After announcing a new start for the company this weekend, Phocus CEO Joey Nickell said functional beverage brand is now preparing an ambitious national expansion with a goal of reaching 10,000 retail doors.

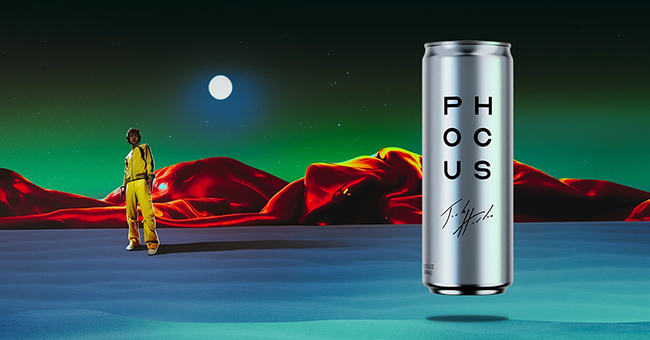

The company, previously marketed as Clear/Cut Phocus, debuted a new name and look over this week, as well as announcing 25-year-old rapper and actor Jack Harlow as the brand’s new co-owner on Instagram on Saturday.

Speaking to BevNET, Nickell described the launch as a clean slate for Phocus rather than a refresh. Beyond pulling online sales listings and the website for the old Clear/Cut Phocus beverages, Nickell said the company has a new operating agreement which now includes Harlow and himself as co-owners and board members, alongside Clear/Cut Phocus investor and former CEO Tom O’Grady.

“We will do business now as Phocus, versus Clear/Cut Phocus,” Nickell said. “We were very, very cognizant that the optics of this may appear to be a refresh, but for every single technical term behind it – down to the product, the liquid, the operating agreement, the website, the trademark, and so on and so forth – we’ve launched the company Phocus, which was really transitioned from Clear/Cut Phocus.”

Nickell noted that the company even considered changing the brand name entirely to avoid association with the old products, but ultimately decided to keep it as Phocus.

As well, the company has reformulated the drinks and stripped the portfolio down to a single new flavor: Orange. The new line, which will see additional flavor launches in the near future, still contains L-Theanine and 75 mg of caffeine from green tea per 11.5 oz. can. But Nickell said the flavor has been improved and electrolytes have been removed from the formulation.

While Clear/Cut Phocus was merchandised in the sparkling water set, the new Phocus will be positioned adjacent to enhanced waters and energy drinks, with its lower caffeine content serving as a counter to the rise of performance energy brands like Bang, C4 and CELSIUS with servings as high as 300 mg of caffeine per can.

“We’re taking it back to where it started,” he said. “Generation Z coming of age, they’ve known [energy drinks as] having crazy amounts of caffeine, versus the millennials where an average energy drink was 140 to 160 mg of caffeine. So, we feel like we’re actually offering a bit of a new proposition to Generation Z.”

In marketing to Gen Z, Nickell said Harlow will be an important addition to the company. Nickell said the Kentucky-based brand first approached the entertainer late last year, as Harlow’s Louisville roots made him a natural choice for a partnership. However, Nickell said talks quickly advanced beyond a traditional celebrity sponsorship agreement and Harlow became a co-owner earlier this year.

Harlow has now taken the role of Chief Creative Officer at Phocus with oversight over all branding and marketing decisions, and as a board member he has input into all aspects of the business from innovation to strategy, Nickell said.

“There’s nothing that we put out there that he doesn’t have a strong view and transparency on. In some organizations, that could be very restrictive, but in our organization it’s not at all. We’ve seen such amazing contributions because he is Generation Z. It’s not just that he’s an extremely talented individual and business entrepreneur, but I don’t think there’s a bigger megaphone for Generation Z right now than Jack Harlow.”

Nickell joined Phocus in October after serving as SVP of sales at Bang Energy parent company VPX. While his predecessor in the CEO role at Clear/Cut Phocus, Todd Creek, is no longer involved in the company, Nickell said that founder John Mittel remains with the brand overseeing product development.

While the company ended ecommerce sales for its legacy products, Nickell said it has about 10 months of inventory for retailers and will continue to sell through the old products in the roughly 3,400 doors where the brand was available. However, the new Phocus is already securing new distribution – with merchandising in the energy and enhanced water sets – and has national retail agreements with Circle K, Kroger, Vitamin Shoppe and Target with a forecast of selling one million cases in the first eight months.

The brand has also entered a distribution agreement with Jumbo and Glazer’s in Texas. However, the restructuring of the business did lead to the brand exiting agreements with other distribution partners, including New York City DSD house Big Geyser. Nickell said the split with Big Geyser was amicable and came down to Phocus not being able to provide full marketing support at the time, but the split leaves the door open to work together again in the future.

Reached by BevNET, Big Geyser president and COO Jerry Reda concurred, stating: “We love the Phocus guys and we put the relationship on pause as they refine their business plans and financing. Hope to relaunch with them in the future.”