Beyond the Industry’s Bright Spot: What’s Driving RTDs in 2026?

If there was one overused term to describe the ready-to-drink (RTD) spirit category last year it was “bright spot.” Despite little M&A activity, RTDs were still responsible for tectonic shifts in distribution power dynamics and remained the industry’s growth engine. So what’s next?

As we enter into 2026, RTDs across all segments now represent 12.7% of dollar sales of total bev-alc off-premise, reaching $13.6 billion in 2025, according to NIQ. Spirits and wine bases are driving RTDs, as well as some niche flavored malt beverage (FMB) segments.

In 2025, spirits-based RTDs were up 25.7%, offsetting about $650 million in spirits declines. As retailers

rationalize SKUs in beer or hard seltzer, distributor and acquirer eyes will likely continue to stay on brands that can generate velocity and scale, while earning the loyalty of Gen Z. Meanwhile, suppliers are already chasing trends in other aisles of the store.

Major Suppliers, Distributors Optimize Around RTDs

With core spirits struggling, last year was marked by some major shakeups in the three-tier system as suppliers aimed to optimize their positions with distributors who have been faster to embrace total beverage and are equipped with appropriate RTD capacities.

Companies including Gallo (the owner of High Noon), Pernod-Ricard and Brown-Forman ditched Republic

National Distributing Company (RNDC) in 2025 to put their RTD products in the hands of Reyes Beverage Group in California, which has been steadily growing its spirits and RTD portfolio. Those suppliers and others also switched to regional distributors across the country – sprinkling more spirits products into beer distributors. The moves away from RNDC eventually led to the distributor winding down its California business. At press time, RNDC was in talks to sell its business in seven states to Reyes.

Meanwhile, Anheuser-Busch InBev (A-B) sold its wholly owned distributor in New York City to Southern Glazer’s Wine & Spirits (SGWS), putting SGWS on a greater path to become a total beverage distributor as it nabbed major beer brands and spirits-RTD leaders such as Cutwater.

The changes bode well for RTD brands that are priorities, and can benefit from the execution of these beer distributors who can provide faster turns, convenience, and the coldbox.

“It’s reasonable to think that wholesalers that are more familiar with moving beer could help juice the momentum by increasing the reach,” said Dave Williams of Bump Williams Consulting.

RTD brands with a point of difference or carrying a higher margin – offering a good proposition for a distributor – may also be able to leverage their position at an existing or new distributor. But as more former RNDC brands scatter and bang on the doors of other distributors, smaller, independent brands will likely need to think creatively and regionally with their route-to-market.

Spirits RTDs Start The Plateau

Distributor optimization of RTDs points to the category being a solid fourth pillar in bev-alc, but that also has a down side: the novelty may fade. Sales of overall RTDs are poised to continue, but single-digit growth (+3%) this year represents a maturing category.

Spirits-based RTD growth momentum peaked in 2020, with dollar sales of more than +150% in NIQ-tracked

off-premise channels, according to 3 Tier Beverages. Growth then progressively slowed, but the segment was still able to more than double sales from 2021 (nearly $1.53 billion) to 2024 (nearly $3.19 billion).

Slower growth from spirits RTDs comes in spite of continued increases in the number of products on the market. In 2021, the segment had 1,950 UPCs selling in NIQ-tracked channels. That number grew to 2,374 in 2022, 2,743 in 2023 and 3,003 in 2024. In September, that number had increased slightly, to 3,098.

All that may mean that the category has plateaued, and some brands might get pushed over the edge in the next couple of years, according to Kaleigh Theriault, beverage alcohol thought leader at NIQ.

“That’s when some of the smaller brands in these spaces won’t be able to survive, because you’re no longer in this increasing pie that everybody can get a piece of, but you’re going to be fighting for that same pie, and some of those slices are going to shrink,” she said.

Opportunities are still ripe on-premise, however, where brands have just scratched the surface, as well as in channels that have yet to open up legislatively, such as states that restrict the sale of spirits-based products from convenience stores.

Still, Theriault compared RTD’s trajectory to craft beer: in 5 to 10 years from now, there may be “bankruptcies and closures, but then there’s going to be acquisitions.”

Thirsty For M&A?

A year with little M&A activity ended with a bang when A-B announced it will acquire a majority stake in party punch maker BeatBox for approximately $490 million.

The brand, famous for its high-ABV, nostalgic-flavored liquid in Tetra Pak cartons, found a space in the market, generating over $340 million in retail sales in the last year, and up 30% in the latest 52 weeks ending January 10 in NIQ-tracked channels.

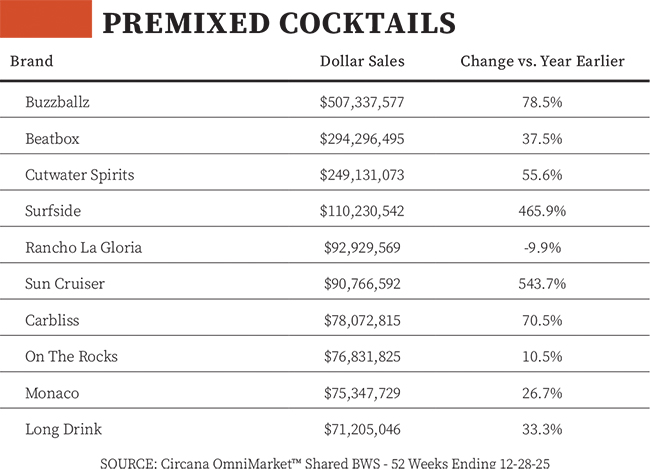

Both the Beatbox buyout and Gallo’s acquisition of wine brand Whiny Baby targeted brands with a loyal following and strong positioning with younger demographics. Those deals follow Sazerac’s 2024 acquisition of BuzzBallz, another high-ABV, uniquely packaged RTD. Beatbox found an opportunity with a generation thirsty for flavor exploration, in-person experiences (the brand made early inroads via music festivals), and value.

After BeatBox shifted to beer distributors, the company unleashed velocity and scale, priming itself to fill a gap for a major beer company that has said it will continue to invest in its beyond beer portfolio.

“As companies evolve their portfolios, as beer companies get more into wine and spirits or even flavored alcohol – let’s call it ‘cast the broader net’ – it makes them a more powerful partner with retailers and wholesalers in terms of what they can bring to the table,” Williams said.

So will there be more deals?

Spirits and wine companies have mostly centered on extending their existing brands or bolting on their own RTDs. Diageo has earned share of the broader RTD segment with its malt extension of Smirnoff, and last year launched the first RTD from Casamigos, which is performing well. Bringing major brand names into new formats and leveraging recognizable names from across the aisle for RTDs has been a consistent strategy for Pernod Ricard. But beer groups such as Molson Coors and Heineken have yet to make a big move in RTDs.

“It seems like it would be more likely to be a big beer company that wants to make a splash in the RTD side through an acquisition,” said Williams. “But it’s not completely foreign territory for a wine and spirit supplier to make that leap as well.”

There are a number of contenders on the market: independents such as Stateside’s vodka iced tea Surfside, the Finnish Long Drink, and vodka sodas Carbliss and Good Boy Vodka have momentum and scale that may suit a big company portfolio more easily than an internally-built brand.

Let’s Get Physical, And Cultural

With brands like Surfside spurring copycats – and selling more than 11 million cases in 2025 – there’s one clear trend emerging in RTDs. Inspiration is coming from other beverage aisles.

Last year was the year of spiked tea, with Surfside and Boston Beer’s Suncruiser both seeing triple-digit growth. This year, RTD suppliers are continuing to look at the success of non-carbonated segments such as energy and sports drinks, as well as juice.

“It’s not a brand new trend that these things are hot, we’re basically on the fourth year of that,” said Brian Krueger of Bump Williams Consulting. “So people that are on the alcoholic side are saying, ‘what can I bring from that into this world?’”

We’re seeing early examples. Malt-based juice RTDs have picked up 210% in the latest 52 weeks ending January 3,

according to NIQ. As suppliers often test malt-based propositions before transferring brand equity to a spirits version, that may be the next move for some, said Theriault.

Another trend that will keep rolling? “The continued intersection of health and wellness with the alcohol world,” Theriault said.

Despite bev-alc’s inability to make health claims, the next generation of products will likely fuse wellness-inspired beverages with a light buzz. Serial food and beverage entrepreneur Jason Cohen’ Spiked Ade has raised $10 million and is expanding distribution as it looks to carve out a new lane at the intersection of hydration and alcohol, while Stateside’s Super Lyte is also mixing nostalgic sports drink flavors with vodka.

“Flavor is no longer going to be the key point of difference,” said Krueger. “On the RTD side, it’s going to be, is there value added as far as perceived health benefits? It’s going to go into juice and water and a little bit of everything now.”

But some consumers are still reaching for global flavors and a bigger buzz. Brown-Forman recently brought its top RTD from Mexico, New Mix, to the U.S. Other RTD brands have already homed in on the thirst for Mexican and tropical flavors across beverages, as well as the buying power of Latino consumers.

VMC, a tequila-based canned cocktail born from a partnership between world champion boxer Saúl “Canelo” Álvarez, Spirit of Gallo, and Casa Lumbre, has quickly catapulted into a top ten RTD spot. Other Latino-focused brands such as Jumex have also made successful forays into RTDs, and BeatBox as well as Sazerac debuted RTD beverages last fall brandishing Spanish names and text or at least the inspiration of Mexican flavors.

“Not just cocktails, but Mexican themed, margaritas, palomas, anything Tequila-based, I think you’re going to see more from that area in 2026,” Williams said.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe