this interest, their placement alongside refrigerated kombucha has, in some cases, led to consumer confusion and share loss.

“From a consumer standpoint, I think they can get a little confused thinking that these sodas belong in the kombucha category if they’re in the same fridge,” Tomirotti said. “I’m seeing the kombucha category really having to innovate and evolve so [it’s] able to stand on [its] own and continue to grow in that market.”

“The buyers at [major chains] are putting these pasteurized, shelf-stable [prebiotic sodas] in refrigerated coolers and taking away space from kombucha,” echoed Vinnie Pavan, co-founder of San Diego’s Babe Kombucha.

Not all consumers – especially newcomers to the digestive health category – understand the difference between pre- and probiotics. Raw, unpasteurized kombucha contains live probiotics that, when consumed in adequate amounts, can help create a more diverse microbiome to support digestion and immunity. Comparatively, prebiotic fiber – like the kind found in many “modern sodas” – may help feed the good bacteria in the gut, depending on the amount.

But what’s easy to understand is the form factor around prebiotic sodas. Rather than introducing a new attribute to a familiar product, kombucha has long been an island unto itself, balancing an emerging functionality with its own flavor, texture, and other sensory differences from better known product types.

For many consumers, that means that kombucha remains something more exotic than a soda – although that exoticism has many converts at this point.

One of the easiest places to educate consumers is through branding and marketing campaigns. GT’s, which commands a 42.6% market share, is celebrating its 30th anniversary with a new packaging refresh for its SYNERGY line, which founder GT Dave said is intended to “reinforce what kombucha should be – real, raw and alive.”

“This is our anthem to the marketplace and to consumers of what makes authentic kombucha undeniably different from other packaged food and beverages. We believe this message is more important than ever,” Dave told BevNET via email.

GT’s has chosen not to participate in the prebiotic soda trend, though Dave says he “respects what [the category] has achieved in such a short period of time.” Instead, the company will continue building its ALIVE and AUGA DE KEFIR products, its own versions of the category which support balanced mood and nourished hydration, respectively.

Elsewhere, kombucha makers like Health-Ade and Better Booch have introduced CSD products to directly compete against “modern soda” brands while educating consumers.

In 2023, California-based Better Booch acquired the assets of fellow fermented drink maker Live Beverages. Better Booch repositioned Live from a kombucha brand to a better-for-you soda brand to better fit the brand’s ethos. The company has maintained a raw, unpasteurized kombucha base for the product while adding in Native+, a blend of pre-, pro- and postbiotics aimed at supporting digestion, immunity and brain function and backed by clinical trials. Native+ has also been incorporated into the company’s flagship kombuchas.

“We kept building, grinding and improving the product. I think building more and more credibility with our customers and with people who care about gut health, and I think that’s been the differentiator for us,” said Better Booch co-founder Trey Lockerbie.

Better Booch relaunched Live Soda with new packaging earlier this year, and the brand has since become the fastest-growing product in that category in the natural channel, according to Lockerbie. In the past 52 weeks, it has grown to #2 by velocity, trailing only Olipop.

“When we play in the soda category, we’re still bringing health benefits to the table, which is a huge differentiator. When we looked at the market, we saw that a lot of the top brands aren’t organic and don’t have probiotics or postbiotics,” Lockerbie said. “Live Soda maintains Better Booch’s core values and beliefs when it comes to gut health.”

Broadening Use Occasions

While kombucha has evolved from a niche health drink into more of a lifestyle beverage, thanks in part to increased availability in mainstream outlets and more approachable flavors designed to appeal to everyday palates, legacy and mainstream brands alike are still working to reach a broader audience.

Founded in 2019 as Komunity Kombucha, RMBR (which stands for real memories, better rituals) has positioned its kombucha as a non-alcoholic social beverage. Its beverages are crafted with green tea, dry herbs and botanicals to provide a “more mild and enjoyable experience,” with flavors like Lavender Bliss, Hibiscus Punch, Island Time and Rosé Berry.

“We really set out to normalize the consumption of kombucha in social settings and put it in the perspective of more of a lifestyle beverage. Kombucha has a bad rep and we want people to perceive it in a higher standard and consume it on a more regular basis,” said co-founder and president Jack Joseph.

After proving out its value proposition in the foodservice channel (cafes, restaurants and coffee shops), RMBR landed its first grocery store partnership with Mariano’s in 2023. Today, the brand is available in nearly 1,000 stores across 16 states.

To capture its target audience of Millennials and Gen Z, the brand participates in in-person events and collaborates with other brands that have strong communities overlapping with its target demographic, such as outerwear company Arc’teryx. From a social media perspective, the company has benefited from organic content, including social media star Alix Earle’s review of the brand’s Blue Dream SKU, which she purchased herself at Erewhon.

