Slow Growth for Next Generation of Kids Drinks

Any parent will tell you that kids grow up fast. The kids beverage category, however, can move a lot slower.

While there’s been a push over the past decade to bring more better-for-you options to the kids beverage set, from sugar free juices to flavored water boxes to functional beverages, there still remains an extensive amount of white space in the category for better-for-you brands that can operate at scale while capturing the taste buds of childhood consumers. For now, legacy players remain at the top of the category.

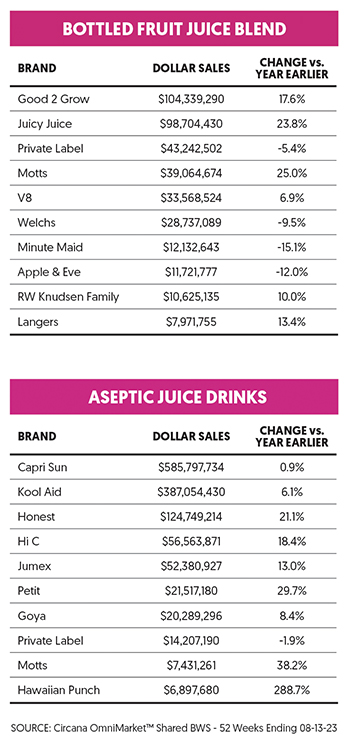

According to Circana, in the 52-weeks ending August 13, 2023, “aseptic juice drinks” grew all channel retail dollar sales by 6.2% to over $1.3 billion, while products simply called “aseptic juices” – a category which includes brands like Apple & Eve and Juicy Juice – were up 13.6% to $640.8 million. At the top of the larger aseptic juice drinks list are several classic lunchbox brands: Capri Sun leads the category, up 0.9% to $585.7 million, followed by Kool-Aid (+6.1% to $387 million) and the better-for-you option, Honest Kids, up 21.1% to $124.7 million. Hi-C ranked a respectable but somewhat distant fourth, with 18.4% growth to $56.5 million.

While that data only provides a slice of the overall picture for kids drinks, it’s also a reflection of how the legacy brands have maintained their grip on the set. While some emerging brands have made a splash in the category, they’re primarily still a fragment of the space. Even one of the fastest moving brands in recent years, the IP-driven Good2Grow – which bucks the category trend of bulky multiserve packs by selling single-serve on-the-go bottles designed to look like licensed cartoon characters – was down -10.2% to $25.3 million.

So why, save for the Coke-acquired Honest, has it been so rare for entrepreneurial brands to stake a serious claim in this set, especially as demand for better-for-you products has remained consistent?

Veteran retail buyer Dwight Richmond, director of center store at Pacific Northwest retailer Town & Country Markets, suggested the problem might be a bit cyclical. Richmond said he doesn’t believe that the turnover or longevity of individual brands in the kids set is much different than any other beverage category, but instead innovation is much slower than it is in adult beverages. As a result, most retailers limit their shelf space as there’s little incentive to expand, leaving those entrepreneurial brands that are trying to innovate in a much tougher position trying to break in.

“In a lot of stores [the shelf is] four feet, it’s not big because there’s not enough innovation to spread it out and make it bigger, especially outside of the Krogers and Walmarts,” Richmond said.

“As opposed to when you think about other beverage categories we talk about, oftentimes the problem is that there’s too many brands for too little space.”

At Town & Country, which Richmond described as a hybrid retailer toeing the line between natural and conventional products, two of the top selling kids beverage brands are currently Capri Sun and Hint, the latter having launched its kids line of flavored water boxes in 2018. Like most kids brands, both are sold exclusively in multipacks.

Kids, Richmond said, typically want something simple and sweet to drink, and most of the aseptic juices on the market fit that niche. In the case of Hint, its flavored waters are unsweetened but still carry the sensation of sweetness, and parents are drawn in by the health benefits of a zero sweetener natural drink.

Trust Issues

Oftentimes, entrepreneurial kids brands can struggle from over-engineering, sometimes going for a product format that is too functional or trendy, essentially making an adult beverage in a smaller package. That can hurt a brand by driving up the price, of course, but it’s also an unfamiliar product that might be challenging for an adult, let alone a child. Think about kombucha, notes Will Ahearn, co-founder and president of CPG merchandiser Dirty Hands – it’s been hard enough for brands to sell adults on that product, let alone kids.

But, Ahearn suggests, brands that have established themselves with adults first often have an easier job making the leap to kids’ formats. Not only do those brands already have built-in affinity with consumers, but built-in trust – an important trait when a parent is deciding they feel comfortable giving a product to their child. Ahearn cited Honest as a prime example of this strategy, noting that Honest Tea had developed a loyal consumer base among adults, making the leap into its Honest Kids line significantly less difficult than had the brand been introduced as a childrens’ product.

“Am I going to spend the money on a $3 kombucha to give it to my picky eater?” Ahearn posed. “Am I going to make this dollar investment with uncertainty around whether or not they actually like how it tastes?”

In the case of Honest, not only did adult consumers already have a relationship with the brand, but they frequently shared it with their kids as well, meaning they felt comfortable making that initial purchase of Honest Kids because they knew their child already liked the brand’s teas.

For Richmond, the decision by The Coca-Cola Company to discontinue the Honest Tea brand last year, while keeping Honest Kids, appeared counterintuitive and removed a key piece of synergy that had positioned Honest for future success: when Honest Kids consumers grow up, what will happen when they can’t find an adult version of the drink they remember fondly from childhood?

“When [Honest founder Seth Goldman] was developing that line, I think he was doing it the right way, which was he was trying to create generational consumption,” Richmond said. “‘I’ve got parents who already trust this brand, I’ve got kids that will now try this brand, and then kids will grow into my tea brand.’ I think he accomplished it.”

Hint, Richmond noted, has tried to find a similar path via its kids line launch: parents were already sharing full-sized bottles of the product with their children, so the smaller water box format already had a built-in consumer base among kids at launch.

With that trend in mind, Richmond pointed to another brand that has started trying to make the jump: frozen treat brand GoodPop, which debuted a canned kids juice line this year. In particular, he saw the minican format as being more favorable for the category, both as environmentally friendlier than unrecyclable pouches and as a format that could be more aspirational for kids, who might see their parents drinking flavored seltzers like LaCroix daily.

“Pouches are not as favored as they used to be,” he said. “They solved a problem, I think, in a different generation, when the problems of that generation were different. Now, people are much more on-the-go, that functionality of that packaging isn’t as fully practical as it used to be.”

Introductions Curtailed

For brands that were founded as kid-focused, Ahearn highlighted a number of in-store marketing challenges that make launching in retail a less-than-favorable approach. For one, there are fewer sampling opportunities.

“There’s no Expo West for kids. There’s no sampling for babies,” Ahearn said. “I think it’s a really hard category to build a story around at retail, I feel like you’re far better off going the DTC model with a kid’s brand and then launching in the store when you have a following because I think you can just reach far more kids and far more parents online.”

When it comes to merchandising, brands may also be better positioned in lower volume aisles, Ahearn suggested, so long as they’re more likely to meet potential customers. While he suggested having better child-friendly aisles in stores could be beneficial to retailers looking to move more kids food and beverages, brands have to make due with what’s available.

“If I’m a kids’ beverage, I should not be in the functional set, right? That’s not where I’m going to get the attention. I should be in the baby food and kids set,” he said. “That may not be high volume, but it’s where I know my core consumer is shopping.”

A Launch Example

So what does it mean to try to launch nationally, in a big way? It takes money, connections, and a trusted marketing focus. For brand incubator L.A. Libations, the stagnant nature of innovation in the kids set meant it felt ripe for disruption. Co-founder and COO Pat Bolden told BevNET that in launching PLEZi, a line of flavored juice drinks made with no added sugars and 2 grams of fiber in 8 oz. bottles, the company hopes to marry the better-for-you trend with the flavor-forward focus of the larger category players, while deploying a trusted national figure to build buzz.

Supported by L.A. Libations’ brand building team, PLEZi touts a powerful public ally who has helped to quickly raise awareness: former first lady Michelle Obama, who formally joined the brand as a co-founder and strategic partner this spring.

PLEZi is now looking to tap into online influencers to raise more awareness, a common strategy for CPG brands today but one with more intricacies when it comes to reaching kids and parents simultaneously. Bolden suggested that messaging can be a tightrope walk between speaking the language of both groups – fun and flavorful for kids, and emphasizing no added sugar for parents.

PLEZi will also be using single-serve offerings to drive trial and is employing a nationwide sampling program that will target youth sports programs, concerts and sporting events. However, Bolden said it is multipacks that ultimately fuel velocity and the goal will be to convert consumers from premium single-serve buyers to regular multipack shoppers.

“We have a lot of influencer contacts that will be available through all the social media platforms – Instagram, TikTok, all the ones where we think that we’ll be able to communicate directly with our consumers, with the kids,” Bolden said. “We’re going heavier on the communication to kids, but we definitely have to make sure that moms are connected as well through another side of our influencer contests to be able to drive trial.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe