Craft Beer Overview: Craft Brewers Go Into the Light…

It’s a time when it seems like just about anything can be an alcoholic beverage (Distilled Doritos Nacho Cheese, anyone?), and some craft breweries have embraced the trend, expanding their portfolios with canned cocktails, flavored malt beverages (FMBs) and even bottled spirits.

Just as many, however, are quickly flocking back to the comforts of what is debatably the most traditional beer stateside: light lagers. Yes, the style previously decried by the craft community and labeled “fizzy yellow water” by the movement’s vocal leaders, including Stone Brewing co-founder Greg Koch, has become a focal point for many craft portfolios.

While craft beer enthusiasts and industry members alike have been predicting (and practically begging for) the “year of the lager” for at least a decade, this new focus isn’t exactly in place to demonstrate appreciation for the full-bodied, German-inspired brews people were envisioning. Instead, it’s a focus on craft’s version of light beers bearing the attributes of major domestic brands: the flavor simplicity of Bud Light, the lower carbs of Michelob Ultra, the low calories of Miller Lite.

More than a dozen breweries launched new light lagers for retail distribution in 2023. In the past six months, even more craft breweries have gotten on board, including New Trail Brewing (State Light), West Sixth Brewing (Sixer Light Lager), 21st Amendment (Amendment Lager) and many more.

Not to be left out, even mega beer companies are playing in the space through their own craft entities. Molson Coors, which owns Detroit-based Atwater Brewery, expanded distribution of D Light earlier this year. Previously, the company sold the Michelob Ultra challenger exclusively at Comerica Park, the home field of Major League Baseball’s Detroit Tigers. Boston Beer Company is also launching its own challenger (more on that later).

Thus far, the financial impact is relatively small: in the last 52 weeks, ending February 24, the craft light lager segment dollar sales increased 13.4% in NIQ-tracked off-premise channels (total U.S. xAOC + convenience + liquor). That’s an increase of more than $2 million in a year, according to 3 Tier Beverages consultant Mary Mills. The average number of light lager items also increased by one in the period, “meaning, on average, there is one more craft light lager on shelf than there was last year,” Mills said.

Light lagers remain a small portion of total craft beer sales, accounting for 0.57% share of craft beer dollars in Circana-tracked off-premise channels in the last 12 weeks (ending February 25). In the last 52 weeks, the style increased dollar sales 0.3%, below growth for pilsners (+2.6%), craft IPAs (+4.9%) and golden ales (+7.1%).

Meanwhile, craft IPAs accounted for 47.12% of craft dollar sales in the period, and the next largest style, seasonals, accounted for 9.11%.

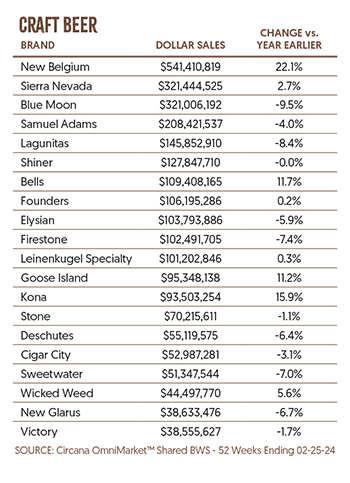

Still, any segment with positive growth is bound to attract the attention of craft producers, after a hard 2023. Craft recorded a 0.9% decline in off-premise dollar sales in 2023, according to market research firm Circana. Volume took an even bigger hit, with case sales declining 4.4%, equating to the loss of more than 5 million cases.

There’s also tempting space available on account of the recent troubles at Bud Light. The Anheuser-Busch InBev’s (A-B’s) stalwart went into a tailspin a year ago following a sponsored social media post by influencer Dylan Mulvaney, a transgender woman. Anti-trans rhetoric against Mulvaney and Bud Light sparked a conservative-led boycott of the brand and other A-B products.

Still, to date, craft gains from the loss have been minimal. In the last 52 weeks (ending February 25), Bud Light dollar sales in Circana-tracked off-premise channels declined 26% and volume declined 27.9%. A-B’s total portfolio recorded a 12.8% decline in dollar sales and 14.6% decline in volume in the period. So far, however, it is fellow mega beer brands that have benefited from A-B’s declines, including Molson Coors’ Coors Light (dollar sales +14.3%, volume +10.7%) and Miller Lite (dollar sales +10.6%, volume +6.7%).

Sam Wants In

In October, Boston Beer told distributors about the planned launch of Samuel Adams American Light. The 4.2% ABV lager, launching this May, is “not replacing anything, nor is it related to Sam Light,” a 4.3% ABV light lager brand that Boston Beer discontinued “years ago,” according to Samuel Adams senior brand manager John McElhenny.

McElhenny touted the brand’s lower ABV and lower calorie count (115), and highlighted the brand’s image as a “clean, refreshing, easy-to-drink” beer “ready for tailgates, beach days and backyard BBQs.”

“Younger drinkers look for lighter, easier-to-drink beers and Sam Adams sees an opportunity to bring a higher-quality, crisp, sessionable light beer to help make everyday drinking occasions even better,” McElhenny said. “So, our brewers spent countless hours perfecting the recipe to develop this distinctly American light craft lager.”

Five years ago, Boston Beer having a traditional beer-centric innovation wouldn’t have had anyone batting an eye. However, the company has focused much of its recent innovation efforts on ‘beyond beer’ offerings, with 80% of the company’s off-premise dollar sales now coming from Twisted Tea and Truly Hard Seltzer alone, founder and chairman Jim Koch shared during the company’s February earnings call with investors. The other 20% isn’t just traditional beer either, with the portfolio also including Hard MTN Dew, Angry Orchard and canned cocktail offerings from Dogfish Head.

Koch estimated that the “traditional” part of the beer category overall accounted for about 80% of total beer volume in 2023, and that those offerings declined volume 4%. Meanwhile, beyond beer volume grew 7%, Koch said.

That cooling of the beer market might explain the staging of the rollout for American Light by a company used to launching into a national distribution network. The brand will launch in 12 oz. can 6-packs, 12-packs and draft, initially only in 15 markets to start: Arizona (draft only); Connecticut; Florida; Georgia; Massachusetts; Maine; Minnesota; New Hampshire; New York; Ohio; Rhode Island; Vermont; Dallas, Texas; Pittsburgh, Pennsylvania; and Washington, D.C. National distribution is planned for March 2025.

The move takes note from smaller craft brand launches that have focused regionally, some of which are top brands in the craft light lager segment, including Michigan-based Short’s Brewing’s Local’s Light (5.2% ABV), Boston-based Night Shift’s Lite Owl series (4.3% ABV), and Ohio-based Rhinegeist Brewing’s Cincy Light (4.2% ABV). The latter, created through a name, image and likeness partnership with the University of Cincinnati collective Cincy Reigns, was the “fastest-growing beer that we’ve ever launched,” Rhinegeist CEO Adam Bankovich shared during his December keynote address at Brewbound Live.

“That was not our goal, that’s not what we set out to achieve, but what we did do was lay the groundwork and the foundation and the road map where if this thing was successful, we could scale it and scale it quickly,” Bankovich said.

Cincy Light is now one of Rhinegeist’s main focuses for 2024, with hopes of making the brand “Cincinnati’s light lager brand,” in its home market, rather than the brewery’s full distribution footprint.

This Time is Different, I Swear

This isn’t the first time craft brewers have tried to disrupt the light lager market. As recently as 2018, major craft brands such as Founders (Solid Gold premium lager) were touting light lager additions to their year-round lineups. Participating industry members preach that this time is different. That’s because both brand leaders and new participants that only focus on light lagers are getting into the game and their connection with consumers is showing up in the numbers.

Some of the current top craft lager brands by dollar sales in NIQ-tracked channels include Garage Beer (acquired from Braxton Brewing in 2023), Farmers Light (Farmers Brewing), Leinenkugel’s Light (Molson Coors), Outlaw (Tivoli Brewing Company), Mountain Jam (Southbound Brewing Company) and Shark Tracker (Anheuser-Busch-owned Cisco Brewers), according to Mills.

Most of the previously mentioned brands are also driving incremental growth for the segment, according to Mills, with Garage Beer and Cincy Light each adding at least $1 million in sales to the segment in the last 52 weeks. Short’s Local’s Light (+$700,000) and Farmers Light (+$650,000) also had significant dollar sales gains in the 52-week period.

“It’s interesting to see how many of these brands are independently owned and solely focused on this light style,” Mills added. “I think they saw an opportunity for a lighter craft option that was lacking in the category, and it seems to be paying off!”

Garage Beer falls into that category. The Midwest light lager brand was founded by Kentucky’s Braxton Brewing, but was spun off into its own company in 2023, with investor Andy Sauer taking over majority ownership. The beer is still brewed at Braxton, but little else still connects the two entities, as Garage Beer focuses on expanding into new markets and building its brand voice.

Garage Beer is 4% ABV, 95 calories and has 4 grams of carbs, with its website touting the offering as “Beer that tastes like beer. Definitely not an IPA.” The company only has two offerings – its original small-batch brewed light lager, and Lime, the same beer, but with a “hint of lime.”

Sauer’s decision to acquire Garage Beer did not start from an interest in the brand itself, but rather the potential of the segment.

“I think the interest goes back quite a bit further than my interest in the brand, it was very much a category interest,” Sauer said on the Brewbound Podcast last fall. “I love the craft movement for its independence, its focus on quality, but I was always a light beer drinker myself. And it was one of those spaces that just always kind of nodded at me that there wasn’t this independent focus on [a] quality, true light

beer brand.”

The increased interest in craft light lagers is consumer driven, according to Sauer, as core craft consumers age out of the trend of high ABV offerings but still seek the quality and company independence that craft is known for.

“What lager as a category had been forever was just that drinkable beer, that sessionable product that you could buy and have around for everybody at all times,” Sauer said. “And, craft as consumers are aging, as the consumer base that built craft was aging, I think the return to light was somewhat inevitable.”

Craft in Light Clothing

Garage Beer doesn’t necessarily market itself as a craft brand. Its limited portfolio and 12 oz. can 15-packs read more like major national brands, like Coors Light or Miller Lite. And it’s an intentional message that seeks to make the brand more appealing to a wider audience.

“We lean into that [craft] style only insofar as we just want to make the best version of that,” Sauer said. “But how we talk about [Garage Beer] isn’t necessarily in a traditional craft beer kind of way, but more of an old school beer – the way your dad knew beer kind of a way.”

In the 52-week period ending February 24, dollar sales of the original Garage Beer offering have increased 109.6% in NIQ-tracked channels, an increase of more than $1.1 million. Volume has also increased 104.5% (38,000 cases). Dollar sales for Classic Lime, which launched in 2023, passed $370,000 in the period, with more than 13,000 cases sold.

Garage Beer’s approach mirrors that of Montucky Cold Snacks, the Montana-based light lager brand that blew past 1 million cases in 2023 with just one beer offering. Founded in 2012, the company continues to grow not just in new markets, but “legacy” markets that continue to post double-digit gains, including Texas (+30% through mid-2023), Tennessee (+40%) and Illinois (+20%).

But despite the growth potential, hopping into light lager isn’t a guaranteed success. Even if you have a celebrity backing you.

Eight Elite Light Lager launched in 2022 with the backing of Pro Football Hall of Famer and Monday Night Football broadcaster Troy Aikman. The 4% ABV lager is marketed as a “better-for-you” brand, with 90 calories and 2.6 grams of carbs, and differentiates itself from Michelob Ultra by being “antioxidant-rich” and brewed without adjuncts.

Eight has intentionally been slow to expand distribution, with Aikman expressing the desire to focus on just Texas for at least the first year. The strategy saw early success: Eight was the fastest independent beer launch in Texas history. By July 2023, in an interview with Yahoo Finance, Aikman said Eight was eyeing Q2 2023 as the time to expand outside the Lone Star State.

However, that expansion didn’t actually hit until late February 2024, and when it did it was just to Oklahoma. While Eight co-founder and CEO Ruchi Desai has shared her vision for Eight to be a national brand one day, the delay suggests that even with strong consumer demand, making your way to the national stage doesn’t happen quickly – especially when Michelob Ultra has 62% of all dollars in the super premium light segment, according to Circana data.

Getting Past Price Barriers

Potentially the largest hurdle for craft light lager brands? Convincing consumers to pay craft beer prices for a product that is known for being cheap and affordable.

Just ask erstwhile hard kombucha and canned cocktail maker JuneShine, which launched Easy Rider American light lager in February.

Easy Rider is available in 12 oz. can 12-packs in limited markets in Southern California, as well as at JuneShine’s tasting rooms in San Diego and Santa Monica. Distribution is planned to expand into Hawaii by the end of March.

Easy Rider “splits the middle” between Coors Light and Coors Banquet in terms of flavor and is 4.5% ABV, according to JuneShine co-founder and CMO Forrest Dein. And the brand is connecting with consumers, gaining 10,000 followers on social media within the first 10 days of launch – an achievement that took JuneShine’s core kombucha offering six months, Dein said.

To stay price competitive, Easy Rider is priced between $15.99 and $16.99, below Constellation’s Modelo Especial, offering a “more affordable price bucket” option for consumers. In some bars and restaurants, the brand is available for $4-$5 a can, or $24 per six-beer bucket.

JuneShine has brought on celebrity ambassadors to help promote the brand, including Jeremy “Twitch” Stenberg, a California-based X Games gold medalist, and Chad Kroeger and JT Parr, comedians who announced their support for the brand through a mock hat ceremony, ala athletes committing to a college.

“In Southern California, the [beer] market is larger than the national RTD market,” Dein said. “It’s like $2 billion just in SoCal light beer. So it’s a massive opportunity in our backyard.”

The consumer base for SoCal light beers also skews primarily male, a new target for Juneshine, which has traditionally appealed to women. JuneShine plans to just offer the one beer “for as long as we can,” but to add other package size offerings as the brand gains traction.

“It really complements our offerings,” Dein said. “And there’s a lot of people that might not be hard kombucha drinkers that love Easy Rider, and vice versa.

“We don’t know what it’s gonna be like, the future for growth: Is that [newly acquired] Flying Embers, FMBs, hard cocktails, hard kombucha?” Dein continued. “But we want to diversify and keep reaching new consumers.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe