In a webinar last week, health and wellness market insights firm Social Nature outlined how better-for-you CPG companies are adapting to changing shopper behavior as consumers’ focus shifts toward health and wellness products and e-commerce.

The webinar reviewed data from 205 North America-based CPG leaders, along with 2,500 consumers, on how shopping trends are informing company strategies. Brands said the most impactful factors are supply chain, financing and cash flow, employee safety and retention and changes in consumer behavior and retail.

The overall outlook for better-for-you brands is mostly positive, said Jessica Malach, Social Nature’s VP of partnerships and insights. The firm’s research found an increased consumer interest in wellness through food, aiming to lose weight, reduce stress and increase energy levels. However, while 74% of companies (and 72% of food brands) surveyed expect sales to grow in the next six months, smaller brands are less confident in their resilience. To succeed, Malach warned against doing too much too soon.

“Focus on where you can move the needle most and identify what’s going to drive growth in your category,” she said.

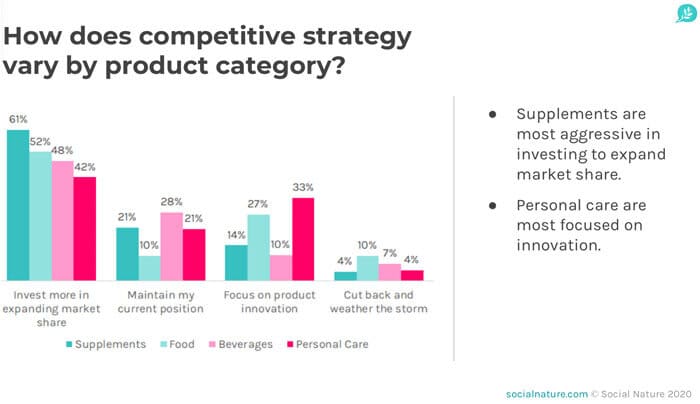

Nearly half of U.S. brands plan to invest in gaining market share, while 26% focus on innovation. As the marketplace shifts, many brands have altered their retail strategies, but haven’t abandoned in-store opportunities: 36% of U.S. brands will target brick-and-mortar channels and nearly half will maintain or enhance in-store marketing efforts. At the same time, 35% of brands plan to hone in on their own e-commerce sites, and 65% noted improving web functionality as a priority. A third of companies are decreasing brick-and-mortar marketing spend and redirecting them online.

“A lot of brands are starting to look for ways to launch direct-to-consumer first, then scale into brick-and-mortar,” Malach said. “[This] can be an effective strategy for early stage companies; you get so much data for what is driving consumer demand for your products.”

With 79% of U.S. consumers currently shopping online, a trend that’s likely to continue, there’s opportunity to create more personalized offerings, such as subscriptions, to keep them engaged. However, online channels are “changing rapidly,” Malach said, adding that brands should work with specialists who truly understand them; for example, she noted that Walmart currently requires at least 20 four-star product reviews in order to be listed on the site.

Half of shoppers are looking for these reviews, Malach said, to inform purchase decisions. Additionally, 45% of consumers want “more confidence” in sourcing, quality and safety of the products they choose via detailed product information.

“Having that information up front and center is a good way to start to support driving more conversions faster,” she said.

Not everyone is shopping online though. While 25% of consumers will buy all items online, and shelf-stable sees high traction, 21% want to pick their own groceries in stores. Another 46% of shoppers avoid buying perishable and frozen items online due to potential delivery issues.

“There’s still a desire to connect physically to experiences,” Malach said. “We believe that retail will potentially start to have more of an experiential feel to drive that community feeling and that loyalty.”

Moving forward, brands can also bring new consumers online via discounts, product samples, good reviews, peer recommendations and detailed product information. Priorities for brands include finding a tribe to aid in storytelling, building direct, personalized connections through “unique” online experiences, such as webinars, and creating a customer-focused culture to thrive online.