Health-Ade, the No. 2 refrigerated kombucha brand in the U.S., has also benefited from partnerships that bring kombucha beyond the store shelf. Earlier this year, the brand expanded its partnership with the Los Angeles Dodgers for the 2025 season, including a limited edition Dodgers-themed can for its Pink Lady Apple flavor. Health-Ade has also partnered with celebrities like Ryan Seacrest, who became a brand advocate and investor in 2023.

“It’s about mainstreaming and demystifying kombucha and bringing in new audiences in unexpected ways, like showing up at a baseball stadium,” said Molly White, CMO of Generous Brands, which acquired Health-Ade from private equity firms First Bev and Manna Tree Partners earlier this year. “In 2024, Health-Ade more than doubled in-stadium kombucha sales and grew its Hispanic shopper base by 45%.”

Under the previous ownership of First Bev and Manna Tree, Health-Ade completed a packaging refresh in 2021 that sought to make the brand more fun and approachable. That decision has proven fruitful; the brand’s retail sales are approaching $250 million annually, and its products are available in 65,000 outlets nationwide.

“Functionality to consumers is serious in and of itself, so the refresh moved the brand to a bright-colored ombre design accompanied by the tagline ‘bubbly probiotic health beverage.’ Additionally, we updated the consumer-facing messaging on our website to present the science-backed topic of gut health in a fun way,” said Nakasone.

Finding Space in Retail

As with any beverage category, shelf space for kombucha in retail is finite, especially in independent grocery stores. Given that two giants dominate the category, what opportunities exist for emerging brands?

Year-to-date, Calif.-based grocery chain Jimbo’s has sold over 100,000 units of kombucha across its four stores, eclipsing the functional category by nearly double the units, according to Jason Murrell, director of center store. While the retailer has reduced overall shelf space for the kombucha, it can flex the real estate for innovative brands that catch its eye.

“Kombucha, though declining in market penetration, still plays a huge role in our stores. There are so many customers that are locked in on the benefits it provides, the simplicity and quality of the ingredients [and] the superior unique flavor profile that only kombucha can provide,” Murell told BevNET via email.

Last year, Jimbo’s pulled GT’s main product line – which had been a store staple for over 20 years – from its shelves after discovering the company was adjusting its ingredient deck from 99% organic (“certified organic”) to 94% (“certified with organic ingredients”). The removal of GT’s and the subsequent increase of available space enabled the retailer to pivot to focus on smaller brands in the kombucha category.

For Massachusetts-based Cambridge Naturals, which has stocked kombucha for roughly two decades, providing shelf space for smaller, emerging brands is also in its DNA.

“It’s our [mission] to support as many local, emerging, unique brands as possible. We’re always looking to differentiate our selection by having those items that you can’t find everywhere and creating customer excitement around those products,” said Emily Kanter, co-owner and CEO of Cambridge Naturals.

Beyond retail, a number of brands – including Better Booch, Babe Beverages and RMBR – have also found success in foodservice.

While it has since gotten more and more adoption in traditional grocery stores, big box retailers and conventional chains, food service is where Better Booch “cut its teeth in the early days” and is still “very much a key focus,” according to Lockerbie. The brand has a lot of popularity in high-end coffee shops, where food-savvy consumers are “very particular” about the quality and tastes of products.

“I think they recognize the superiority in craftsmanship and I think beyond that, people are looking for the science that we’re bringing to the table,” said Lockerbie.

For California-based Babe Beverages, which started off as a kombucha tasting room in 2007, food service is “really moving.” According to Pavan, the brand has sold $1 million worth of product to two major customers in the channel.

“Our mission is to expand the horizon of kombucha and show consumers that it’s possible to make a product that is truly alive and still tastes good. If we do that, and we get into more retailers, then I think we’re doing our part in the segment well,” he said, adding that the brand has gained interest from new retailers after winning Best Tasting Kombucha in the mixed fruit category at the World Kombucha Awards.

Where Do Future Opportunities Lie?

While those in the space are hopeful that kombucha can return to growth, some are adapting by expanding their portfolio to include new formats or products in adjacent categories.

“I’ve lived through the hyper-growth years and the mid-cycle growth years that we’re in now. I remain excited about the category and digestive health. There’s obviously a lot of competition in beverage and beyond. I think the [kombucha] category needs to play a bigger role in grabbing its share of digestive health,” said Nakasone.

“To me, the prolonged decline over the past few years really just points to the opportunity for innovation, perhaps even within the kombucha category,” said Murrell. “I think that innovation will most likely take place away from kombucha, as we are seeing significant lift in other functional beverage categories, but I truly believe that innovation lies within simple, clean ingredients in new forms that customers haven’t even heard of.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe