With its business expanding amid a rising U.S. energy drink category, Monster Beverage Corporation projected confidence in its widening product portfolio during its annual investor meeting presentation yesterday.

During the live presentation, co-CEOs Rodney Sacks and Hilton Schlosberg highlighted +3.8% retail sales growth for its U.S. business against +7.9% growth for the total energy category in the 13-week period ending December 30, 2023.

Monster won’t be initiating an immediate pricing action in the U.S., although Sacks and Schlosberg suggested they are hoping to announce an increase within the next few months. As well, Goldman Sachs Equity Research noted that the company said gross margins for Q4 2023 were in-line with Q3 due to cost pressures.

“Importantly, we were encouraged to hear [management’s] focus on improving its execution levels and increasing its sell-rate, which we think should translate into stronger volume growth and margins this year,” Goldman wrote in its report on the meeting, noting that analysts “came away incrementally positive” on the company’s innovation pipeline and other growth drivers.

Having acquired multiple manufacturing facilities to produce more of its U.S. portfolio in-house, the company said it has an ambitious strategy in place to drive growth in 2024.

New Innovations for Reign Storm, Ultra Lines

Monster previewed its lengthy innovation slate for the year, including new flavors on the Ultra, Java Monster and Reign lines.

For Reign, this year will see the launch of Sour Gummy Worm in the core line, while the better-for-you positioned Reign Storm will see a full roster of new flavors including Citrus Zest, Guava Strawberry, Strawberry Apricot and Mango.

Characterizing Reign Storm as a “softer” brand that speaks to a different consumer group, Sacks said the line will be marketed differently with a focus on unique brand partnerships, including beach volleyball and pickleball promotions.

“The positioning for Reign Storm is going to be very different and separate from Reign itself,” Sacks said. “We’re not looking at trying to merge the brands or one being a sort of extension of the other. We’re actually positioning them as separate brands standing on their own and with different programs.”

On other lines, the company will be introducing Monster Ultra Fantasy Ruby Red, Juice Monster Rio Punch, a reformulated Java Monster Irish Crème, Rehab Monster Green Tea and Monster Reserve Peaches n’ Crème.

For the NOS brand, the company is taking cues from the success of its Monster Zero Sugar launch last year and has now introduced a NOS Zero Sugar variety which Sacks said will be a focus in 2024.

Bang Gets a Refresh

After acquiring Bang last year in the wake of Vital Pharmaceuticals’ high profile bankruptcy proceedings, Monster has now rationalized the brand down to 12 core SKUs that the company believes represent the “core items,” Sacks said.

The company has now introduced a refreshed look for Bang, bearing the slogan “Fuel Your Destiny” at the top of the can where the controversial callout for “Super Creatine” previously sat.

“We’re going to focus on getting them re-established, which is what we are now doing,” he said. “We’ve got listings again and we are going to get them onto shelves…. We see great low hanging fruit and low-hanging fruit to establish Bang.”

During the presentation’s Q&A segment, co-CEO Hilton Schlosberg noted that although the brand had fallen from a roughly 7% market share of the energy category to a 2% share, Monster is now seeing former retailers, including Walmart, restocking Bang products. He suggested that many lapsed Bang consumers are likely to return to the brand given proper marketing support and increased availability.

“We don’t give guidance, so I’m not saying it’ll get back to where it was, but it’ll certainly increase from where it is today,” Schlosberg said.

In an email to BevNET, CPG consultant Joshua Schall suggested that Bang’s move into The Coca-Cola Company’s distribution network is likely to help with the rebound effort.

“Coca-Cola is no rookie when it comes to this evolutionary balancing act and they will figure it out quickly,” Schall wrote. “It’s taken just under six months, but it feels like Monster has torn Bang Energy down to the studs, assessed what needs to happen next, and is slowly rebuilding bits and pieces of it.”

CANarchy Emphasizes Nasty Beast/Beast Unleashed Duo

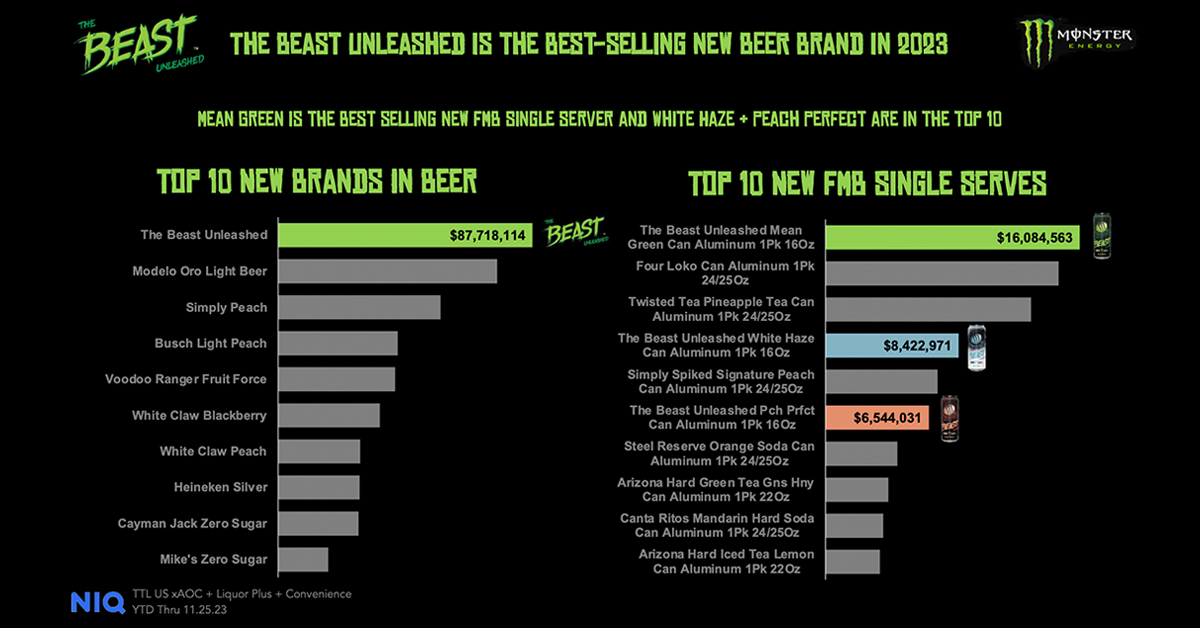

Monster is continuing to grow its CANarchy division, with particular emphasis on The Beast Unleashed and Nasty Beast lines.

Sacks said The Beast Unleashed will transition its single-serve offerings from 16 oz. to 24 oz. cans early this year, as well as launching a second variety pack option.

He noted that the marketing strategy for the brand is “not dissimilar from Monster” and will emphasize music, motorsports and tailgating parties.

Meanwhile, hard tea line Nasty Beast is now rolling out to distributors in variety pack formats and will be hitting shelves throughout January and February. The company is building inventory for 24 oz. single serve cans on the line, which will launch within “a month or two.”

Marketing Nasty Beast and The Beast Unleashed together will be key, Sacks said, to growing both brands.

“If you look at [Nasty Beast] together with The Beast Unleashed, we think that the two of them together are going to give us an ability to have a presence on shelf so that it won’t be lost with one or two facings. We think it’s going to make a big difference to the whole line. We’re putting an emphasis on [the] convenience channel in 24 oz. for both of those product lines and also for the multipacks in the more traditional and the bigger stores grocery and the bigger box stores.

Sponsorships Continue to Drive Marketing

In an update on its sports marketing campaigns, Sacks announced that Monster recently partnered with Power Slap, a rising slap fighting league founded in 2022 and owned and operated by longtime Monster partner UFC. The company is also ending its sponsorship of the Mercedes Formula 1 motor racing team and will switch its allegiance to the McLaren Formula 1 team this year; Monster initially announced to leap in November.

The brand also has signed a sponsorship agreement with pop punk band Green Day, promoting the groups’ world tour this year.

Looking ahead, Sacks said social media marketing for name brand Monster will ramp up this year as the company puts more spend behind social ads for Monster, while he noted it is already a major marketing channel for other portfolio brands like Reign Storm and Bang.

“We’re going to place more emphasis on the social media, we’re putting more financial resources behind the social media,” he said. “We plan to grow that part of our marketing spend this year and going forward it’s becoming a bigger and more important part for Monster.”

Turning to retail promotions for 2024, Sacks said the first third of the year will emphasize new innovations and driving trial in stores, while later in the year the company will launch a “gear program” built around branded clothing and accessories while the final third of the year will focus on a tie-in partnership with the Call of Duty video game series.