Iced Tea Reboot: Emerging Brands Tap into Next-Gen Consumer Tastes

While ready-to-drink iced tea has been an American staple for decades, the category is, as Just Iced Tea CEO Seth Goldman puts it, “ripe for a renaissance.”

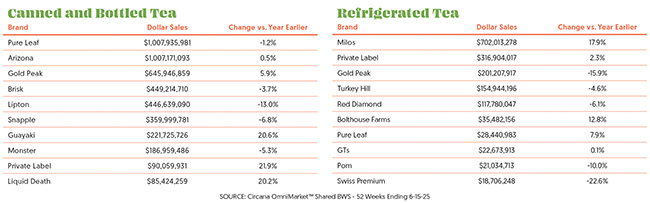

Viewed from the top down, RTD Tea is a cartel scene, with three brands, Pure Leaf, AriZona, and Gold Peak, holding more than half the category share. But they aren’t growing: according to Chicago-based market research firm Circana, shelf-stable canned and bottled tea sales dipped 0.4% year–over-year in the 52-week period ending June 15. Category leader Pure Leaf (produced by The Coca-Cola Company) underperformed, with sales dropping 1.2% to $1 billion.

But below the old warhorses, newcomers like Liquid Death (+20.2%), Just Ice Tea (+66.7%) and The Ryl Company (+179.5%) are seeing accelerated growth and gaining significant traction with a different set of consumers, especially from the Millennial and Gen Z cohorts.

So what do those insurgent brands know that’s allowing them to accelerate? Who are those younger consumers and what do they want? And are there enough of them to fuel this RTD Tea Renaissance? In other words, who is the young tea drinker?

Defining the Next-Gen Consumer

Today’s consumer expects more than taste, reaching for options that boost wellness, deliver functional benefits and align with a mindful approach to sugar. For Gen Z, drinks have become a form of self-expression, with 72% of the generation trying a new beverage monthly, according to Keurig Dr Pepper’s inaugural State of Beverages Report, released earlier this summer.

That health halo is undoubtedly boosting the tea category, but it’s somewhat quiet. While tea offers inherent health benefits, such as antioxidants and polyphenols, depending on the variety, only a few brands try to lean in on their healthy aspects. On the consumer side, in the market, 23% of consumers opt for iced tea with low/no/reduced sugar claims when making a purchase, per Innova Market Insights. What’s more, 26% of category launches in 2024 feature sugar-related claims, including low sugar, no added sugar and sugar-free.

Iced tea consumption – particularly unsweetened and diet/low sugar varieties – is becoming more gender-balanced and seeing a renewed interest from Gen Z alongside steady engagement from Gen X, according to The Brightfield Group, a social listening-enabled research firm. Social media discussions around the category have surged 27% between 2023 and 2025. Comparatively, discussions surrounding red-hot prebiotic soda rose 32.9%.

While the iced tea category includes functional varieties, natural and organic options, and specialty and premium choices, Scott Dicker, senior director of market insights at SPINS, believes there’s an opportunity for brands to hit on all of those attributes in one product.

“There’s some runway in the RTD space as people look for lightly flavored, lightly sweetened options. There’s also inherent functionality and some caffeine, hitting on a lot of [opportunity] for consumer demand,” Dicker said.

Meeting Demand

Unless you’ve been frozen inside your ice dispenser, you’ve likely witnessed the wave of better-for-you CSDs, often characterized as “Modern Soda”, that have taken over grocery store shelves.

Now, a handful of RTD iced tea startups are hoping to transform their category into the next modern soda.

Part of what has made the modern soda set so successful is front-of-pack callouts highlighting purported health benefits, like lower sugar or added pre- or probiotics. Both Halfday Iced Tea and The Ryl Company are employing similar tactics, with the former using the tagline, “New Era Iced Tea” and the latter selling “Iced Tea With Benefits.”

Halfday’s primary audience comprises Millennials and Gen Z, and skews slightly female, according to co-founder Mike Lombardo. However, he believes that iced tea is a broad enough category that the company’s beverages “work well for anyone who wants a better-for-you iced tea they can feel good about drinking.”

The New Jersey-based company recently unveiled a “mature and modern” new look, highlighting Halfday’s evolution from next-generation startup into a growing insurgent brand. The new cans feature a prebiotic callout (6 grams of prebiotic fiber per 12 oz. can). In the first six weeks of the new packaging rollout, Halfday saw a 40% lift in sales in Whole Foods, one of its “critical” retailers.

“When you have a modern soda going against an [iced] tea, that iced tea has to call out some additional benefits that it has. Some of those things have been inherently known, but you can’t assume a consumer is going to know all of the benefits you bring,” said Sally Lyons-Wyatt, global EVP and chief advisor of consumer goods & foodservice insights at Circana.

Generally speaking, many emerging brands in the RTD tea set are looking to carve out new terrain as opposed to stealing consumers from legacy players.

“There’s a world where we definitely think about converting consumers from incumbent brands. But for now, there are so many consumers out there who no longer drink those because it’s not good for them. So there’s a lot that can be done with that,” Lombardo said.

Blodin Ukella, founder of The Ryl Company – which produces zero sugar iced under the Ryl Tea brand – shared a similar sentiment, stating, “Our goal isn’t to displace or replace anything in the legacy set. We want to bring a new incremental growth driver to the space and create what we call the ‘modern tea’ category.”

Founded in 2022, Ryl – which stands for “rethink your liquids” – is on an accelerated growth trajectory, projected to be sold in 40,000 accounts by year’s end. The company’s expanded distribution footprint will be supported by a $15 million funding round closed in April.

According to Ukella, “When you look at today, you have to be focused on tomorrow and tomorrow is going to be driven by the Gen Z consumer.” Although that principle helps drive the brand’s innovation process, Ryl is focused on being a brand that’s approachable by all age brackets across the U.S. with a beverage that’s functional, zero sugar and has less than five calories per can.

The Ryl Company has leveraged its partnership with country music star Morgan Wallen, who is also an investor in the company, to raise consumer awareness and increase household penetration. As Ukella puts it, “there are very few people that have a cult audience like [Wallen] does.”

Meanwhile, Just Ice Tea, which was born out of The Coca-Cola Company’s cancellation of Goldman’s first organic, less sweet, Fair Trade-certified brand, Honest Tea, captures a “disproportionate share” of younger consumers compared to the category. Its shoppers drive higher spend and frequency to the category, per internal data: whereas the average RTD tea buyer purchases a drink 16.3 times a year, the Just Ice Tea buyer purchases 27.6 times, according to Goldman.

The company produces a lineup of “Just Sweet Enough” teas sweetened with cane sugar (11-16 grams per serving) and packaged in glass bottles and cans. After building out proof of concept in the natural channel – where it has become the No. 1 RTD tea brand in the Mid-Atlantic, Northeast and North Central regions, per SPINS data – Just Ice Tea is seeking to replicate that success in the mainstream channel, rolling out to Target and CVS.

Just Ice Tea’s products are currently available in over 10,000 doors nationwide, and Goldman expects the company to reach over $30 million in sales this year – its third in business. Comparatively, Honest Tea didn’t hit $23 million in sales until its 10th year of business.

“Just Ice Tea wasn’t really a startup; it was more of a jump start. We had an engine that was already ready to go; we just needed to put it in action,” said Goldman. “It’s time for the category to grow again.”

Sweet Victory

Though a significant percentage of new RTD tea brands focus on lower sugar, that doesn’t mean sweetened products aren’t also succeeding. Some consumers remain sweet on sugar.

Case in point: The Milo’s Tea Company. The family-owned brand, with recipes dating back to 1946, continues to dominate the refrigerated RTD space. In the 52-week period ending June 15, the company outpaced total refrigerated RTD tea sales (+4.4%), climbing 17.9% to $702 million and representing a 40-point share of the category, per Circana.

“We continue to see increased demand for our traditional sweet teas. Our growth reflects that. Consumers are looking for products that deliver real satisfaction and flavor while prioritizing quality, real ingredients and transparency,” said Tricia Wallwork, chair and CEO of Milo’s, noting that the company has never added colors or preservatives to its products.

Even so, as listening to consumers is “part of [Milo’s] DNA,” the company answered the call from some of its fans seeking better-for-you products by offering unsweet tea, zero sugar tea and, later this year, zero sugar lemonade. The consumer push for greater transparency, more flavor profiles and more functionality provides the company ample opportunity to grow.

“Our recent innovations represent another chapter of what refrigerated tea and lemonade can be. And we have more in the pipeline, reimagining the categories where we compete without losing sight of our heritage,” said Wallwork.

What Comes Next?

Though emerging and family-owned companies are breathing new life into the RTD tea set, this “renaissance” is still in its infancy. The smaller businesses are the ones gaining share, showing consumers are, indeed, seeking new innovations.

“Consumers like new and innovative. It could be a new campaign rather than a new product, or it could be a new flavor or variety,” said Lyons-Wyatt. “Additionally, smaller companies typically can do some grassroots, personalized marketing, whether it be niche or local. They’re getting trial by getting engaged with communities.”

“Iced tea is certainly ripe for disruption. Whether or not it gets there is dependent on players really making those moves,” said Dicker, noting how modern soda was a tale of a couple of brands reshaping the landscape.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe