Energy Brands Find Footing in Multi-Format

Is bigger always better? Based on what we saw at NACS, it really depends on who you ask.

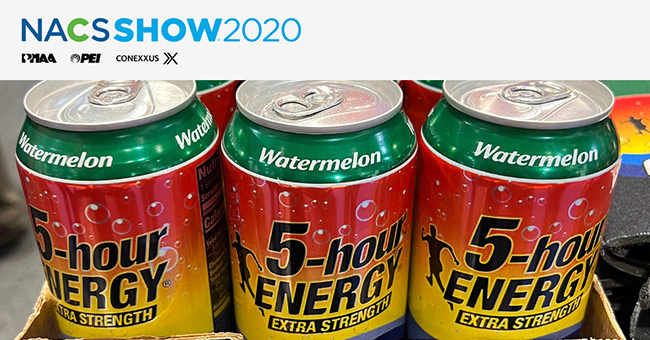

From the perspective of 5-Hour Energy, the answer is a clear yes. As we reported last week, the company is seeking to leverage its category-leading position in energy shots into the broader energy drink space with the launch of 5-Hour Energy in 16 oz. cans. From the package design to the formulation itself, the new format keeps the same look and taste as the original product’s Extra Strength variety with 230 mg of caffeine; don’t expect “lifestyle” vibes or yoga poses in any marketing materials, nor any of the candy-inspired flavors that we saw elsewhere (though they did boast a very on-trend Watermelon flavor, along with Berry and Grape). With the rest of the business chugging along — $841 million in dollar sales year-over-year through August 8, per IRI stats — 5-Hour is looking to seed the 16 oz. cans in c-stores through DSD partners this fall. The line will retail for $3.99 per unit.

In entering the big-can energy market, 5-Hour will find itself competing alongside ZOA, the Dwayne Johnson-founded, Molson Coors-distributed, L.A. Libations-backed natural energy drink line launched less than a year ago. At its NACS booth, brand reps met rumors about its current run rate with a knowing smile; without getting into the numbers, indications are that things are looking good. After debuting with a splashy ad during the Summer Olympics, the brand’s marketing and awareness push is set to continue this fall, but new innovations won’t arrive until January when the brand is set to launch two new 16 oz. flavors — Tropical Punch and White Peach — in both sugar-added (100 calories) and zero-sugar (15 calories, with Sucralose) varieties. But in an indication of the impact ZOA has already had, reps said that a new 12 oz. can will be in the mix next year, in singles and 4-packs, at the specific request of retailers like Target, which have not taken on the larger format. That size will carry a lower natural caffeine payload than its big brother (160 mg per can), and will be available in all flavors.

With ZOA and 5-Hour Energy both mixing things up, energy brands are showing a greater willingness to break out of the package formats with which they built their businesses. Recall that Monster Energy announced the launch of a 12 oz. can for c-stores back in January, a package size that Red Bull also shifted into several years ago and that has been a welcome spot for female-leaning brands like Alani Nu and Celsius to grow. But, at least as an entry to the category, 16 oz. remains the format of choice, with names like GHOST, C4 and Rowdy Energy staking their respective claims.

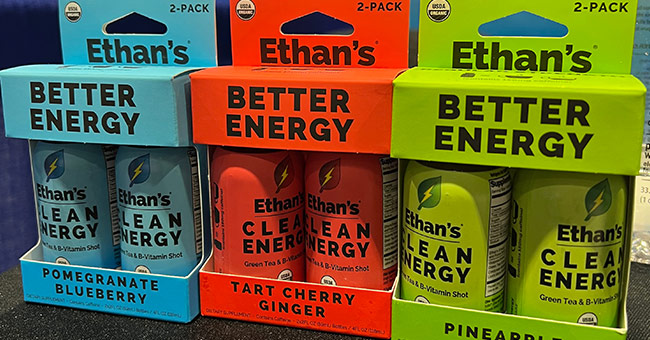

Even as some of the more established brands play around with their assortments, there’s still innovation to be found in shots. Colorado-based brand Ethan’s first arrived on the market as an apple cider vinegar-based shot product, offering the benefits of ACV with the addition of fruit juice. However, at NACS, founder Ethan Hirschberg said that product’s momentum has slowed (it’s still available at longtime partner Whole Foods), causing it to pivot towards organic energy shots. Natural alternatives to synthetic products like 5-Hour have struggled to migrate into the mainstream (including 5-Hour’s own attempts), but the brand is hoping its equity in the shot space — along with secured placement at CVS, where it will be merchandised alongside 5-Hour in the Health & Wellness section — will help reach its target audience. The line is available in three flavors — Pomegranate Blueberry, Tart Cherry Ginger and Pineapple — in 2-packs of 2 oz. bottles to encourage trial. Alongside its clean energy shots, the brand shared a look at its newest release: an on-trend Immune Boost shot packaged with Vitamin C, zinc, Vitamin D and reishi mushroom extract, available in Elderberry or Orange Pineapple flavors (and also in 6-packs of single-use powder sticks).

Snapple Set to Tap into the “Elements,” Dumping “Diet”

Amongst KDP’s expanding portfolio, it can be easy to overlook the core Snapple brand, still chugging along after making the much-discussed move out of glass bottles and into PET last year. Yet at NACS, KDP teased a look at new innovation for the storied brand called “Elements.” Details were scarce but the three SKUs on display took inspiration from earth elements — Air (Prickly Pear & Peach White Tea), Rain (Agave Cactus) and Fire (Dragon Fruit) — to form the basis of “light and refreshing” juice drinks packaged in colored 15.9 oz. PET bottles. While those items will clock in at around 25 grams of sugar per serving, the brand is also innovating in the other direction with Zero-Sugar Snapple (no longer Diet), showcasing a Kiwi Strawberry flavor with 10 calories.

Coke Innovation: Less Brands, More Focus

Over the last 12 months, much of the narrative around Coca-Cola has been about what it isn’t doing — i.e. dropping Zico, Odwalla, and Tab; aborting the Coca-Cola Energy experiment — rather than what it is developing. At NACS, company reps shared a look at where its current efforts are going.

While better-for-you options and reduced sugar SKUs continue to drive product strategy, Coke’s CSDs remain strong performers, particularly in c-stores. Leaning into its positioning as a “global fruit soda,” Fanta will be rolling out a new program called “What the Fanta?” that will see the brand release a limited time “mystery flavor” twice annually; the SKU will be released in 20 oz. bottles and as a frozen dispensed product. But it’s not all sweet: Fanta will also release a Dragon Fruit flavor in zero-sugar format.

By ending Odwalla in 2020, Coca-Cola made a clear pivot away from refrigerated juice and cold-chain distribution overall. However, that change seems to have directed energies back into Minute Maid, as evidenced by a slew of new innovations on display at NACS. That included some modest updates, including a revamp of MM’s To-Go lineup in 12 oz. PET, with “100% VIT C” getting a bigger callout on the front panel, the release of a new Blue Raspberry flavor to its 20 oz. “Refreshers” line, and a Strawberry Lemonade fountain option. Yet Coke is also using the brand to dip its toe into new categories: see Minute Maid Aguas Frescas, launching next year in 15.5 oz. cans in Hibiscus, Mango and Strawberry.

It’s worth noting that Coke has had a stake in the agua fresca space for several years through fountain product Barrilitos. However, while that brand has been focused on foodservice and different beverage styles — the latest flavor on pour at NACS was Horchata — Minute Maid’s product is set to compete with brands like Agua Lucha and Mex2o in a space that’s been notoriously difficult to crack into the U.S. mainstream, despite past attempts from Nestle, Califia Farms and others.

Not all juice innovation will be housed under Minute Maid, though. Not-from-concentrate line Simply is still going and set to release its pure orange juice in an 8 oz. format next year, and juice drink Hi-C is set to rejoin the roster at McDonald’s restaurants due to consumer demand, reps noted.

There was also another familiar face in the mix: Hubert’s Lemonade. Though the RTD product in glass bottles has been discontinued for some time, the brand is being revived as a premium option for foodservice providers via the launch of branded bubbler machines. It’s worth remembering that this comes after a judge ruled against Coke and Monster by awarding $9.6 million in damages (plus an additional $7.4 million in legal fees) to the heirs of Hansen’s Beverage Co. founder Hubert Hansen last July.

Take out the “frescas” from aguas frescas and things get much simpler: flavored sparkling water AHA has been a strong performer since its launch several years ago, and smartwater continues to churn out big numbers in the premium water space. Thus, it’s no surprise to see both get a boost from new innovations. For AHA, that means a new caffeinated entry (40 mg) for its c-store friendly 16 oz. cans in the form of Fuji Apple White Tea. Maybe more significantly, AHA will also be integrated into Coke’s fountain options for foodservice, with Peach + Honey, Blueberry + Pomegranate and Lime + Watermelon flavors.

For smartwater, innovation means an expansion of the function-forward smartwater+ products introduced last year: Smartwater+ Support, available in Black Currant Blueberry and boasting 20% of the daily recommended allowance for zinc. The flavored roster is also getting an innovation injection with tropical-inspired passionfruit mango.

While some brands are expanding, others are pulling back and refining. Dairy line Fairlife is retiring its YUP! sub-line in 14 oz. bottles and pulling those products back into the core roster.