Hard Cider Continues to Find Growth on Bev-Alc’s Bumpy Seas

The approaching New Year’s Day can’t come soon enough for many in beverage-alcohol. The industry would be happy to forget 2025 and move onto a potentially stronger 2026. But within a sea of lackluster scans, rising supply costs and a swell of macroeconomic headwinds, one small, but mighty segment has found growth: Hard cider.

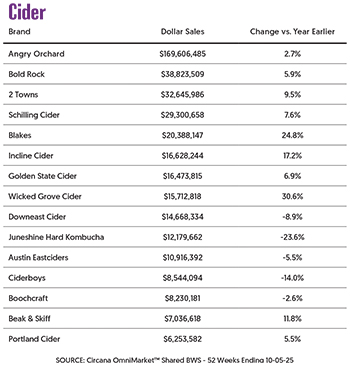

Hard cider has had a year of major milestones, including record-breaking months for leading craft brands, and a return to growth for large player Angry Orchard. Year-to-date (YTD) through November 2, hard cider dollar sales (+1.9%) and volume (+1.7%) are both in the black in Circana-tracked off-premise channels. The segment is one of only three beer segments to record growth YTD, along with domestic super premium (dollar sales +2.9%, volume +2.8%) and non-alcoholic [NA] (dollar sales +22.3%, volume +24.1%).

That growth comes as the total beer category is down 3% in dollar sales and 4.6% in volume YTD, driven by another soft summer.

Cider’s growth story over the past two years has been led by regional brands, which overtook national brands for the dominant share of cider sales in 2023. But as regional brands helped buoy the segment in consumers’ minds, national brands, led by Boston Beer Company’s Angry Orchard, have also started to rebound.

Angry Orchard ended 2024 with dollar sales (-3.8%) and volume (-6.3%) both in decline in NIQ-tracked off-premise channels, according to data shared by 3 Tier Beverages (data ending December 28, 2024). Now, the brands’ trends have completely flipped, with dollar sales (+5.6%) and volume (+5.1%) both in the black YTD through November 1.

Angry Orchard’s rebound hasn’t been from an explosive new strategy. Instead, Boston Beer has made several small tweaks to return to consumers’ baskets. There’s a new campaign, “Don’t Get Angry, Get Orchard,” new limited edition and single-serve packages, and a focus on the convenience channel – Angry Orchard’s strongest channel in YoY growth this year.

Angry Orchard Crisp – the cider brand’s flagship offering – is now a top 50 beer brand in c-stores (dollar sales +4%, volume -2.7% YTD) and No. 32 in grocery (dollar sales +2.3%, volume +1.2%). The offering is the 39th largest beer brand in total Circana-tracked off-premise channels, with dollar sales up 3.4% and volume up 2.5% YTD.

In spite of hard cider’s growth, the segment is still the smallest within beer, with 1.12% share of category dollar sales and 0.71% share of volume YTD. However, that share is growing.

“We were and are such underdogs, less than 5% of the size of the beer category,” Bauman’s Cider founder Christine Walter said in an August interview. “It’s easy to see the total pie as small and each of us as fighting to get a bigger piece of it. But I know that the pie could be much bigger, and that without strong leadership, we would never realize that potential.”

That leadership includes American Cider Association (ACA) CEO Monica Cohen, who took the role in January.

In her first in-person address to members during February’s CiderCon event, Cohen said she believes “it’s cider’s time.”

Her goals for her first year include:

• Making sure members are “able to keep your lights on and grow your business;”

• To be present at Capitol Hill and fight “for things that make it easier for you to do business,” including eliminating laws that “don’t make sense;”

• And “tell the stories of cideries” to fellow bev-alc industry members and consumers.

“My journey to the stage today has taught me the possibilities of cider,” Cohen said. “It’s vast, it’s diverse – I had no idea. Now I know, and as the leader of the ACA, I’m going to make sure everybody else knows too.”

Cohen will address members again in Providence, Rhode Island next February, during the 16th annual CiderCon (February 2-5, 2026).

Below are other highlights from cider’s year so far:

Schilling Cider Records ‘Best Month Ever’ During National Cider Month

National Cider Month returned this October, marking the sixth annual celebration of hard cider, with on- and off-premise activations meant to promote and expand the segment.

National Cider Month is brand-agnostic, with 215 participating cideries, but it is spearheaded by Washington-based Schilling Cider, which recorded its “best month ever” this year, CCO Eric Phillips shared.

The month didn’t benefit just Schilling. In the last week of October (data ending Nov. 2), hard cider recorded its second best week of sales, behind the week of July 4, according to Phillips. For the four-week period ending November 2, hard cider led alcoholic beer growth in Circana-tracked channels, with dollar sales up 4.9%, to nearly $128 million in sales, and volume up 5.3%.

In the same period, total beer dollar sales were down 4.5% and volume fell 5.8%, marking an acceleration in declines compared to YTD figures. The contrasting trends helped cider claim 2.1% share of beer dollars in October, according to Phillips.

Angry Orchard also recorded a notable boost, with dollar sales (+15.9%) and volume (+19%) both up double-digits in the four-week period.

This year’s cider growth was made possible by support across all three tiers, according to Phillips, who noted that this year had strong new participation from retailers outside of cider’s strongest market (the Pacific Northwest), including California and Colorado.

One of the most vocal supporters of the campaign is national retailer Whole Foods Market, which has led retail support for National Cider Month since 2023, when the campaign started having a more national reach.

“It is so exciting to see how much National Cider Month is allowing new consumers to discover and learn about cider,” said Smanatha Fletcher, Whole Foods senior category merchant, adult beverage. “Cider has not always garnered the attention that longtime cider consumers and producers knew that it warranted.

“Being from the south, cider was not part of my initial beverage experience, either through family or social tradition,” she continued. “This may be surprising to those who are from cider producing regions, but not everyone knows how or when to drink cider. National Cider Month provides that spotlight and reason to explore this delicious beverage.”

Hard cider sales at Whole Foods are up 1.3% YTD, while volume sales have increased nearly 3%, according to Fletcher. For National Cider Month this year, the retailer created promotions around 127 SKUs from 62 cider brands, mixing both national and regional offerings.

“Whole Foods Market has supported National Cider Month since the beginning, so what’s also exciting for us is that we are now seeing other retailers not only increase the number of cider options they carry, but we’re also seeing them lean into and embrace the full branding of October as National Cider Month,” Fletcher said.

“As consumers become more intentional with learning about what they consume – where product is made, how the product is made and/or philanthropic missions of who makes the product, cider is the underdog that has been here all along,” she continued. “It’s the product consumers didn’t know they wanted – with high quality, natural flavor and gluten free as just a few of the traits that get their time to shine during National Cider Month.”

2 Towns Celebrates 15th Year with National Milestone

Fifteen years after launching Oregon-based 2 Towns Ciderhouse, founders Aaron Sarnoff-Wood and Lee Larsen have grown the company to be the second largest cider brand in grocery nationwide, with their products available in 19 states.

The duo “didn’t start this company to be a national player,” with the focus on the two towns where the founders lived – Corvallis and Eugene (hence the cidery’s name) – hoping to bring “top-shelf quality” cider to their communities “at an everyday price,” making cider “an accessible luxury for the masses,” Sarnoff-Wood said.

“Both of us had spent some time in Europe and really fell in love with cider as a cultural element in Spain, France and England,” Sarnoff-Wood said. “And getting back to the States, we saw the U.S. was treating cider very different. It was kind of a near-beer, sweet beverage for people that didn’t like beer, and we thought that there was so much more to offer in the cider category than that.”

2 Towns focused on growth where it “made sense,” eventually becoming the first craft cider brand to pass Boston Beer Company’s dominating national brand Angry Orchard in dollar sales in any state, hitting the milestone in Oregon around 2016, according to Sarnoff-Wood. The cidery’s core West Coast markets continue to be the drivers of growth for the company, with the Northwest and California primarily contributing to 2 Town’s early 2025 milestone of becoming the second best-selling cidery in grocery.

“It’ll happen where and when it makes sense for us to grow, but our priority isn’t to try to take over the world,” Sarnoff-Wood said. “When we see an opportunity to enter a new space, we like to work with partners there. We like to be a community partner, a member of that region, wherever we’re going. And so we want to be intentional when we make the decision to go to new places.”

2 Towns increased total dollar sales +5.4% and volume +6% in NIQ-tracked off-premise channels in 2024, according to data shared by 3 Tier Beverages. This year, the cidery has accelerated growth, with dollar sales up 9.8% and volume up 10.4% YTD, through November 1.

2 Towns’ growth comes as the cider industry draws more attention from beer industry members hoping to capitalize on the potential opportunities the segment could bring to a struggling category. In 2023, the Brewers Association welcomed cideries to pour at the Great American Beer Festival (GABF) for the first time, followed by the addition of hard cider awards at GABF in 2024. 2 Towns came away with the most awards out of any participating cidery at the 2024 festival, and was named Cidermaker of the Year.

“As a cider producer, I wasn’t really sure what to expect,” Sarnoff-Wood said. “I’ve been to GABF before as a participant, tasting beers and enjoying the time, and I think it was really an important step for just the acknowledgement of cider as a legitimate category to be included at GABF.

“It’s been a long time in the making, and certainly some of the current trends in the market have not been kind to craft beer,” he added. “And it’s forced a lot of folks to look over and see cider as a legitimate category as we’re still seeing some pretty nice performance when domestics and craft are both down pretty substantially.”

A Familiar Name Gets (Back) Into the Hard Cider Biz

In its 157-year history, Martinelli’s has become a staple in many U.S. households; from its squat 10 oz. apple juices that fit conveniently into kids’ lunch boxes, to its green sparkling cider bottles that allow consumers of all ages to toast and celebrate without booze.

But the company realized it had a problem: Consumers were forgetting about the brand. After consumers grew up, Martinelli’s became more of a memory or nostalgic reminder of their childhood, and a brand they wouldn’t reach for again until they had kids themselves. And then the cycle would begin again.

Enter Martinelli’s 1868 Hard Cider.

Martinelli’s launched the hard cider at the end of 2024 exclusively in California. The offering is available in three 5.7% ABV flavors – 1868, Mango and Berry Blush – as well as an 8% ABV Imperial 1868, packaged in 12 oz. can 6- and 12-packs.

“If you look at the life cycle of our consumers, many people know us until they’re kind of in their high school years, and then they become college age and [in their] 20s before they start having kids, and people forget about us,” president and CEO Gun Ruder said. “Then they start having kids and we’re back in people’s minds.

“[Hard cider] is an opportunity to bring something interesting and new to young adults that knew our brand, loved our brand, and now they’re seeing it again in a different space that may be of more interest to them as they enter their 20s and beyond,” he continued.

1868 Hard Cider technically marks Martinelli’s return to bev-alc, as the company was founded as a hard cider company in the same year it’s named for. It eventually was forced to move away from bev-alc ahead of Prohibition, and focused its portfolio on NA sparking and still apple juice.

Martinelli’s has brought hard cider back a few times in limited batches, as recently as 2018, when bottled hard cider was available to celebrate the company’s 150th anniversary. But this marks the company’s first return of hard cider as a permanent piece of its portfolio.

Martinelli’s is a national brand. However, 1868 is only available in its home state of California, for now. The company is being intentional about expanding at first, as it sees how consumers respond to the brand, Ruder said.

Martinelli’s has about 95% of the NA sparkling cider market in the Golden State, according to Ruder. California is also one of the largest states for hard cider consumption and production, along with states in the Pacific Northwest and Northeast.

“We were fortunate that it was a sizable market,” Ruder said. “We’re fortunate that it’s a market that our brand is very distinctive [in], so the value proposition that we’re developing should play here first and foremost. And if we can develop the skills and grow to market capabilities, which we have done for California and we’re successful here, that will provide a strong foundation to expand.”

Once a value proposition is fully established in California, Martinelli’s will begin to explore other markets, such as the rest of the West Coast and the Northeast.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe