All Banged Up: Opportunities Emerge As Energy Giant Faces Uncertain Future

In May 2019, around the height of Bang Energy’s rocketship rise towards becoming a billion dollar brand and the number three player in the energy drink category, Jack Owoc, the bombastic founder and CEO of Bang parent company Vital Pharmaceuticals (VPX) agreed to an email interview with BevNET to discuss the rapid growth and its ongoing legal battles with its chief rival, Monster Energy.

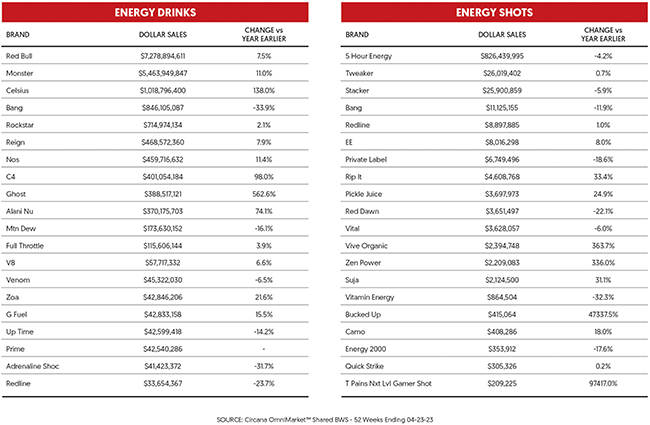

At the time, Owoc wrote that Bang had surpassed then-independent competitor Rockstar Energy in sales, achieved its first $5 million sales day, and opened a 250,000 square foot warehouse with seven canning lines, capable of producing 2,000 cans per minute. The company certainly had every reason to invest in expansion: In the 52-week period ending June 15, 2019, per NielsenIQ, retail dollar sales of Bang grew 724.7%, while its top competitors were facing muted growth or declines. Within the fitness and performance energy niche, the brand’s only serious competition was Monster’s newly launched Reign, which had ignited a fresh set of lawsuits between the companies over alleged trade dress infringement (which Monster ultimately won).

As the sole owner, CEO, chief science officer and chairman of VPX, Owoc had made himself the face of the Bang brand, presenting himself as a larger than life personality through a series of online posts ranging from him playing the drums to offering motivational quotes. Owoc also, as he was wont to do, frequently made grand proclamations about the looming demise of Monster both in the market and in the courtroom, positioning himself as the man responsible for revolutionizing the energy drink industry. In both interviews and in public statements he took regular aim at the company and its CEO, whom he had dubbed “Rotten Rodney” Sacks.

“Bang #1!” Owoc declared in a social media post that summer. “Monster, all Banged up, takes another Bang beat down into negative obscurity and irrelevance!”

But even a year later, the cracks in Owoc’s energy empire were beginning to show as an exclusive distribution deal with PepsiCo, signed in April 2020, turned sour, and a wave of insurgent performance energy brands – bolstered by Bang’s success – presented themselves as worthy competition who were ready to serve as level-headed alternatives to Bang’s over-the-top reputation.

By October 2022 the company had filed for bankruptcy, owing more than $478 million in combined damages to Monster after multiple legal defeats.

According to NielsenIQ, in the two week period ending May 6, 2023, retail dollar sales of Bang fell -58.8%, and the brand has lost its long-held third place spot in the energy category, falling to fifth behind PepsiCo and fellow Florida brand Celsius, which took over Bang’s position as Pepsi’s exclusive energy drink distribution partner last year. Bang’s dollar sales performance was matched by its volume, which fell -61.4% in the two-week period. Extended to 52-weeks, Bang’s dollar sales were down -33.5% for the full year with volume at -35.7%.

As of this writing, Owoc is no longer with the company he founded and VPX is set to go up for auction – originally scheduled for April, it was pushed back to this summer. As the company’s struggles have been met with intrigue, opportunism and occasional schadenfreude, understanding how the billion dollar brand fell apart is just as important as knowing what will happen next.

How Did We Get Here?

VPX was a 25-year long overnight success. Founded in 1993, Owoc had been a high school science teacher prior to starting the business and through its first two decades VPX mounted several launches into the sports nutrition and ready-to-drink beverage segments, including shake line Protein Rush and Redline, an energy drink line that amped up the category’s caffeine content by offering 250 mg per 8 oz. can. Redline had maintained sales throughout the 2000s despite its own trademark battle with Red Bull, which VPX won, and controversies over health risks, but the brand never rose to the level of the category leaders Owoc sought to supplant.

The company introduced Bang in 2012, presenting its new caffeine-packed beverage (a whopping 300 mg per 16 oz.) as a better-for-you alternative to mainstream energy drinks with zero sugar and added ingredients to support fitness and muscle growth. Offering consumers functional benefits with BCAAs and other performance supporting additives, Bang’s star ingredient was “Super Creatine,” a proprietary supplement developed by Owoc that claimed to be a more effective and water-soluble version of creatine – a notoriously difficult ingredient for beverage due to its bulkiness and tendency to separate. VPX built out a national DSD network for its beverage portfolio, including numerous Anheuser-Busch InBev and other beer houses, hired numerous energy category veterans, and by 2018 Bang had hit its hot streak, eventually breaking over $1 billion in annual retail sales.

In March 2020, PepsiCo cleared the way to bring Bang on board its blue truck fleet by purchasing Rockstar Energy for $3.85 billion, thereby removing an exclusive distribution agreement it had with the Las Vegas-based brand. The next month, the conglomerate announced a new exclusive agreement with Bang set to last through October 2023, but by October 2020 the collaboration was already deteriorating. Bang had experienced a reversal of its triple-digit growth streak, facing declines under their new partnership, and Owoc wanted out ASAP.

Transitioning distribution networks will invariably create disruptions, and Bang was making the move from indie DSD to Pepsi’s system amid the early days of the pandemic, when retail foot traffic – in particular convenience stores – had dried up under lockdowns. However, Owoc insisted loudly and repeatedly that Pepsi was failing to properly service the brand, claiming that Bang’s retail coolers were being misappropriated for other Pepsi products, among other issues. That fall, Bang issued a press release calling for an immediate dissolution of the agreement, sending the two companies to court barely six months after the partnership began. After a judge found in favor of Pepsi, Bang remained in the network – with scanner data regularly showing sales in decline or at best achieving muted growth – until the summer of 2022, when VPX was able to negotiate an early end to the contract.

While the breakup fee was not disclosed, bankruptcy documents filed last year listed PepsiCo as VPX’s third largest creditor, owed $115 million.

As Owoc worked to rebuild and reactivate Bang’s old DSD network – a difficult task given the number of new performance energy brands that had taken its place on trucks in the two years since it joined with Pepsi – the restructuring was sandwiched between two devastating legal losses to Monster. The first was a breach of contract and trademark infringement lawsuit involving a small family-owned beverage brand called Orange Bang, which had partnered with Monster to go after their shared legal target. Orange Bang claimed that VPX violated an agreement between the companies that allowed it to use the Bang name on products containing creatine by releasing products without the ingredient. VPX was ordered to pay $175 million, an additional $10 million in attorney fees, and a permanent 5% royalty fee on every can of Bang sold thereafter.

The second blow came in September when a jury found VPX had violated the Lanham Act by falsely marketing its Super Creatine ingredient as efficacious and that Bang drinks barely contained any creatine at all. The trial, which included a two-day witness testimony from Owoc where his combative statements were repeatedly stricken from the record, concluded with an order for VPX to pay Monster $293 million in damages from lost sales.

One month later, Bang filed for Chapter 11 bankruptcy protection, but by then the damage to Bang’s reputation was done and several retailers quietly dropped the brand from their stores following the verdict.

As the original April date for the auction of VPX’s assets neared, it was announced abruptly in March that Owoc was no longer with the company he had founded 30 years prior. While he remains the company’s sole shareholder, Owoc called his exit an “ousting,” telling beverage industry consultant and YouTuber Joshua Schall in May that his firing constituted a hostile takeover.

Owoc was also ordered by a judge to delete disparaging social media posts railing against Monster, VPX’s bankruptcy consulting firm and the Florida bankruptcy courts, among others.

Although VPX said in November it would redesign its cans to remove the offending “Super Creatine” name from its products, a judge found in April that the company had continued to produce more cans with the same label, leading to an order on April 12 for all infringing cans to be pulled from stores within 60 days.

Even before the order to pull cans, Bang had been suffering severe out-of-stocks and delistings. Goldman Sachs Equity Research, in its quarterly Beverage Bytes survey, noted that in Q1 36% percent of the retailers it polled had experienced “significant” out-of-stocks for Bang – the highest in the energy drink category – and another 29% reported “some” out-of-stocks. That uneven reliability has led to concerns for at least some of the retailers who carry the brand; one told Goldman that Bang had gone from three shelves to one at its stores. About 29% of survey respondents said they expect to allocate no shelf or cooler space to the brand at all, while another 50% anticipate reducing their facings. Just 7% said they’re likely to give Bang more space in the coming months, compared to rising competitors like C4 (73%) and Celsius (60%) whom a vast majority of retailers plan to expand.

As of April, convenience retailers projected a -19% annual sales slide for the brand this year, faring even worse than their October 2022 expectations of a -15% decline and directly inverse to their positive 19% growth expectations for the overall category.

Where Do We Go From Here?

As of this writing, an auction hearing was scheduled for May 25 and a sale hearing planned for June 7. Ahead of the hearings, Monster has been suggested as a strong candidate to buy up the remains of Bang. In April, investment banking firm Stifel sent a research note to clients making a case for Monster as the best positioned buyer of its old nemesis – although the firm admitted it had no inside knowledge of the discussions and the analysis was purely speculative.

“We view Monster as best-positioned to acquire Bang given it is the largest creditor in bankruptcy and co-rights holder to a 5% perpetual royalty/license for use of the Bang beverage trademark,” Stifel wrote. “Relatedly, Monster is challenging Bang’s ability to transfer the Bang trademark license to an acquirer, which, if successful, would give Monster near total control over Bang’s future.”

Schall noted in a May video that VPX also owns a West Coast manufacturing facility in Arizona, which could be of value to Monster or any other prospective buyer, assuming it isn’t sold off prior to the auction.

“Bang Energy had Q1 net revenues of $72.8 million,” Schall said in the video. “That should give you a strong picture of how far and how fast Bang Energy has fallen from a brand that reported $1.4 billion in retail sales in 2021.”

Indeed, there’s the question of whether any other company would want or need Bang. While there’s arguments to be made for a number of prospective buyers, including private equity, Bang’s considerable debt, Monster’s royalty claims, and the need to turn around steep declines would all complicate an acquisition. As well, most beverage strategics have already made bets in the energy category – and at least a couple have previously passed Bang over for smaller brands.

In August 2022, prior to the false advertising case verdict, talks between VPX and Keurig Dr Pepper (KDP) about a possible acquisition quickly fell apart after a potential deal was reported by business media. In December, KDP entered a strategic partnership with C4 parent company Nutrabolt, and the conglomerate also has a stake in smaller performance energy player A-Shoc.

Besides the sour relationship with Pepsi, the conglomerate already owns Rockstar and MTN Dew and last year it made a $550 million investment into Celsius as it signed a new exclusive distribution agreement with the fast-growing fitness energy brand – not to mention its existing partnership with Starbucks. As well, Coke is aligned with Monster, AB InBev is matched with Ghost, and Molson Coors has ZOA. Even Red Bull, which has always remained staunchly independent, entered a strategic partnership with KDP last year to service its Mexican business.

If Bang’s rise and fall reshuffled the deck for the energy drink category, it’s already created an environment where the major buyers are all spoken for – a shift that represents a serious long term challenge for new startup brands looking to break in today.

Nevertheless, Bang’s impact on the industry has led to a wave of better-for-you energy innovation and, perhaps unexpectedly given its own proclivity towards sex-driven advertising, a marketing tone shift that has broken away from the gendered, macho-minded ad campaigns that defined the space for years. While Bang may be rapidly losing market share, it can’t be denied that its focus on sports nutrition and functionality opened the door for this new generation of brands to build on.

In an email to BevNET, Howard Telford, head of soft drinks at Euromonitor International, said the rise of brands like Celsius, Alani Nu and Ghost suggests the energy drink category is “(finally) growing up.” The need-state for energy, he said, has segmented, with performance and pre-workout, “gamer fuel,” wellness, hydration and refreshment all becoming more important to consumers and each requiring unique ingredients and sources of caffeine.

“Consequently the marketing approach and positioning of these brands has evolved and become more inclusive – this is no longer a one size fits all category geared to young male consumers,” Telford wrote.

Telford compared the demographic shift of the category to the way hard seltzer and other RTD alcoholic beverages have attracted consumers through a focus on lower calorie counts and new flavors. In energy, flavor innovations such as tropical fruit and candy – another trend where Bang was out in front – have been a big growth driver for insurgent brands. The trend has even led established players to seek out ways to grow their own bases: Monster this year launched Reign Storm, a subline intended to speak more to female consumers than the core Monster brand.

While brands experiencing sudden success and sudden collapse is not unusual, Bang and its founder’s grandiose personality have made this story anything but ordinary. In the event VPX is acquired and its new owner opts to keep the brand going, then it will be contending with a Balkanized shelf set and fighting to regain the trust of loyal consumers who believed in the Super Creatine difference. More so, the Bang identity was, for better or worse, inextricably tied to Jack Owoc, and without him it’s hard to imagine the voice of the brand remaining the same.

But whether Bang can be saved or if it eventually fades away, it’s become perfectly clear that no matter what happens, its impact on the industry has been made, and will continue to be felt for years to come.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe