Brewscape: The Latest Craft Beer Brand News

The collective craft beer community shared mixed emotions this summer when Japanese beer giant Sapporo announced plans to cease operations at Anchor Brewing, one of the nation’s oldest craft breweries.

The San Francisco craft brewery, which was acquired for $85 million by Sapporo in August 2017, cited “a combination of challenging economic factors and declining sales since 2016” for the decision to close and liquidate its business. Ultimately, the company said the economic pressure “made the business no longer sustainable.”

Workers at Anchor were given 60 day’s notice on July 12 “with intent to provide transition support and separation packages in line with company practices and policies,” according to a press release. Some workers found out about the news through media reports first, rather than the company directly, according to Anchor’s union workers on social media.

Production has ceased at the brewery, but packaging and distribution of remaining beer continued.

It was already a tumultuous year for Anchor, leading up to the big news. The company started the year with reports that union contract negotiations were delayed, with workers claiming Sapporo was not transparent on its purchase of Stone Brewing the year before, and the sale was muddying the waters for Anchor workers seeking better wages and benefits.

Later, Anchor announced it was pulling back its national distribution to just its home state of California and cutting production of its beloved seasonal offering, Christmas Ale. Those cost cutting measures were part of what the company termed “final attempts … to evaluate all possible outcomes” but “expenses simply continued to outstrip revenues, leaving the company with no other viable choice.”

Two days after the Anchor news dropped, Narragansett launched a petition to save Anchor.

In its change.org campaign memo, Narragansett wrote: “18 years ago, our community rallied together and provided unwavering support to resurrect our beloved company. Today, we are calling upon all craft beer enthusiasts and supporters to do the same for a fellow pioneer in the industry, Anchor Brewing Company.

“Being a good neighbor is not merely about existing alongside one another; it is about standing shoulder to shoulder during times of adversity,” the brewery continued. “We have an opportunity now to show our support and help save this iconic brewery. While the path forward is uncertain, be it Chapter 7, 11, or sale, we are starting this petition to create a community of like-minded crafter brewers and consumers interested in the preservation of Anchor Brewing Company. Again, we do not know where this conversation will take us, but we should have the conversation nonetheless.”

Narragansett highlighted the historical significance and influence of Anchor, as well as the economic impact of the brewery closing, including the loss of more than 200 jobs. As of July 21, the petition had more than 6,000 signatures.

Shortly after, Anchor workers launched their own effort “to purchase the brewery and run it as a worker co-op,” Vine Pair’s Dave Infante reported, citing a letter sent by the union’s business agent to Sapporo USA president Mike Minami.

The letter from Pedro de Sá of the International Longshore and Warehouse Union Local 6, which represents the brewery’s union labor, stated:

“We are not asking for a handout or charity. All we want is a fair shot at being able to continue to do our jobs, make the beer we love, and keep this historic institution open. We do not want the brewery and brand we love to be sold off before we even had a chance.”

The union is giving Sapporo USA a deadline of Friday, July 21, to respond as to whether it will work with the union on a potential sale.

“Welp, here ya go,” Union members wrote in a post on Twitter. “Time to put everyone’s love of this brand to the test. Let’s work this out together and bring back what we’ve almost lost.Welp. Here ya go. Time to put everyone’s love of this brand to the test. Let’s work this out together and bring back what we’ve almost lost.”

Several other potential buyers have been listed by various publications, including a handful of investors in San Francisco. One of those investors even expressed the desire to create a reality T.V. show out of the purchase, documenting the journey of bringing Anchor back to life.

But the reality of any of these efforts is unknown. Sapporo seems determined to let the liquidation process go through unchanged, according to a statement from Anchor spokesman Sam Singer, first reported by Infante:

“It is heartening to see so many stepping forward to possibly carry on the tradition of an iconic San Francisco company and beer,” Singer said. “We remain hopeful that Anchor will be purchased and continue on into the future, but it will be in the hands of the liquidator to make that decision and is dependent on what is offered by potential purchasers.”

Union Struggles Continue to Hit Craft Beer

Anchor isn’t the only craft brewery facing union conflict this year.

In late June, Brewing Union of Georgia (BUG) updated its unfair labor practices (ULP) filings against Creature Comforts to include employee retaliation firing, after an employee of the Athens, Georgia-based brewery was allegedly fired for his union efforts.

Spencer “Spicy” Britton – who worked for Creature Comforts for more than six years – was fired from the company on June 12, after a more than 10-week suspension, for allegedly making threats against other employees, according to a BUG Instagram post. BUG has said the claims against Britton are false, and that the firing was actually a result of Britton and others’ involvement with the union.

“Spencer’s treatment has been really motivating because he’s a super beloved coworker and friend to so many people at the brewery,” Katie Britton, Creature Comforts brand marketing manager and one of the BUG organizers, told Brewbound. “To see someone that everybody’s like, ‘This is one of our the nicest people here’ and to see what’s being done, it’s been really enraging and motivating for people.”

Creature Comforts employees first announced union efforts in early January, forming BUG as an independent union to bring “positive workplace culture and core values” to Creature Comforts and other Georgia breweries. The majority of the brewery’s employees signed a petition with the National Labor Relations Board (NLRB) to formalize the union and schedule an election.

Less than two weeks later, BUG filed two complaints against Creature Comforts with the NLRB, alleging ULP and failure to recognize the union. Brewery leadership denied the allegations.

“The charge contains false and baseless claims and shows that the Union lacks a fundamental understanding of the National Labor Relations Act,” Herron and Creature Comforts chief product officer Adam Beauchamp told Brewbound in a January statement. “We are confident that after reviewing the evidence, the NLRB will conclude that these claims are invalid. We are committed to continuing to communicate directly with our employees and to ensuring they feel supported and empowered to exercise their legal rights and engage in this process.”

In early February, a two-day pre-election hearing with the NLRB was held, with witnesses advocating for the union to be recognized. BUG is still waiting on the results of that hearing, as the NLRB has been “completely swamped” and the increase in labor movements across the country has “put them under water,” Britton said.

“We’re really frustrated with the company and angry with them for what they’ve been doing,” Britton said. “They took us to a hearing back in February because they knew it would delay us having an election, and the fact that they’ve continued to amp up their union busting within that time period of just waiting has been extremely frustrating.

“We keep saying every time something else happens that we’re baffled by, we’re like, ‘This is why we’re doing this, this is why we need this,’” they continued. “Because once we have this established, we can protect against these things happening.”

In April, BUG filed two additional ULP complaints against Creature Comforts, after Spencer Britton and another known union leader were suspended. The two employees were allegedly told not to speak to any other coworkers, with an investigation underway, and were escorted from the premises by police officers.

The continuation of alleged union busting hasn’t deterred employees from pushing for the union, but has rather “solidified how much we need this,” Katie Britton said.

“Everybody’s really fired up and angry about the firing of Spencer, and we’re just ready to have our election and be able to move forward,” Britton said.

Leinenkugel’s Workers on Strike After ‘Meager’ Wage Increase Offer

On July 10, 40 workers at Leinenkugel’s Brewing Company, represented by Teamsters Local 662, went on strike after rejecting “the meager wage increases offered” by the Molson Coors-owned brewery, according to a press release.

“Leinenkugel’s has been brewing beer in Chippewa Falls for over 150 years, which is a point of pride for both the facility’s workers and the entire community,” Local 662 secretary-treasurer Tom Strickland said in the release. “That storied history of success wouldn’t have been possible without the hardworking Teamsters who keep this operation running. Molson Coors needs to respect these workers by agreeing to a fair contract.”

“We are sick of the corporate greed and want a fair and equitable pay increase,” added Leinenkugel’s maintenance technician Dann Jackson, who has worked at the brewery for 16 years. “We are underpaid given our qualifications and the number of different jobs that we do.”

Brewers Association 2023 Harris Poll: Equal Number of Craft Beer Consumers Drinking More Craft in 2023 than Consumers Drinking Less

In craft beer data news, Brewers Association chief economist Bart Watson recently detailed the results of the BA’s annual Harris Poll evaluating craft consumer trends.

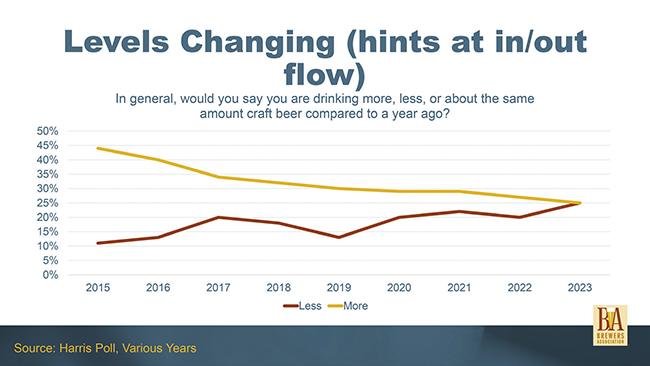

For the first time since at least 2015, an equal number of craft beer drinkers surveyed in the 2023 poll said they were drinking more craft beer in 2023 than the amount who said they were drinking less craft beer – about 25% each.

The survey includes responses from more than 2,000 craft consumers, defined as consumers who drink craft beer several times a year or more.

The amount of respondents who are drinking more craft beer has always outpaced those who are drinking less in previous surveys, dating back to at least 2015. One caveat is that the survey does not include consumers who have left the segment completely or no longer fit in the “craft consumer” definition.

The survey backed up other data, such as Scarborough USA data from 2020-2021, which showed the number of consumers who bought craft in the last 30 days was static versus the previous year, after steadily increasing in years prior, according to Watson.

Watson dove into why consumers are choosing craft more – or less – and other bev-alc attributes that factor into consumer buying decisions. Here are some of the highlights:

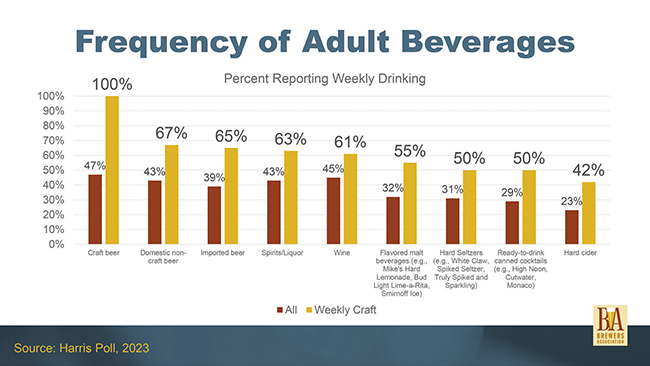

Drinking Other Products No. 1 Reason Consumers Drinking Less Craft

Of the respondents who said they were drinking less craft beer than last year – again, about a quarter of total respondents – the No. 1 reason cited for drinking less was they were drinking more of something else. More than half of respondents who are drinking less cited drinking more of other bev-alc products as the reason for the change, significantly above the next highest reason, “opting for a healthier lifestyle” (less than 30%).

The third largest reason was “cutting back on overall calories consumption,” followed by “cannot afford it anymore” due to higher prices and “less disposable income.”

The significance to craft producers is that breweries can do more to counteract the shift to other products, while inflation and interest in health are less in their control, according to Watson.

“You can’t control inflation,” Watson said. “You can control how your brand is positioned relative to other beverage-alcohol offerings.

“That gives some agency back to brewery owners as you’re thinking about the challenges and the headwinds that craft faces, that the No. 1 challenge is still that people are thinking more of something else” he continued.

Flavor Most Important to Craft Buyers

When choosing which craft beer to purchase, flavor was the No. 1 reason – important to about 95% of respondents – followed by freshness (just over 90%).

Flavor has been in the mid- to high-90s every time the BA has conducted the survey, Watson said.

“If you’re not thinking about flavor as the No. 1 value proposition of craft, then you’re not where most customers are when they think about craft,” Watson said.

The emphasis on flavor could be the reason why craft lagers have struggled to get a foothold, but they could have success by leaning into consumers’ desire for “freshness,” Watson added.

Younger Consumers Care More about ABV, Less About Locality

The amount of craft consumers that care about whether a beer is locally made has been on a decline since 2021, with just over 60% of 2023 survey respondents saying locality was “somewhat” or “very” important.

That decline is expected to continue as younger consumers make up more of the bev-alc consumer base, Watson said.

Millennials were the generation that pushed the most for locality, emphasizing the importance of local business to local economies. Gen Z cares more about supporting a business that supports causes they align with, rather than supporting a business just because it’s in the same area code. It’s a shift that’s happening across most consumer goods, not just beer, Watson said.

Younger legal-drinking-age (LDA) consumers also care more about ABV when making purchasing decisions, Watson said. The importance of high ABV and low ABV were both the highest with respondents aged 35-44, followed by respondents aged 21-34.

While younger LDA consumers being interested in higher ABV beers isn’t a total surprise – possibly some “bang for your buck” buying – it is “interesting” that they’re also interested in low-ABV offerings more than 45-and-older consumers.

“These two youngest groups care the most about this, [which] to me suggests in the future this is going to be more important,” Watson said.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe