Malternatives: How RTDs Have Affected the Segment

Flavored malt beverages (FMBs), sometimes referred to as “alcopops” or “malternatives,” enjoyed a heyday in the mid ‘90s, with brands like Bacardi Silver and Zima skyrocketing in popularity before crashing soon after. Slate specifically called Zima’s demise a “long, slow, torturous death,” reporting that “After selling an astounding 1.3 million barrels in 1994, the year it went national, Zima’s sales fell to just 403,000 barrels in 1996.”

At the same time FMBs were declining, craft beer began its meteoric ascent, with the number of operational independent breweries in the United States increasing every year since 2007. Today there are more breweries operating in the U.S. than ever before: nearly 9,000, according to the Brewers Association’s last count. But for as long as beer has dominated the beverage alcohol space, its share has been shrinking for a decade as spirits have continued to climb. One contributing factor to spirits’ increased popularity is a higher demand for pre-mixed, canned, ready-to-drink (RTD) cocktails.

Global data research firm Nielsen calculated that RTDs saw 574% growth of annual sales in 2019, with spirits-based RTDs increasing 40% from the previous year and accounting for $62 million in sales alone. COVID-19’s influence on the alcohol beverage segment catapulted RTDs even higher; year-over-year off-premise sales of RTD cocktails grew just over 90% after pandemic restrictions took effect.

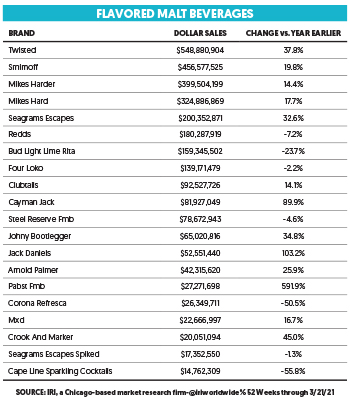

But even with this staggering rise in spirits-based RTD popularity, malternatives haven’t disappeared completely. In fact, well-developed FMB products like Mike’s Hard and Harder brands, Smirnoff, and Twisted Tea still dominate as the top sellers in the FMB category, collectively accounting for around half of the $3 billion captured in total U.S. multi-outlet with C-Store during the 52-week timeframe ending March 21, 2021, according to Chicago-based market research firm IRI.

“We see no signs of slowing down,” says Taylor Roy, Sr. Communications Specialist at The Boston Beer Company, who owns the Twisted brand family. Roy goes on to explain that Twisted Tea currently holds a more than 93% share within the hard tea category. “With continued double-digit growth, up 47% YTD, Twisted Tea is now the fastest growing brand in FMB and is a top 20 beer brand family that is the fastest growing behind only Truly [hard seltzer],” he says.

It’s impossible to talk about FMBs without mentioning hard seltzers. However, most research firms like Nielsen have broken out hard seltzers into their own category due to their position as an wildly high-performing outlier. Products that fall within the more traditional definition of malternatives, like Seagram’s Escapes or Four Loko, aren’t experiencing the double- or triple-digit growth many hard seltzer brands are, but that’s largely due to their surprising longevity and well-established position within the segment. Similarly, RTDs are still growing as well, but not as abruptly as hard seltzer, according to alcohol ecommerce platform Drizy. “Over the past 12 months, we have seen both hard seltzer and ready-to-drink gain share year over year. Hard seltzer share of sales grew 20% YoY while ready-to-drink share grew 160% YoY,” says Liz Paquette, head of Consumer Insights at Drizly. “Though RTD share has grown at a faster rate than hard seltzer over the past year, they make up one-third of the share of sales that hard seltzer accounts for.”

Despite RTDs and FMBs continuing to hold firm, if not grow, Amy Gutierrez, BevMo’s Category Manager of Beer & DSO Beverage believes that they’re flourishing independently of one another, rather than at the expense of either. “We don’t believe that they [spirits-based RTDs] are having an effect [on traditional malternatives],” she says, explaining that malternatives like Smirnoff and Mike’s variety packs actually exceeded sales forecasts during the pandemic. “During COVID, they ran out of stock on both of those. So the sales don’t even say what they could have done. Those types of products are still doing very, very well.”

She goes on to say that SKU growth and average unit sales of RTDs doubled compared to 2020, with sales volume up over 600% over the prior year based purely on year-to-date sales. Malternatives also saw strong growth at BevMo. “Sales in this category have grown over 100% in Feb and March of 2021 versus 2020 and over 50% 2020 versus 2019,” explains Gutierrez, saying they even added eight new products in 2020 versus 2019. Top selling malternatives remain variety packs, including Smirnoff Ice Party pack, Corona Refresca Variety, and Mike’s Variety 12-pack, all of which Gutierrez says experienced out-of-stock issues during the summer of 2020 due to an increase in customer demand. Both RTD cocktails and malternatives benefit from offering variety packs, as customers increasingly desire multiple flavors when purchasing new-to-them products.

Some early entrants into the malternative space, like Not Your Father’s Root Beer, rely more on the steady stream of repeat customers rather than focusing on exclusively capturing new customers. “Those types of products are still doing very well,” says Gutierrez. “Not Your Father’s Root Beer, it’s still doing very high up there. People still can’t believe that people are still looking for it. It’s not crazy like it was, but… it still outsells lots of brands.”

In her opinion, the individual, but concurrent growth for both RTDs and FMBs could be due to varying core customers. One theory she suggested is that people who have just reached drinking age or are in their early twenties are less likely to have the disposable income required to recreate the bar experience at home, leading them to rely more on premixed cocktails like Cutwater’s RTD offerings. “I think they can’t afford to go to the store and buy everything you need to make cocktails: you need the shaker, you need glassware, you need a bottle of vodka, you need these three ingredients,” says Gutierrez. “The people that are young, 21ish, they’re grabbing the total ready-to-drink… and then the people who are a little bit older who were already on the cocktail train, the Millennials who have the extra money, they’re staying at home, they’re doing cocktails, they can afford to buy quality ingredients.”

Comparatively, FMBs tend to appeal more to the older drinker already less likely to select RTDs, as their desire for convenience can be often outweighed by their ability to more closely replicate a cocktail experience that’s not premixed. Their purchasing motivation may also differ when it comes to health and wellness, as traditional FMBs typically don’t fall into the low calorie or “better for you” camp. Products within the malternative segment haven’t evolved en masse to appeal to consumers who specifically seek out better for you beverages, simply because there’s no need to do so. “Mike’s and Smirnoff, if they really saw their sales declining, they would discontinue selling those products, and they’re not. They’re still doing well,” Gutierrez explains. “Same thing with Seagram’s Variety Pack—that has always done well, but that’s not low-cal. Neither is Mike’s and Smirnoff and Malibu and all those.” She goes on to say that after reviewing the sales of all 161 BevMo stores, the Malibu Splash 8-pack, remains the number one seller in the malt category and number eight overall, with the first through seventh positions solidly occupied by hard seltzers. The next malternatives are Twisted Tea’s party pack at number 17, followed by Mike’s Variety packs in 18 and 19, with number 28 as Smirnoff Ice’s original pack. “That’s pretty high, when I have 466 products in that [malternative] category,” she says.

It seems that despite spirits-based ready-to-drink cocktails’ upward trajectory, the segment’s impact on the traditional malternatives remains minimal. FMBs aren’t growing at stratospheric rates, but neither are they receding under the crush of new entrants. With different core customers valuing fairly different aspects of each segment, both spirits-based RTDs and traditional malternatives are poised to continue succeeding in their own siloes.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe