Even as Spirits Sales Drop, Mixers Remain Relevant to Retailers

Typically, when the economy gets tough, consumers look for as many ways to save money as they can. But as we’ve seen in the last few years of turbulent up-and-down economic fortunes, marked by inflation and tariffs, small premium comforts have been cemented as a worthwhile splurge for troubled times. If you need proof of that, then cocktail mixers may just be Exhibit A.

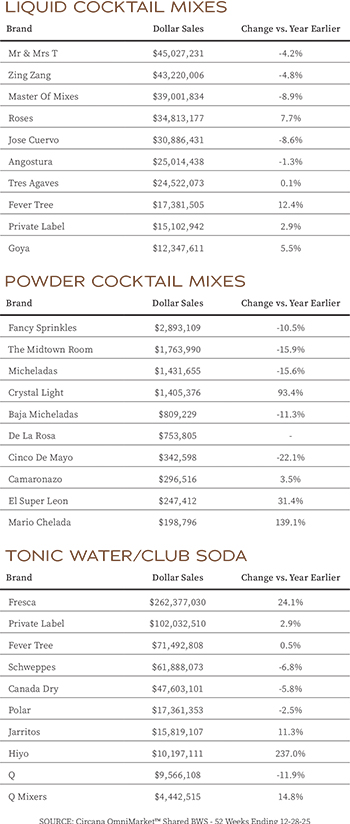

According to market research firm Circana, U.S. retail (MULO and c-store) sales of cocktail mixes were up 3.2% to over $1 billion in the 52-weeks ending December 28, 2025. Within the category, tonic waters and club sodas outpaced the total set, growing 5.7% to $618.6 million, while other liquid mixers declined 0.3% to $414.2 million. The much smaller powdered cocktail mix segment was up 3.5% to $12.4 million.

While those numbers suggested a mixed bag of consumer interest, particularly in a period where non-alc and sober curious trends are driving down sales of nearly all alcohol categories, within the data, a long-term trend toward premiumization continues to play out, with top shelf brands remaining elevated while traditional “value” or budget products are struggling to keep up.

According to Randy Ornstein, senior director of beverages at Gopuff, legacy budget brands like Canada Dry and Schweppes are in decline on the delivery platform, while premium brands outperform the market. Q Drinks, Ornstein said, saw sales rise 4.5% on Gopuff in 2025 (compared to 2024) while Topo Chico’s Mixer line – which includes Ginger Beer, Tonic and Club Soda varieties – leapt “an incredible” 461%.

This growth for premium mixers, Ornstein suggested, is continuing despite signs of overall economic distress and wallet-tightening among American consumers.

“Consumers are seeing many of these premium mixers as coveted brands in their own right,” Ornstein said in an email. “Interestingly, this trend is in opposition to the larger push towards value we have seen on Gopuff. Searches for terms like ‘deals,’ ‘discounts,’ and ‘savings’ increased significantly in 2025, pointing to a more value-conscious consumer base at large.”

On Gopuff, those “discount” search terms were up 29% last year and were continuing to spike in the new year, up 40% year-to-date as of January 23, 2026.

But for mixers, that premium craving even extends to the packaging. Ornstein said that “small-format glass bottles” are the preferred format for consumers at the moment, with Topo Chico’s 7.1 oz. glass 4-pack being the fastest-growing SKU in the category “as the single-serve options help ensure freshness and carbonation, which are priorities for the premium consumer.”

The trend has opened doors for brands like Owen’s Craft Mixers, a 10-year-old startup which produces both single-serve cans and bottles, as well as larger multi-serve bulk offerings.

Joshua Miller, co-founder of Owen’s, said the brand is thriving at “the crossroads of where quality meets convenience,” providing an alternative to the budget multi-serve mixers in the category which can’t deliver the same “bang for your buck” on flavor.

Owen’s is in a high-growth phase at the moment, Miller suggested, noting that the brand is rapidly scaling its on-premise business through partnerships with Chili’s, Applebees, Buffalo Wild Wings, Lucky Strike bowling alleys and LiveNation. But the brand also performs well for at-home occasions as well, where Miller said consumers are leaning deeper into at-home mixology and can utilize Owen’s mixers as simple “two-step” cocktails, or as part of a more complex four- or five-step libation.

“I think it’s intent-driven consumption,” Miller said. “We’re reading all these things where people are saying they’re not spending money the way they used to, obviously [due to] inflation and other reasons. But what’s really remarkable is that in our category, I think that really the person that’s buying the premium product wants the premium taste, the premium experience and the ease of use.”

Cassie Finley, EVP commercial, Americas for whiskey brand Compass Box, said the premium movement has represented a major shift and significant impact on the mixers category in retail. However, she also noted that there’s still room for budget brands to thrive, particularly within a challenging macroeconomic environment which is still liable to officially become a recession in the near future.

“I would say there’s still this consumer that is facing really heavy price sensitivity when it comes to basket,” Finley said. “So you’re still going to obviously have those budget brands that, I think, are probably overperforming right now from a percent of mix, because a lot of customers within this category will sacrifice quality for price.”

Finley joined Compass Box in September, and she has held a long career in adult beverage, most recently serving as VP National Accounts for Southern Glazer’s Wine and Spirits and previously spent several years as a buyer for both Kroger and Whole Foods.

According to Finley, because mixers are so frequently an add-on item for spirits shoppers, the category is also attractive for retail buyers looking for ways to increase pull-through in stores.

“With this category, you have to think of the omnichannel shopper and how cocktail mixers have really become another item in the basket for buyers,” Finley said. “If you look at what [buyers are] graded on, obviously revenue and gross profit are critical, but getting one more item in the basket and increasing that basket ring is critical. And I think cocktail mixers is a category to do that with.”

The Non-Alc Sea Change

While mixers have to contend with economic headwinds, the category is also facing perhaps an even bigger dilemma: the rise of non-alc and the decline of alcohol consumption.

Mocktails are competing with liquor-based drinking

occasions on convenience and wellness grounds, and while some mixers have attempted to position themselves as NA alternatives in their own right – Miller said that Owen’s ginger beers can hold up as standalone drinks – the category is contending with a generational change in consumer behavior.

On Gopuff, Ornstein said that customer orders for non-alcoholic beverages grew nearly 50% year-over-year between 2024 and 2025.

A number of NA brands like Recess and San Pellegrino have extended into mixers and mocktails in recent years, while hemp-derived THC spirits brands such as 1906 are also competing in the space as zero-proof alternatives to hard drinking.

Ultimately, Finley said the key word for understanding the segment is “mood,” which drives both the demand for premiumization over budgets, as well as the increased competition for alcohol from alternative relaxation beverages.

“If I were a buyer today, I would be looking at the category differently because it has changed so much from even five years ago, but we’re actually in the mood changing business,” she said. “I think you’re going to continue to see brands like Recess and some of these other ones that are very, very clear about how the product will affect them functionally, but not necessarily marketing the number one ingredient driving that, which is obviously a shift in the category completely.”

Flavor in Demand

As consumers demand higher quality cocktails, their flavor cravings are also being refined.

According to Ornstein, spicy flavors are in demand, up 35% in BevMo! stores and 26% on Gopuff, driven mainly by spicy margarita- and spicy ginger beer-related products. Meanwhile, Finley said she’s seeing the continued strength of Asian fruit flavors like yuzu, dragon fruit and lychee playing a key role in on-premise cocktail menus.

The espresso martini continues to be a big seller as well. Ingredients for espresso martinis grew 17% in BevMo! stores last year, according to Ornstein, while traditional martinis are also rising as Gopuff saw a 58% increase in sales for olive-related mixers and brines. At Owen’s, the brand’s espresso martini mix is the centerpiece of its new casual dining restaurant partnerships, Miller said.

Illinois-based mixer brand Zing Zang is also getting in on the espresso martini demand. The company, a subsidiary of Mizkan USA, is preparing to launch a multiserve bottled Espresso Martini mix this spring, made with Angostura cocoa bitters.

“I think people are trying to get away from Red Bull and vodka, and the espresso martini gives you a little boost, but it also has great taste,” said Brent Albertson, CEO of Zing Zang.

Sweeter classics are also beginning to rise as well. Both Owen’s and Netherlands-based mixer startup Double Dutch suggested that lemonades are becoming more popular. Joyce de Haas, co-founder of Double Dutch said that as wallets tighten, many consumers appear to be more adventurous drinkers at home but when they are out on the town they’re turning to familiar and reliable drinks rather than risk wasting money on an experimental cocktail.

“I do think that the general consumer is, while they are adventurous, they are less looking for these out-of-the-blue, crazy flavor combinations that maybe were happening four or five years ago,” de Haas said. “We also see that in our flavor profile, that actually the more traditional flavor profiles do better.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe