Taste & Nutrition Drive Consumers Back to Dairy by Way of A2/A2

Consumers want multiple benefits – natural, clean label, sustainable, high-protein – packed conveniently into a single consumption occasion. Those demands have turned interest back on traditional dairy, leading plant-based milks to decelerate and novel formats like A2/A2 to ascend.

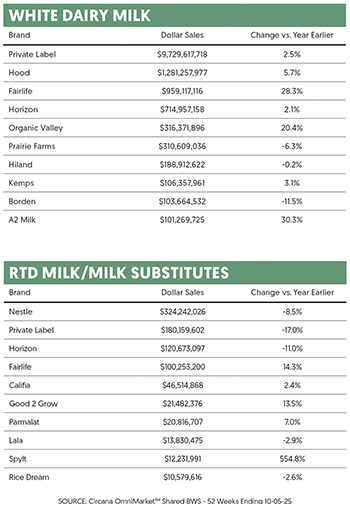

The market for A2/A2 dairy, an easier-to-digest iteration of cow’s milk, has been gaining momentum in the U.S. since 2018, when (aptly-named!) The A2 Milk Company put marketing behind the science. But the dairy format’s acceleration over the past year comes amid heightened demand for minimally-processed, high-protein functional products.

“Today, the shift in awareness is unmistakable,” said Celeste Bennett, general manager of Ohio-based Snowville Creamery, an early adopter of A2/A2 that now produces an array of products including milk, yogurt, crème fraîche and cheeses.

A2/A2 claims are now showing up in fluid milk, yogurt, cheese, ice cream and even RTD lattes sold throughout the U.S. New products are being spearheaded as upstart CPG brands partner with local, small A2/A2 dairy farms to carve out some share in the traditionally complex and corporate-run supply chain.

With about 36% of the American population sensitive to dairy consumption, the A2/A2 dairy space appears to be poised to change the category’s consumption habits with its premium, natural and gut-friendly attributes. The form hurdles the organoleptic barriers facing plant-based alternatives, and appeals to consumers looking for minimally-processed, high-protein products.

“Consumers are far more intentional about the protein they choose, especially those who want the nutritional density of real dairy but are seeking an easier-on-the-gut experience,” said Bennett. “This is where A2/A2 has real traction. People aren’t just buying into a trend – they’re looking for something that delivers the benefits of high-quality dairy protein without the digestive discomfort they’ve come to believe is inevitable.”

What is A2/A2?

Milk proteins are composed of both whey and casein, the latter of which contributes about 80% of the protein contents of cow’s milk and is made up of beta-casein. There are two forms of beta-casein – A1 and A2 – the combination of which are determined entirely by the cow’s genes.

The majority of commercially available milk is sourced from Holstein cows, a breed popular for its classic black-and-white look. Valued for their higher milk output; Holsteins typically produce A1/A1 and A1/A2 dominant milk. Heritage breeds such as Jersey, Guernsey, Normande, and Brown Swiss cows are known for having a higher chance of producing A2/A2 –as well as sheep, goats, yaks and donkeys.

Unlike most novel CPG trends, A2/A2 is not necessarily an innovation, but the result of genetic mutations in milk proteins. A2/A2 milk can only be created by sourcing from a cow with the proper genetics and cannot be achieved via processing.

In the late 1990s, The A2 Milk Company’s eventual co-founder, Dr. Corran McLachlan, discovered the distinction in milk’s protein makeup. Less than a decade later, his startup began to grow across Australia and New Zealand.

Now the company is the largest mainstream supplier of the milk format, and claims it has become one of the fastest-growing premium milk brands in the country, with revenue increasing 8.2% in 2024.

California-based Alexandre Family Farms has also played an integral role in popularizing A2/A2 milk beyond the carton by supplying milk to U.S. CPG brands such as latte brand Laurel’s, Alec’s Ice Cream and Once Upon A Farm. By supplying A2/A2 milk to early adopters, the dairy was able to jumpstart awareness and build its own namesake brand, which is now sold at Whole Foods stores across the country.

Though new formats and uses for A2/A2 milk are coming from the startup space, and no major dairy brand has introduced A2/A2 liquid dairy products yet, private label brands have a growing piece of market share. Costco’s Kirkland brand and Ahold Delhaize’s Nature’s Promise have been selling A2/A2 milk cartons for a few years and this year, Trader Joe’s added its own organic, A2/A2 private label product.

But if Big Milk wants to get into this new market, it would require farmers to cull and replace entire herds, a financially and ethically risky endeavor. National milk marketing cooperative The Dairy Farmers of America declined to comment for this story.

Constraints on Cows

Like any perishable, agriculture-reliant supply chain, the complexity of sourcing puts a natural cap on how fast the sector can scale up.

Brands like RTD coffee brand Laurel’s originally sourced solely from Alexandre Family Farms. While the Alexandres have been working to expand their supply by helping neighboring farms transition to A2/A2 production and regenerative practices, they have reached a limit for new CPG brand partners.

Laurel’s began retooling its own sourcing network after a manufacturing shift to the East Coast. Isabel Washington, Laurel’s founder and CEO, said she began looking for new dairy suppliers located in closer proximity to the new facility, noting the process of finding an A2/A2 dairy supplier large enough and with the right capabilities was painstaking.

The brand is now sourcing from a small farm in Virginia and is in conversion with another farmer in the region. She said that the company had to make some investments up front in order to help the farm reach a commercial scale, including helping its current supplier source, recycle and create a sanitation plan for the totes that are used to transport the milk between the farm and processing plants.

Factor in a cold chain sourcing network, and the A2/A2 latte business truly isn’t for the “faint of heart”, Washington emphasized.

“I’ve cried countless times over [the dairy supply chain],” she said. “We’ve lost thousands of dollars on it. It’s a Goliath, for sure.”

Awareness and Premiums

But here’s the upside: at a moment when Big Food and Big Beverage are facing the forces of the MAHA movement, the natural, minimally processed tenets of A2/A2 could be a boon for local dairy businesses and be the organic marketing boost A2/A2 has been looking for.

“From a positioning standpoint, A2/A2 remains a premium attribute, but it’s no longer an obscure one,” said Bennett. “The conversation has shifted from introducing the concept to explaining Snowville’s long-standing commitment to it and how it aligns with our broader values around transparency, animal welfare, and product quality. Being an early mover gives us credibility in a category that continues to grow in visibility and consumer relevance.”

According to Snowville Creamery, customers are willing to pay between 14% to 18% more for the brand’s A2/A2 milk-based products. Alexandre Family Farms has reported similar premiums, noting that consumers are willing to pay about 10% to 12% on top of the price of organic milk.

However, Laurel’s has worked to bring its pricing down to parity with its dairy and plant-based latte competitors; that strategy is largely due to shelf dynamics in the coffee set. Laurel’s first launched at $4.99 per can at Whole Foods, but eventually dropped its price to $3.99, closer in line with shelf neighbors La Colombe ($3.99), Equator ($3.99) and Pop and Bottle ($3.49).

“We were not really getting the trial that we should have… It is tough to be at a premium price point and not have the brand awareness and be putting all that money into marketing,” said Washington, explaining that after margins and markups, the brand really only lost about 15 cents per can after the price cut.

Differentiated product types also help draw consumers in and convince them the premium is worth it. Washington noted that after Culture Cups, a probiotic-infused, single serve innovation A2/A2 dairy-based product from Alec’s Ice Cream, “blew up on TikTok,” awareness for A2/A2 has skyrocketed.

“The people who know about A2 [milk] appreciate the fact that it’s A2/A2, but there are a lot of people who are just happy that a real source of dairy is being used without all of the additives, the protein, the adaptogens, and all of those other things,” Washington said.

Market Opportunities

A2/A2 dairy production has already proliferated across local dairy producing economies. The smallhold farmers raising A2/A2 producing cows often follow regenerative and organic practices as well, layering in natural sustainability alongside the milk’s functional benefits.

Regional suppliers and cooperatives are beginning to gain traction at retail with their own brands, including Snowville Creamery (sold in select Kroger and Whole Foods regions), New York-based Family Farmstead (sold in select Whole Foods regions), Colorado-based Grazeful Dairy (sold at select Weis Markets and Target stores) and Virginia-based Homestead Creamery (sold in select Kroger stores), among others.

“The supply chain has also caught up to the demand,” Bennett said. “What once required cumbersome milk testing can now be managed proactively at the herd level through genetics,” Bennett explained. “That shift has made sourcing more reliable, more scalable, and ultimately more accessible. It has allowed producers like Snowville to offer A2/A2 consistently – and to do so with the transparency and integrity consumers expect from companies in this space.”

As consumer demand for natural, high-protein products rise alongside A2/A2 awareness, could the promises of natural, gut-friendly dairy be enough to overtake conventional counterparts?

Not necessarily, according to Washington. While the brand’s cans front-of-pack “happy tummy coffee” callout doesn’t dissuade purchasers, she is not convinced that A2 dairy is all that’s needed to convince all consumers to keep coming back.

“I don’t know why the hundreds of cans that are sold every day at Whole Foods are sold, but as we’re thinking about telling our investment story, we’re focusing more on flavors and flavor innovation,” Washington explained. “I’m surprised that nothing else has come to market with A2 dairy in coffee nonetheless.”

Washington said that Laurel’s will always use A2/A2 dairy. One the side of the can is a blurb to support A2 awareness, explaining that this form “allows people to consume dairy, again,” but beyond that it aims to use its other attributes, and those naturally bolted-on to A2/A2 dairy, as leverage.

This notion was validated after Washington spoke with an investor who had recently led the funding round of another A2-focused brand earlier this year. Washington said the investor emphasized that the use of A2/A2 was not the primary reason they backed the company, but rather the other attributes, like its flavors and regenerative organic status.

“I still think it’s an important attribute, and I still think awareness and excitement in the category is growing,” Washington said. “I don’t think it’s gonna be what lasts. We will never get rid of it, but it’s not gonna be our strongest differentiator forever.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe