BevNET Best of 2025

Even in a world bombarded with more distractions than ever before, there’s still nothing that captures the public’s imagination like a good beverage.

2025 was littered with proof of that theory: amid all the things people can do on TikTok, it’s telling that so many are using it to share videos of them mixing up sodas to create super-sweet ‘dirty’ treats. Or what about the beloved chicken sandwich maker that suddenly wants to be your Starbucks alternative? Or the U.S. President negotiating changes to Coca-Cola’s precious recipe? The world had

collective mindshare.

This year saw major strategics flex their muscle with multi-billion dollar deals that fueled consolidation, creating bigger and more powerful platforms with which to drive categories further. Amidst that, nimble and creative entrepreneurs found pockets to innovate in high-ceiling, on-trend spaces like yerba mate and coconut water, proving that those billions, while useful, aren’t required to make an impact. This year reflected how simple but powerful ideas – female-focused energy drinks, THC beverages made with craft and quality, reimagined non-alcoholic experiences – can be carefully nurtured into zeitgeist-moving commercial forces, even at a time of global economic uncertainty and strained consumer confidence.

This year’s Best of Award winners exemplify the determination, ingenuity and love for beverages that inspires our industry, as we honor a group boldly moving into the future and illuminating the way for others to follow in their footsteps.

BRAND OF THE YEAR

Alani Nu

If you look at the numbers, Alani Nu’s case as 2025’s Brand of the Year is a powerful one. The supplement and energy drink brand is on its way to clearing $1 billion in sales this year, joining an elite group that includes Red Bull, Monster and Alani’s parent company Celsius, which forked over $1.8 billion to buy the brand in February. The brand hit a new quarterly revenue record in Q3 at $332 million, with retail sales rising 114% year-over-year. And as of late November, it represents a 7.2 dollar share of the U.S. RTD energy category, an impressive 3.3 point gain from Q3 last year.

But those eye-popping stats risk overshadowing the other, powerful ways in which Alani has reshaped the energy category, and the ripple effects that have spread out across the entire beverage industry. The brand’s successful exit from Congo Brands to Celsius this year represents important validation for influencer-born drink ventures, showing that a new and untraditional model can result in a traditional big-ticket acquisition from a major strategic. Building upon the pioneering work done by Bang, Alani proved that leaning on indulgent flavors and organic social media marketing could help bring new consumers to the category – particularly women – who will follow the brand from niche nutrition and supplement channels into mainstream retail. That approach has done more than just drive Alani’s own popularity: it has shifted the way operators are viewing the market, as female-focused energy innovations from Bloom and Monster (FLRT) have shown. And while Alani’s beer distributor partners will undoubtedly miss the brand on their respective trucks, the roughly $246 million in distributor termination fees paid out by Celsius to bringAlani into the PepsiCo system hasalso confirmed the importance of those suppliers in creating the next big energy brand. Yet as much as this award is in recognition of the work done so far, Alani Nu’s ascent feels far from over. If anything, this honor seems to be an appropriate way of marking the end of the beginning of Alani’s story, and there’s still much more to go.

PERSON OF THE YEAR

Allison Ellsworth, Co-Founder, Poppi

Allison Ellsworth’s journey over the past decade is a perfect arc for that near-mythic “heroic founder” and the fact that it culminated in this year’s sale to PepsiCo makes it seem too easy. It hasn’t been, of course: there have been pivots, competition, investments, social media intrigue and a massive Super Bowl coming out party. Through it all, though, Ellsworth has been the face and voice of the brand on Social Media, one that’s so closely identified with her that even as company leadership transitioned away from her and her husband, Stephen, it was clear that she was its most important asset.

All the parts are there at the start: driven by personal need for a product that could improve her life, Ellsworth discovered apple cider vinegar; developed a recipe and took her product to the farmer’s market; used feedback to start a brand with her husband; went on Shark Tank while very, very, pregnant and attracted a star investor in Rohan Oza; took the product – then Mother Beverage – and rebranded it completely as Poppi, a gut-friendly, better-for-you soda and launched a category alongside a dogged competitor in Olipop.

But it wasn’t until the pandemic that Ellsworth went beyond innovative founder and into the realm of marketing pioneer. Someone who said she has lived most of her life online, she discovered TikTok as the channel that clicked for Poppi, generating video after video and flooding the space with Poppi content, developing low-cost, heavy-impact topspin for the brand as the app also went to warp speed. As such, there are some staggering statistics out there: 3 billion views on TikTok, a face that has been seen at least seven times by one-third of the platform’s users, and that eventually added up to Pepsi’s $1.95 billion check for the company.

Beverage entrepreneurs take on many personas, but Ellsworth, through her innovative work that allowed millions of consumers to see themselves in her, to take the advice of the unfiltered cool mom from Texas, has created a new founder archetype. Even at close to a half-billion dollars in sales this year, she’s the brand and the brand is her. Beverage brands rarely, if ever, retain that strong a tie to the founder at that size, and with PepsiCo now calling the shots it’s hard to tell what the future brings for Poppi, but in 2025, for so clearly being the driving force behind the success of brand Poppi, Allison Ellsworth is BevNET’s person of the year.

BEST MARKETING

Tractor Mad Farmer Tour

Two years ago, we gave Tractor the 2023 Best Marketing award in recognition of its debut ad campaign, “Escape the Ordinary,” a psychedelic cartoon odyssey starring a sentient plastic cup. Since then, the organic, non-GMO fountain drink maker hasn’t lifted its foot off the gas. It’s added a new chief brand officer, secured $15 million in fresh funding and supercharged its on-premise reach through a new multi-year alliance with AEG.

Even amid this rapid growth, Tractor remained committed to doing “business as unusual” – driven by its belief that food and beverage should nourish people and the planet.

This year, we’re recognizing Tractor for its Mad Farmer Tour, a guerrilla-style nationwide marketing campaign that took the brand “out in the wild,” literally, while highlighting its ties to independent farmers and regenerative agriculture. For seven months, the brand zigzagged across the country in a retrofitted Airstream trailer hosting beverage tastings and community gatherings, proving that storytelling doesn’t need a studio, just purpose, creativity and a roadmap.

Liquid I.V. “Liquid O’Clock”

In a June New York City activation, electrolyte mix maker Liquid I.V. sought to transform the dreaded 4 p.m. slump from a productivity killer into a purchase trigger. The brand launched a takeover campaign reframing this time as “I.V. O’Clock,” the moment when consumers should reach for a hydration boost to prevent headaches, fatigue and irritability.

At 3:50 p.m., Liquid I.V. took over every Times Square billboard with synchronized “system error” screens that then flipped into branded creatives, followed by a fleet of robot carriers dispensing samples to passersby. The stunt helped position hydration as a daily ritual tied to a predictable consumer pain point, aiming to create habitual usage of the brand’s products.

BERO x Happy

If you’re searching for a masterclass in harnessing star power to accelerate brand awareness and trial, look no further. In October, Marvel heavyweights Tom Holland and Robert Downey Jr. brought together their respective beverage startups, non-alc beer brand BERO and coffee maker happy, for alimited edition collaboration featuring BERO Coffee Draught and Happy Eternal Hoptimist ground coffee.

The partnership paired two founders with high consumer recognition and tapped into their on-screen history together to build momentum. By “swapping” collaborations rather than co-branding a single SKU, both BERO and happy expanded their reach without diluting their respective identities. The outcome was measurable: both products have sold out.

RISING STARS

Slate

It might be hard to imagine just a few years ago that an ultra-filtered canned chocolate milk brand would be drawing so much attention and investment, but, amidst booming demand in high-protein products, Slate Milk is doing exactly that.

And appropriate for a brand that is “selling strength,” as co-founder Manny Lubin told us in 2023, the gains have been clearly apparent. Slate has spent 2025 growing its distribution footprint to 20,000 stores (Target, Albertsons and Sprouts among them), along with closing a new $23 million investment round. Along with a fresh tranche of growth capital, Slate added to an already diverse group of strategic investors which includes the founding team of frozen Greek yogurt brand Yasso, UFC president and CEO Dana White, actor Jonah Hill and DJ/producer Diplo, among many others.

That expansion has validated Slate’s differentiated approach, whether it’s tapping into college influencers via NIL or helping establish aluminum’s place in the protein category. With its new three-SKU Ultra sub-line (42 grams of protein) complementing canned entries at 20 grams and 30 grams, the Boston-based brand is poised to keep pushing forward.

Bloom

Bloom Nutrition seemingly blossomed out the gate. Founded in 2019, the women’s supplement brand had its finger on the pulse from the start, with fans on TikTok fueling its sudden rise from startup functional CPG business to a formidable competitor in energy drinks, powders and, now, soda via its Bloom Pop line. Now under the ownership of emerging platform giant Nutrabolt, the parent brand of C4, Bloom is enjoying an increasingly prominent role for distributor Keurig Dr Pepper across its expanding RTD portfolio.

Founded by self-described “transformation queen” Mari Llewellyn – who serves as a powerful and influential face for the brand – Bloom’s rise has been somewhat similar to that of Alani Nu – another female-focused wellness brand that swiftly filled wide open white space for an overlooked audience via on-trend branding and quality products. But after selling 100 million cans of its energy drink in its first year, Bloom has shown there’s plenty of room for multiple brands to shine in this space, and its rapid innovation turnaround, command of social media and strong sales numbers have us hoping for more sunny days ahead.

TRIP

In barely half a decade, functional relaxation drinks have gone from a niche trend for the jet set to a full-fledged beverage category carving out their own space in shelves and coolers in conventional and mass retailers across the country. There may still be a long path ahead, but Trip’s journey from British import to category leader has been remarkably smooth thus far. This year its swift seeding in the U.S. continued, with further validation arriving in the form of a fresh $40 million in growth capital.

To get a sense for just how much more we can expect to see from Trip, that ten-figure investment is going solely towards building “the brand and community in the U.S.,” the company has said, and with over 40,000 doors globally – among them Whole Foods, H-E-B and Target – TRIP is well on its way towards $100 million in revenue this year with potential to double that take over the next 12 months. For a six-year-old business in a category that is still just making itself known with mainstream consumers, Trip is making the entrepreneurial trek look light and easy.

St. Agrestis

Despite being known for its “phony” drinks, there’s been nothing fake about St. Agrestis’ prodigious rise.

Riding on a surging wave of interest in adult non-alcoholic drinks, the Brooklyn-based mocktail maker has steered that momentum in a very specific direction – as in, devoting itself nearly exclusively to a single SKU. The “Phony Negroni,” introduced in 2022, has become not just St. Agrestis’ signature drink, but a staple of on-premise non-alcoholic beverage programs at top bars and restaurants across the country. This year represented a culmination of the journey thus far: the product portfolio expanded with the subperb Phony White Negroni, its third SKU, while the line was backed with a retro-inspired video campaign for Dry January. Finding the white space between boring non-alcoholic beer and overelaborated zero-proof spirits, St. Agrestis has established its unmistakable tapered glass bottles as a coveted symbol of sophistication, accessibility and craft – without the booze.

Nowadays

While demand for intoxicating THC drinks has been growing over the last several years, it wasn’t until recently that the limits of how and where the category can go have been truly tested — a challenge to which Nowadays has risen with gusto this year.

Building on the foundational work of brands like Cann (a BevNET Rising Star winner in 2021), Nowadays has helped reshape the cultural conversation around THC, giving it a sense of style and sophistication to rival top-shelf spirit brands. Quite literally, they’ve given cannabis drinks an invite to the party: see the brand’s activation at the F1 Miami Grand Prix, a four-day event which attracted over 275,000 attendees and ranked as the third most-watched F1 broadcast in U.S. history. Its presence there helped land hospitality platform Palm Tree Crew (PTC) as an investor, which came with an exclusive THC beverage sponsorship for PTC events over the next 12 months, including Palm Tree Music Festival dates in Aspen and the Hamptons. The brand’s party streak continued this fall at events like South Carolina’s Greenville Country Music Festival and the Sunset Cruise with Steve Aoki in Miami.

That kind of validation says a lot about Nowadays as a brand and portfolio, with both ready-to-drink cans and 750ml glass bottle formats that fit into a variety of occasions. The community-driven approach is breaking down lingering stigma around THC drinks and proving that hangover-free fun is a powerful motivator, even at the biggest and swankiest parties around.

BEST PACKAGING DESIGN

Tizz

As better-for-you sodas flood the market, we can appreciate “tangerine fizz” maker Tizz for remembering that soft drinks should essentially be: fun. The California-based brand’s squat 8 ounce cans caught our attention with its loopy

cartoon aesthetic, bright printed cans and overall playful personality.

Match Tonic Water

How do you make tonic water sexy? Start with a striking, single-serve square glass bottle and you’re already halfway there. Swiss brand Match seduced us with its brilliant minimalism, creating something fresh and vibrant yet also steeped in classic vibes that give it an irresistible and timeless appeal.

All Dia

Whether or not a canned tequila seltzer is an “all day” drink is up to you to decide. But what’s not in question is the brand’s packaging design, which creates a colorful shelf billboard across the four SKUs and balances warm and cool chromatic touches to provide its distinctive look.

BEST NEW PRODUCTS

Zico Pure Organic

Delicious in its simplicity, Zico’s premium Pure Organic gives maybe the truest and best coconut water experience outside of cracking one fresh from the tree yourself, as we noted in our five-star review in October.

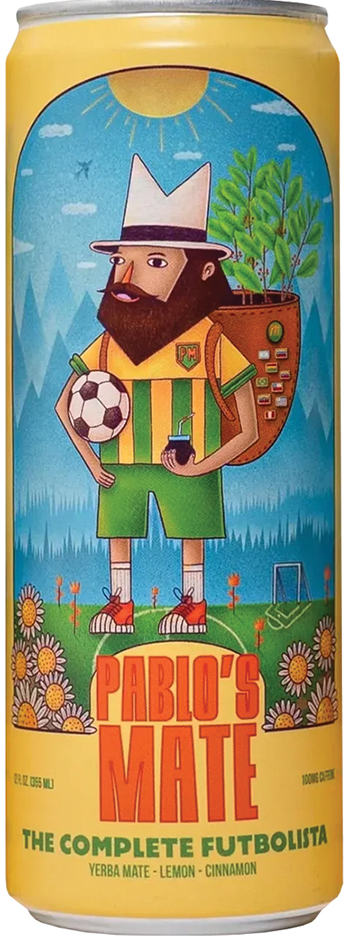

Pablo’s Mate

Ready-to-drink yerba mate has been begging for innovation for some time, making Pablo’s recent arrival particularly welcome news. Blending function, fun design, truly differentiated flavors (including both full and zero-sugar brews) and some inspiration from South American soccer, the three-SKU family of 12 oz. cans is a winner.

Squier’s Elixirs

We certainly appreciate the thoughtful balance of added cannabinoids (5mg THC/10mg CBD), but Squier’s Elixirs are delicious just as pure refreshment drinks, first and foremost. Delightfully fizzy and bursting with bright, fresh and juicy flavors from 100% real fruit (no flavorings), it’s primed for both the canna-curious and regular consumers alike.

Stiller’s Soda

Celebrities have a mixed record as beverage entrepreneurs, which makes us particularly impressed with actor/producer Ben Stiller’s sensational debut in soda this year. Stiller’s embraces an unapologetically nostalgic look and feel, yet its mid-calorie (30 per can) and “no fake stuff” takes on fountain favorites like Shirley Temple and Root Beer are very much on-trend amidst a broader CSD resurgence.

Proxies Dry Cider

Proxies’ superb Dry Cider in 12 oz. cans caught us by surprise, with a brilliantly executed blend of dry apple flavor layered in a French oak finish, packaged in an inviting and engaging design. More than just another cider, this one is bursting with craft, inspiration and flair to rival the best in adult non-alcoholic drinks right now.

Jolene

While the category pushes for more innovation, we sometimes wish more brands would follow Jolene’s narrow focus on simply creating a best-in-class RTD cold brew. From the minimalist can to the liquid inside, Jolene’s black and oat milk latte varieties are both clean and appealing examples of elegance over elaboration.

St. Agrestis White Negroni

The ’Phony Negroni’ specialists at St. Agrestis seduced us again this year with their spectacular White Negroni. Presented in the brand’s signature tapered bottles, the champagne-hued liquid is itself reason to celebrate, achieving a near-perfect calibration of bitter, burn and sweet.

Halfday ½ and ½

You might say the world doesn’t need yet another take on the classic Arnold Palmer lemonade-tea cocktail, and you’d be wrong. Halfday’s reduced-sugar version (5 grams per can) is a testament to skillful sweetening and reimagining of a familiar recipe, further earning the growing brand a distinctive edge within the category.

Something & Nothing Orange & Mandarin

Does the perfect orange soda exist? We found compelling evidence in Something & Nothing’s outstanding citrus SKU, the British company’s first U.S.-exclusive release. The bright pop of fruit flavor from the juice, softened and given some subtle depth from the added botanicals, is maybe the best example yet of S&N’s simple-but-sophisticated “premium soda, inspired by travel” ethos.

Narra Ube Oat Milk Lattes

Narra’s outstanding Ube Vanilla oat milk latte is a caffeine-free, decadent-yet-delicate delight that manages to give a relatively niche hero ingredient (ube) a broadly appealing, low-sugar (six grams per 7.5 ounce can) platform on which to strut its stuff.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe