Fizz Factor: How Soda’s Resurgence is Helping Bring Flavor, Focus to Sparkling Water

Do Bubbles by Any Other Name Taste Just as Sweet?

After the last several years, it’s a fair question for beverage industry observers to ask. Amidst growing worries around sugar consumption, the past two decades have witnessed a slow march towards ubiquity for sparkling water: with consumers actively seeking soda alternatives, category giants like La Croix, Spindrift and Sparkling Ice surged to meet the demand. As the category commoditized and private label jumped to the forefront, the initial wave of innovation subsided and, similar to coffee, retail sets coalesced around a handful of dependably popular fruit flavors.

But in recent years the sparkling refreshment space has evolved; now awash with better-for-you and functional products – think prebiotic sodas, carbonated relaxation drinks, lightly caffeinated and zero-sugar options, to name a few – consumers aren’t grading flavor on a curve. Big flavors, including those traditionally reserved for soft drinks, are in high demand, and if you can deliver, drinkers don’t seem to mind what you call it. Those conditions have opened the door for long-established sparkling water brands to expand, while also giving them more leeway to innovate and excite consumers with their core products.

Today, almost all the top names in sparkling water are also dabbling in next-gen CSDs, but that doesn’t mean they’re abandoning their roots. Rather, buoyed by soda’s rehabilitated public image, sparkling water is taking advantage of the moment.

Sparkling Gains Fuel Soda Dreams

Having enjoyed a front-row seat to the evolution of carbonated soft drinks over the past decade, Sparkling Ice is changing with the times.

In February, the Washington-based company joined the prebiotic soda gold rush with the release of Popwell, billed as the category’s “first cold-crafted, full flavor entrant.” The 12 oz. can release has understandably been Talking Rain’s biggest focus for this year, backed by a “Breaking Bad” themed TV campaign starring one of the show’s former stars, Anna Gunn. The arrival of Lisa Holcomb as VP of Brand in April has helped drive momentum behind expansion efforts.

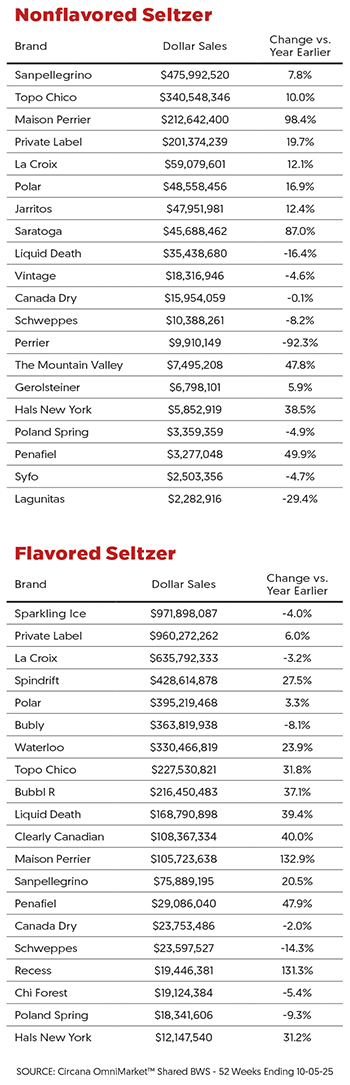

But Popwell’s release has perhaps overshadowed another year of steady, consistent growth from Sparkling Ice; despite contracting 4% year-over-year through November 5, according to data from Circana, the brand still leads the flavored sparkling category with over $971 million in sales, good for an 18% share. That includes soda-style lines like Sparkling Ice Caffeine, which has leaned into classic flavors like Cherry Cola in 16 oz. cans, an exclusive launch at convenience chain Casey’s from September. The January appointment of Chelsea Sobran as Talking Rain’s first-ever VP of Convenience marked a step in that direction.

After introducing Emmy Award-winning actor Annie Murphy as its Chief Flavor Officer last year, Sparkling Ice has sought to keep that momentum rolling in 2025. Murphy returned as the face of the brand’s “Anything But Subtle” campaign this year, focusing mainly on Sparkling Ice Caffeine, but it’s been the brand’s collaboration with iconic candy Starburst that has had the real staying power.

According to Talking Rain, the company shipped 2.4 million cases of the initial four flavors from January through March 2024, with full-year projections for the line increasing over 300% by April. Two new flavors, Fruit Punch and Watermelon, were released as part of the brand’s 12-count Starburst “Red Pack” in January.

This year the brand dipped into collaborations with Sun Pacific’s Cuties brand for a limited release of two flavors, Mandarin and Orange Cream, in 10-packs of 7.5 oz. mini cans.

“If there’s one thing that ties all of Talking Rain’s newest Sparkling Ice flavors together, it’s nostalgia. Comforting, nostalgic flavors are having a major moment in food and beverage right now,” said Lisa Holcomb, Talking Rain’s VP of Brand.

With modern soda providing a more natural path towards new revenue sources, that has also eased the pressure to play in hard seltzers, particularly as that category’s popularity has cooled from its peak at the turn of the decade. Sparkling Ice quietly discontinued its alcoholic Spiked line in 12 oz. cans, untangling multiple layers of organizational complexity in the process.

It was a similar story at Spindrift, which sunset its Spiked extension in August after roughly four years on the market, citing “substantial resources and time due to the unique route to market, dedicated manufacturing requirements and necessary regulatory compliance.” Now under the ownership of San Francisco-based private investment group Gryphon Investors, the Massachusetts-based brand returned to its CSD roots in January with Spindrift SODA, launching in 12 oz. cans in five flavors.

Meanwhile Spindrift’s sparkling waters have continued to produce strong numbers across retail channels. According to Nielsen data (including xAOC + Convenience and Amazon), Spindrift is up 30% over the 52 weeks ended October 28, and its volume increase of 27.3% during that period dwarfs total category gains (2.5%). The company is at over $343 million for the year, per Nielsen, but CEO Dave Burwick has projected sales to pass $400 million by the end of 2025. And yet household penetration is only around 5%, suggesting plenty of room left to grow.

That trajectory has encouraged Spindrift to go further in emphasizing its use of real ingredients: this year’s new releases included Yuzu Mandarin – an online exclusive that inspired a collaboration with the award-winning Momofuku Noodle Bar in New York City – and Cranberry Punch, the latter being a limited seasonal SKU this fall.

The sodas and sparkling waters are each playing a distinct role across Spindrift’s two-pronged portfolio, explained Burwick and co-founder Bill Creelman during an appearance on the Taste Radio podcast in April.

“We were able to kind of see where those categories overlap, where the retailers overlap and then where they’re different,” said Creelman. “There’s still particularly the ‘with food’ occasion [that] in our opinion is probably better suited for a more intense flavor [of soda].”

Bubbling Up from the Border

The complementary, parallel tracks for sparkling water and soda can be seen coming up from the Southern border.

Mineragua, a division of Mexican-owned beverage giant Novamex, has a long-established presence in the sparkling water category through its imported line in glass bottles. But while its better-known sister brand Jarritos dabbles in zero-sugar innovation of its own, Mineragua is being positioned for its first big change in years with the introduction of Mineragua Mas.

Launched in October, the 12.5 oz. glass bottle line, sold in 24-packs, leans into traditional Latin flavors across its three SKUs (Mandarin, Guava and Mango Passion), achieved through the addition of cane sugar.

The new line may provide a breakout moment for Mineragua; despite a packaging revamp aimed at broadening its reach in 2021, the brand’s glass bottles and branding have limited its shelf presence to Latin food stores or aisles at grocery. Launching Mineragua Mas is an intentional investment in better-for-you refreshment, and a chance to highlight “the authentic flavors and heritage that define Novamex” outside of the Jarritos brand.

“Mineragua Más lives within the flavored sparkling mineral water category, offering a unique middle ground that is lighter than a soda but more flavorful and satisfying than traditional sparkling water,” said Jazhen Gonzalez, Brand Manager at Mineragua. “Its lightly sweetened profile delivers the crisp refreshment people want from sparkling water, while also providing a healthier option for those moments when consumers crave something fun and flavorful without committing to a full-sugar beverage.”

Like Spindrift, Mineragua is also considering where the sparkling water line can most effectively support its sister soda brand. While Jarritos has become a staple of taco trucks and Mexican eateries, Mineragua Mas debuted at Latin specialty grocery chain Northgate Supermarket in California, and has since widened to select Food For Less stores in Northern California as of this month.

“We’re taking a measured, community-first approach, building excitement where Mineragua has deep roots before scaling to additional regions,” said Gonzalez.

There’s reason to believe in that strategy: see Coca-Cola’s stewardship of Topo Chico, during which it has dialed up innovation, including in alcohol, while leaving the brand’s long-standing identity in place. The Mexican mineral water brand is a high performer within Coke’s non-CSD sparkling portfolio, with additions to its juice-sweetened Topo Chico Sabores line (Raspberry with Lemon and Tropical Mango) arriving this spring, and another, Passion Fruit, hitting shelves this February.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe