The Dream of the 90’s is Alive — Slice Is Coming Back!

Just when 90’s nostalgia looked like it might be hitting its peak, another blast from the past arrives.

Slice, a fruit-flavored soda formerly manufactured by PepsiCo, is being relaunched as a low-calorie soft drink sweetened with fruit juice, according to a report in The Chicago Tribune. The Slice trademark was acquired by Chicago-based entrepreneur Mark Thomann via his companies Dormitus Brands and Spiral Sun Ventures after he successfully argued that PepsiCo had abandoned the brand. The product will be developed through a new firm called New Slice Ventures.

According to the Tribune, Thomann plans to launch the brand with several flavors, including grapefruit, berry, and lemon-lime. He hopes the brand will grow to a point where he can sell it back to big soda, ideally sparking “a bidding war,” according to his business partner and attorney Joe Gioconda.

Acquiring abandoned trademarks is another day in the office for Thomann and Gioconda. The pair have scooped up defunct names such as audio equipment brand Aiwa, video game brand Coleco, and even Anheuser-Busch’s classic bull terrier advertising mascot Spuds Mackenzie — the latter of which they plan to use to sell dog treats under the name Spuds Ventures.

“People remember the brand, but they don’t always remember the specifics,” Thomann told the Tribune. “It’s sort of like clay that you can mold how you want.”

Nasdaq Delists Long Island Iced Tea Maker After Blockchain Pivot

Long Blockchain Corp., formerly known as Long Island Iced Tea Corp., has been delisted from the Nasdaq Stock Market after the exchange claimed the company has misled investors in an attempt to take advantage of “general investor interest in bitcoin and blockchain technology.”

The iced tea maker saw its stock rise by more than 500 percent in December after it announced it would pivot towards developing blockchain technology, had purchased bitcoin mining rigs, and changed its name to Long Blockchain Corp. The curious move raised eyebrows from investors and pundits, with some likening the gold rush for blockchain-related investments to the “dot com” bubble of the early 2000’s.

In January, Seeking Alpha noted that prior to its blockchain rebrand, Long Island Iced Tea Corp. had received a warning from Nasdaq that it needed to increase its market value above $35 million for 10 business days in a row or risk delistment.

Long Blockchain Corp. has denounced the decision by Nasdaq and has appealed the decision.

“The notification letter stated that the staff believed that the company made a series of public statements designed to mislead investors and to take advantage of general investor interest in bitcoin and blockchain technology, thereby raising concerns about the company’s suitability for exchange listing,” the company said in a filing.

Last week, Long Blockchain announced a plan to separate its iced tea business from its new blockchain focus, announcing Shamyl Malik as CEO of its beverage subsidiary.

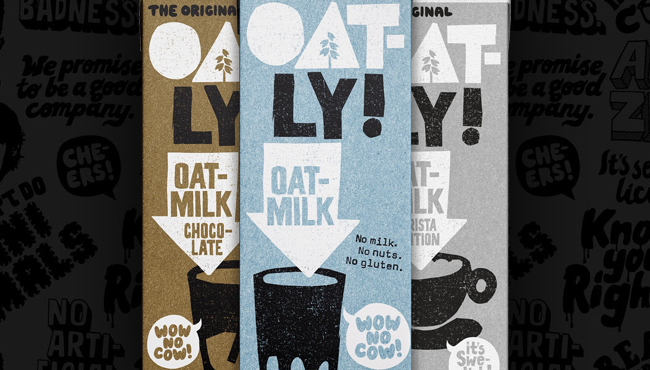

Oatly Address Pig Farm Controversy

Swedish plant-based milk maker Oatly, which launched in the U.S. market last year, came under fire from animal rights advocates earlier this month after it was revealed that the company had been selling oat residue from its European factory to a pig farm.

Some of the brand’s vegan consumers took to Twitter to criticize the brand for doing business with the meat industry, suggesting the oat residue could instead be sold to an animal sanctuary.

According to Plant Based News, Oatly responded to the controversy, explaining that the practice was an attempt to act sustainably and achieve a carbon neutral production facility, but ultimately conceded it had acted against its plant-based mission.

“Yes, sending our production residuals to a local farm as feed has eliminated the unnecessary waste of nutrients and at the same time contributed to the production of biogas. And with the help of biogas our production plant has become totally carbon neutral.” The company said in a statement, reported by Plant Based News. “This accomplishment does not, however, free us from the need to constantly probe deeper in order to reach our other core objective – to promote plant-based nutrition over animal based nutrition in every way possible.”

German Olympians Choose Non-Alcoholic Beer

Germany may be renown for its beer culture, but what are German Olympians to do when they need to choose between a cold one and keeping in shape for competition.

The New York Times reported last week that many German Olympians, competing during the 2018 Winter Games in Pyeongchang this year, have taken to non-alcoholic beer as a sports drink alternative. Johannes Scherr, doctor for the German Olympic ski team, told the Times that all of his athletes drink it during training.

There is some science behind the choice, Scherr said. One study showed runners competing in the 2009 Munich Marathon who drank non-alcoholic beer suffered less inflammation and fewer respiratory infections after the race than those given a placebo.

German athletes ended the 2018 Winter Olympics with 14 gold medals, 10 silver, and 7 bronze, coming in second for total medals won behind Norway.

Diet Coke’s “Moment of Panic”

When Diet Coke debuted its revamped branding and line extension last month, The Coca-Cola Company pitched the pivot as a means of better connecting with millennial consumers and keeping up with changing consumer palettes.

The change comes with good reason — the brand has been going nowhere but down. The Atlantic’s Derek Thompson last month suggests the Diet Coke rebrand comes with a hint of panic as North American volume sank 5 percent in 2016, bottled and sparkling water rise to dominance, and the brand loses market share to “more flavorful beverages.”

“One could argue that, in the last decade, all of the jobs of Diet Coke are being outsourced to superior beverages,” Thompson wrote. “The role of hydration has been outsourced to bottled water and sports drinks, like Gatorade. Getting a jolt of energy has been outsourced to coffee and energy drinks, like 5-Hour Energy. And the satisfaction of a cold liquid fizzing on one’s tongue? That’s been outsourced to the trendy crop of flavored seltzers, like LaCroix.”

The Diet Coke rebrand comes on the heels of the relaunch of Coca-Cola Zero as Coke Zero Sugar, which, according to the company, has seen increased sales in the first month of its release.