Modern Family: Led by Olipop, Poppi, and Culture Pop, A New Generation of Soda Sits at the Table

This past October, Walmart announced it was officially recognizing a new beverage category in its stores with a refreshed shelf set it was calling “Modern Soda.”

Nick Scutari-Dunn, associate merchant for Modern Soda and RTD coffee at the mass channel chain stores, showcased the assortment on LinkedIn that month with a shelf made up entirely of trendsetting functional CSDs Poppi, Olipop and Culture Pop, as well as stevia-sweetened brand Zevia. In the attached photo, each brand received at least one shelf – if not several – to itself with large flavor assortments and numerous multipacks. Online, consumers can also find a “Modern Soda” page on Walmart’s ecommerce site with all four brands represented alongside smaller players in the space like Health-Ade’s SunSip, Daytrip, No Cap! and even canned tepache brand De La Calle, which just recently rebranded itself as a “Modern Mexican Soda” this summer.

“This new category will bring your favorite healthy soda brands to one location both in-store and online,” Scutari-Dunn wrote in his announcement. “We are thrilled to see these brands continue to exponentially grow and provide healthy alternatives for our customers!”

Tom First, co-founder and CEO of Culture Pop, told BevNET a week after the announcement that Walmart’s Modern Soda set marks chainwide expansion for his brand, and suggested it shows mainstream retailers are increasingly recognizing the opportunity to drive CSD growth, particularly with younger Gen Z shoppers.

“They’ve seen the success of the category and they jumped on it in a big way,” First said.

Walmart’s new category designation, complete with an umbrella name for a soft drink trend that has long defied simple characterization as merely “better-for-you” or “functional”, is just one more moment of validation for these fast-rising brands. And if there were still any doubts left that these products had officially achieved mainstream status, the past 12 months did away with them; from Poppi’s blockbuster Super Bowl ad in February (which has continued to run in prime time TV slots, including during the World Series) to Olipop’s claim to Bloomberg in May that it could hit $500 million in sales by the end of the year, the Modern Soda trend appears to be here to stay.

Coming up on five years from when apple cider vinegar startup Mother Beverage rebranded as prebiotic soda Poppi, the category has evolved, and many of those selling the drinks – from distributors to retailers to the brands themselves – say it’s just getting started.

Brands Pop Off

Jerry Reda, president and COO of New York DSD distributor Big Geyser, which carries both Poppi and Culture Pop, said that Poppi is among the fastest growing brands in the distributor’s portfolio, with some stores selling 500-600 cases “every few days.” He compared the simultaneous rise of Poppi and Olipop in the market to the ascendance of Red Bull and Monster establishing the U.S. energy drink category in the early 2000s.

Poppi, he said, has generated intense demand from retailers as well as independent on-premise accounts, such as pizzerias, which he said can be hesitant to take a chance on newer brands. But the trend has broken out, stores are regularly adding more facings, and now even Big Geyser is struggling to keep up with requests.

“A lot of resets are [planned] 90 days, 180 days ahead,” Reda said. “We’re getting double, triple the amount of space – but by the time we set it, we don’t have enough space!”

Anecdotally, Reda said he’s seen the velocities these better-for-you sodas can generate both firsthand in New York, and elsewhere around the country from restaurants in Vermont down to grocery chains in the South.

“I went down to Publix in Florida, and every Publix that I walked into the shelf was empty,” Reda said. “Then you see they gave them more space, and you go back and they doubled or tripled the space – and the shelf is still empty! It was full the night before, it’s just the velocity of sales is unlike anything that I’ve seen.”

In the 52 weeks ending September 21, NielsenIQ reported U.S. retail dollar sales of Poppi were up 167.1% to over $553.5 million in tracked sales, while Olipop grew 129.2% to over $528.2 million in the same period. While that data may not reflect all channels or all product lines from each brand, the two companies stand firmly among the largest independent soda makers in the U.S.

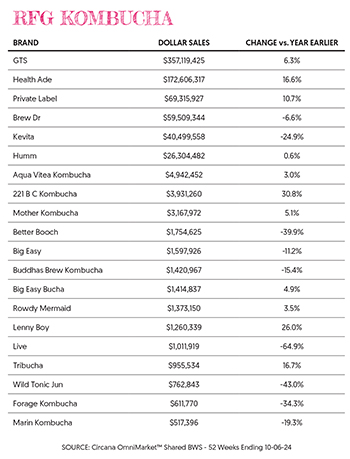

At Pacific Northwest natural channel retailer Town & Country, director of center store & own brands Dwight Richmond said he believes this “Modern Soda” category is entering its “maturity phase” and while they are taking market share from the traditional CSD giants, they also are likely providing tougher competition for kombucha and other gut health oriented products that previously sought to position themselves as healthier soda alternatives.

While Richmond acknowledged that he believes taste and low sugar positioning are likely driving more sales for these sodas than their gut health components, the trend opens the door for more functional drinks to establish themselves in the mainstream.

“I see the growth of functional beverages really taking the mainstream standing within the American consumers’ beverage choices,” Richmond said. “I think we’ll see this further expansion of better-for-you, functional beverages, some will be carbonated, some won’t, and I think that’ll be where this will pivot. That’s kind of where I’ve directed our sets to go long term.”

But what about the wave of other independents looking for a piece of the pie? From non-functional brands like United Sodas to other functional soda lines from Humm Kombucha, Rowdy Mermaid, Levo, Cove, Jones Soda and MyMuse – to name a small handful – there’s no shortage of products to fill out a broad set. While retailers are certainly clearing space for the category, both Reda and Richmond said it’s clear that Poppi and Olipop have established their leadership status, while Culture Pop is a strong, and differentiated, number three among the functional brands. But their best assets may not even be functionality, but instead a powerful mix of good leadership, vibrant branding and great taste.

“I don’t think anybody cares whether it’s prebiotic or probiotic anymore, that’s completely out the window,” Reda said. “This is a great tasting, low calorie [beverage]. It’s ‘Soda 2.0’; it’s like nobody’s ever been able to penetrate the force field around Coke, Pepsi and KDP, and they’ve been able to.”

What Comes Next?

Even if functional CSDs are at the beginning of their maturity phase, and there are already clear market leaders, it’s still early innings for the category and there’s big earmarks yet to hit. Though Trader Joe’s – a retailer known for its store brand-heavy product assortment – has launched its own sparkling gut health drinks, there’s yet to be much in the way of retailers introducing their own private label prebiotic sodas. And despite many rumors of potential acquisition talks or in-house R&D plans, as of this writing the top soda giants of Coke, Pepsi and KDP have yet to make moves in the space.

But whether or not the strategics do move to have a stake in Modern Soda, the independents are braced for it. At Culture Pop, First said he anticipates Coke and/or Pepsi are liable to jump into the set soon, saying it’s “typical for any fast growth category” and cited their long history of using existing portfolio brands to create challenger products as one possible way they could go about it: He pointed to PepsiCo’s 2009 Vitaminwater answer, Aquafina Plus Vitamins, as one example, or more recently Coke’s AHA and PepsiCo’s Bubly as plays for a claim in the sparkling water category.

“It can be a challenge for upstart brands, there’s no question,” First said. “You can’t discount the power of these big companies. But it’s a part of the process of growing a brand and competing in a marketplace, so I’m very familiar with it.”

For Culture Pop, First said his overarching goal is simple: just keep growing the brand. The company announced in February it had raised $21 million in an investment round; looking into the new year the brand plans to launch new products, grow retail distribution and mount new marketing campaigns to raise awareness.

Others are certainly looking to do the same – Olipop showcased its new shelf-stable, 12 oz. slim cans at this year’s National Association of Convenience Stores (NACS) trade show as part of a heavier push into c-stores, while Poppi is forging sports partnerships, becoming the Official Soda of the Los Angeles Lakers.

“I had a thought six years ago that the carbonated soft drink category was not appealing to younger people for a bunch of different reasons,” First said. “If we could create something with really clean ingredients that had delicious flavor, and had packaging that invited people back into carbonated soft drinks, that we could make a really big change to the category. And it’s amazing. It’s happened and it’s happened quickly.”

RFG Kombucha

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe