Considered the “most developed” category within the plant-based category, milk alternatives now account for 35% of the plant-based food and beverage market at $2.8 billion, according to a report by the Good Food Institute and the Plant Based Foods Association.

Based on retail sales data from SPINS, the market insights report found that plant-based milks outpaced dollar sales in the $8 billion plant-based food and beverage market, which increased 7% year-over-year from 2021 to 2022 with unit sales down by 3% “mirroring total food and beverage and animal-based food” trends.

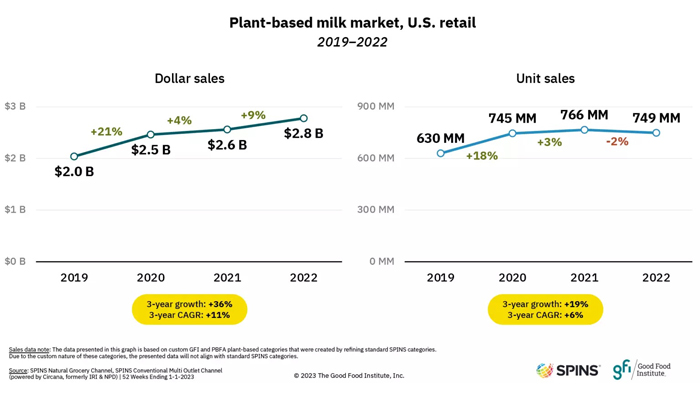

Comparatively, plant-based milk dollar sales increased 9% year-over-year in 2022, accelerating from 4% dollar growth between 2020 and 2011. The three-year dollar growth rate was 36%, although unit sales were down -2% to 749 million (compared to 766 million in 2021) – in line with the broader CPG trend of price increases offsetting volume declines.

Although the report dubbed plant-based milks the “innovation leader in the milk category,” dairy alternatives’ market share of the total U.S. retail milk category remained flat at 15% in 2022. Plant-based dairy’s share is much larger in the natural channel, where it represents 42% of all milk dollar sales. As well, non-dairy products have continued to outpace the growth of traditional dairy milks, growing unit sales by 19% from 2019 to 2022 versus a -4% decline for animal-based milks in the same period.

Much of this growth has been thanks to more ingredient diversity within plant-based grocery sets, as well as product development advancements that have led to more beverages that “replicate both the sensory experience and nutritional attributes of cow’s milk.”

In grocery, merchandising plant-based milks within the same area as dairy milks has been “critical” towards driving sales, the report added. Refrigerated milk alternatives made up 89% of all sales, with shelf-stable – typically placed away from the cold set on dry shelves – covering the remaining 11%.

Within the set, almond milks remain the top selling product, followed in order by oat, soy and coconut, multi-ingredient blends and, in sixth place, rice.

Household penetration for the category was 41%, down 1% from 2021, with a 76% repeat purchase rate, and the rise of plant-based milks has been meaningful for the larger plant-based foods industry.

“Plant-based milk is a major entry point for households trying products across plant-based categories,” the report stated.

Outside of plant-based milks, other plant-based beverages have also continued to increase sales and market share. Non-dairy creamers grew dollar sales 24% from 2021 to 2022 to $645 million, with a three-year growth rate of 119%. Unit sales were up 12% year-over-year to 137 million in 2022, with a three-year growth rate of 77%. Plant-based creamers now hold a 12% dollar share of the total U.S. retail creamer category and the set is outpacing animal-based creamers, which were up just 5% year-over-year.

Other plant-based ready-to-drink beverages, including coffee and teas made with plant-based milks, were up 17% to $239 million in 2022, with unit sales increasing 11% to 57 million.