There’s no sugarcoating how Seattle’s government feels about soda.

In a 7-1 vote yesterday, the Seattle City Council approved a 1.75 cents per ounce tax on distributors of sugar-sweetened beverages (SSB) that is expected to take effect in early July. The bill was signed into law by Mayor Ed Murray, who initially proposed the tax in his State of the City address in February, and returned to the council earlier today.

The vote makes Seattle the latest addition to a growing group of cities and counties that have implemented similar measures, joining the likes of San Francisco, Oakland, and Philadelphia. A similar proposal in Sante Fe, N.M. was defeated last month.

As in previous instances, the debate over the soda tax inspired strong feelings on both sides of the issue. Murray, along with community advocates and public health professionals, supported the bill as a means of reducing consumption of SSB and raising revenues for programs aimed at “reducing disparities between white and African-American students and other historically underrepresented students of color.”

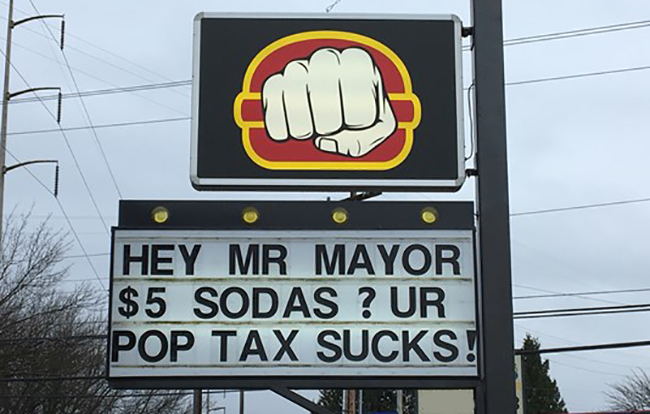

On the other side, some industry trade groups and members of the local business community attacked the bill as an unfair penalty that would hurt the city economy. The Seattle Metropolitan Chamber of Commerce and the Martin Luther King County Labor Council both voice their opposition to the bill. In April, over 150 small business owners sent a letter to Murray asking him to reconsider the tax.

As a result, Murray proffered a new version of the bill in April which reduced the tax from the original proposal of 2 cents per ounce to 1.75. Citing statistics that showed more wealthy white people drink diet sodas compared to minorities, he also broadened the bill’s language to cover diet sodas, which were exempt in the prior iteration.

However, that decision was reversed in the final version of the bill approved yesterday. Diet sodas that use artificial sweeteners, as well as baby formula, medicine, weight-loss drinks and 100 percent fruit juice, are all exempt. Meanwhile, sugar-sweetened sports drinks, energy drinks, fruit drinks and syrups used in fountain sodas are all covered.

In a flashpoint of particular importance for a coffee town like Seattle, Murray shifted his position several times with regards to how barista-prepared coffee drinks that contain sugar would be affected by the tax; they were initially exempt, followed by a change exempting only milk drinks. As of Monday, a report in The Seattle Times said it remained unclear whether flavoring syrups used at coffee shops would be taxed or not.

The tax is expected to raise about $15 million per year. The council also earmarked $1.5 million over the first five years of the tax for retraining programs to assist workers in the soda industry impacted by the bill.