The growth of the specialty food industry over the past year was primarily driven by products used for at-home cooking and baking as consumers looked to make easy meals and indulgent treats as lockdowns carried into the new year. In a recent report published by the Specialty Food Association (SFA) with research from SPINS and IRI, the SFA predicts that these categories will continue to lead growth in the industry as cooking at home becomes more habitual to consumers.

Changes Within The Industry

Specialty food sales at retail increased 24% to $136.3 billion between 2018-2020. The industry continues to grow, outpacing all retail food sales and accelerated 19.4% in 2020 alone. Those results were surprising to market analysts; speaking during last week’s State of Specialty Food webinar, researchers David Brown and David Lockwood said that they had not expected the industry to continue growing at this rate due to increased financial concerns among consumers and the free fall of food service throughout the pandemic.

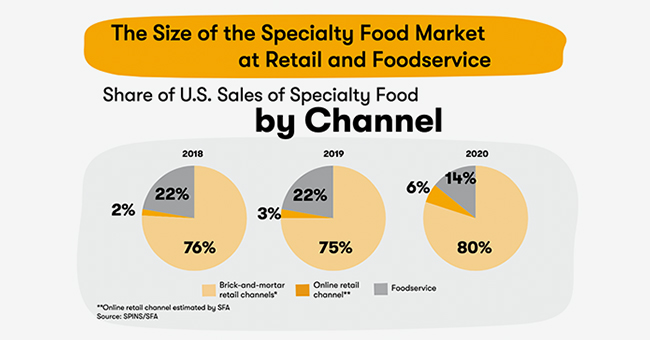

However, according to the report, sales growth in retail and e-commerce channels helped to offset the 30% decline in food service; the channel accounted for only 15% of specialty food sales last year. E-commerce helped balance out the blow with online grocery sales growing 170% since 2018 reaching almost $10 billion market value.

“The average retail, e-commerce customer base skyrocketed in 2020,” said Browne. “Consumers of all ages, including seniors 65 plus were ordering online, possibly for the first time ever. About half of all consumers purchased e-commerce groceries at some point in 2020.”

Although many retailers quickly adapted to modernize or entirely implement e-commerce platforms, brick and mortar retail still led the way with $136 billion in total sales. Around $71 billion of those purchases came through multi-outlet (MULO) stores such as Whole Foods and Trader Joes, leading to slower growth at natural and specialty stores which only saw a 20% increase in sales since 2018.

New product discovery was virtually non-existent throughout the spring and summer months of 2020. While maintaining an environment of minimal in-store contact between staff and customers, retailers put product sampling programs on hold and limited store capacity meant that consumers were less likely to leisurely browse the aisles. The majority of retailers focused on keeping their stores adequately stocked and grappling with staffing restrictions and supply chain issues across categories.

“They were just doing the business of doing business: managing surging volume and strained supply chains,” said Lockwood. “There wasn’t very much new product discovery going on. They weren’t taking on new brands, they weren’t showcasing them. A lot of end caps gave way to hand sanitizer.”

Top Selling Specialties

Despite facing limitations, new product categories were able to break into the top-ten bestsellers list with condiments, dressings and marinades making the list for the first time ever. Browne and Lockwood noted that nearly every top-ten selling category from the past year “were directly linked to at-home cooking and baking in some way.” Meat, poultry and seafood took the top spot, followed by both dairy and plant-based cheeses. According to the report, indulgent and on-the-go products such as chocolate and yogurt saw a significant decline in sales as consumers made decisions about what was necessary and the need for portable foods virtually disappeared.

In terms of format, frozen saw a significant boost this year, growing 45% since 2018. According to the report, consumers looked to frozen products as they stocked up on essential meal preparation components. Browne highlighted this trend in the webinar with data that showed freezer sales at appliance stores “skyrocketing,” likely due to consumers needing more space in their homes to store these items.

“Frozen is a big story this year,” said Browne. “It grew 27% in the market whereas refrigerated and grocery categories didn’t grow as well. Really the star of this is frozen fruits and vegetables which, I am a big consumer of anyway, but even more so this past year. [Frozen food] grew 45% over the past two years.”

Looking Forward

According to Browne, the pandemic has created consumer habits that will continue to influence the industry even as lockdowns begin to ease up. Lockwood noted that food service in particular will struggle to get back to pre-pandemic conditions, with many restaurants permanently closed and takeout delivery becoming quicker, easier and more cost effective. The report predicts that e-commerce grocery sales will continue to rise, likely upwards of 50% over the coming year.

In terms of categories, the report predicts that at-home cooking and baking products will continue to see steady growth. Browne said he expects to see a significant sales increase and “dynamic growth” in center-store plant-based products, marking a shift away from the frozen and refrigerated plant-based products which currently lead that market.

“There is a much smaller segment of center store grocery where plant-based product sales, I think, are really going to explode over the coming years,” said Browne. “There’s a lot more opportunity there. When you think about a retail store, frozen and chill sets have finite space, it’s very difficult to expand, but in center store you can do a lot more with the plano-gramming and end caps.”

Overall, those center store categories will likely be the major beneficiaries of specialty market growth, which is projected to grow 4.4% by 2025. Pantry-staple categories such as beans, rice, pasta and sauces have also been “reinvigorated” by pandemic shopping habits and consumers will continue to reach for these items in the coming years.

“If the pandemic had not happened, 2021 sales would probably have been about $74.6 billion instead of $82 billion,” said Lockwood. “So there is a permanent bump of around 10 to 11% that came from the pandemic and will stay in there going forward. It really did turn out to be something that worked well for the specialty food industry.”