Class Acts

Without a playbook for taking on this unprecedented challenge, companies and entrepreneurs have been tasked with forging their own paths forward. Whether through direct in-classroom support of teachers and students or through packaging innovations and the opening of e-commerce channels, brands in the kids’ beverage category are taking the initiative to find the right solutions for their specific issues.

With kids beverages spanning a range of categories, gauging current market conditions requires a closer look at the data. In terms of total U.S. multi-outlet (plus c-store) sales, aseptic juice drinks have fared well over the past 12 months: according to data from IRI, the category as a whole is up 3.4% year-over-year through August 18. The segment’s leading brands — Capri Sun, which has a 40% dollar share of the category, and Kool Aid, which has around 29% — each posted sales gains of 6.6% and 1.8%, respectively, during the period. Meanwhile, at approximately $87.4 million in sales year-over-year, Honest Kids now represents a far larger business than its parent company’s original flagship product, Honest Tea.

Yet aseptic juices are a different story: the category as a whole contracted 7.5% according to IRI, falling to around $427 million. Brands like Juicy Juice (down 4.6%) and Minute Maid (down 22.5%) faltered, as did Capri Sun’s entries in the segment.

Further afield, there are green shoots to be found. Atlanta-based Good2Grow, launched in 2014, continued to expand across several formats: the brand has become the second largest in shelf stable bottled fruit juice blends, rising 5.3% to over $49 million in sales, while also increasing 3.2% to just over $37 million in sales in shelf stable bottled fruit drinks. Meanwhile, as reported in BevNET last year, the spate of new water-centric kids beverages in recent years from brands like Hint, Rethink and Hellowater have emerged in response to concerns over the use of added sugars and artificial ingredients. Though still a small piece within the larger category, there are signs of movement: while lagging far behind aseptic juices, Apple & Eve’s shelf stable bottled fruit juice blends had roughly the same year-over-year sales as its aseptic juice drinks.

Back to School

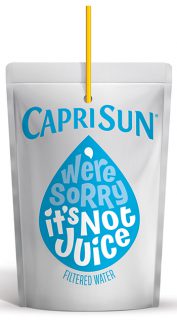

Capri Sun’s signature 6 oz. juice pouches have been a school cafeteria staple for decades, during which time the brand has updated its offerings to include organic products, sports drinks and other line extensions. Yet in a period of increased stress for parents, students and teachers, its role within the school ecosystem, at least temporarily, had little to do with juice itself. Instead, when officials announced that water fountains would remain closed even as schools began reopening this fall, the brand recognized an opportunity to provide meaningful support for families in a different way. The company shifted production from juice to filtered water pouches (“We’re sorry it’s not juice,” the package label reads), 5 million of which were donated to schools in the Chicagoland area.

“We acted quickly on this approach and did not have any other campaigns planned for this year’s back-to-school season,” said Naor Danieli, associate director of kids hydration at Kraft Heinz, which manufactures Capri Sun. “We anticipated a lot of changes and when we heard water fountains were going to be off limits at schools, we saw a unique opportunity to help.”

The development underscores the need for CPG brands to be fast and flexible in the current environment: having never produced a filtered water pouch previously, the brand had to quickly research and execute the product across its R&D, manufacturing and marketing teams ahead of school reopening this fall. Though Danieli noted the product will not be a part of Capri Sun’s permanent lineup, she added that the initial run received an “overwhelming response” and that the company is running a giveaway offering five winners the chance to receive up to 1,000 water pouches for their communities.

Remote learning means parents not only have to keep their kids hydrated, they also have to keep them busy — representing another opportunity for brands to amplify their respective positions as a resource this school year. To that effect, Juicy Juice has partnered with Lanesha Tabb, a kindergarten teacher and the founder of parenting site Education With An Apron, to offer tips, guidance and an online library of educational crafts and kid-friendly recipes for parents via the brand’s website.

The pandemic also brings some practical concerns for a growing brand of any type: how to get more product to customers. Although pantry stocking habits have dissipated since the pandemic started this spring, multi-serve formats have begun to take a more prominent role.

“When stay-at-home orders were first set in place, we noticed a significant boost in sales for our multi-serve bottles,” said Ilene Bergenfeld, Chief Marketing Officer at Harvest Hill Beverage Company, makers of Juicy Juice.

Learning Online

In contrast to legacy brands like Capri Sun and Juicy Juice, category newcomer Silly Juice is taking a different approach to building value with consumers during the pandemic. Launched in August ahead of the fall school semester, the California-based company — in which David Langer, VP of Langer Juice, is a co-founder — is hoping its playful branding and colorful aesthetic, rather than any explicit overtures to challenges in schools, will create positive associations for kids at time of increased stress, isolation and anxiety.

“We just really wanted to put a smile on people’s faces,” explained co-founder Keith Davis.

Simple enough, yet the brand’s execution suggests possibilities for the kids beverage category, specifically online. Ahead of launching at retail this fall, Silly Juice has been available exclusively through e-commerce in 12-packs of 10 oz. PET bottles for $15.95. Available in six fruit flavors, each flavor contains 20% real fruit juice, no high fructose corn syrup, and no added colors, along with 150 calories and 37 grams of sugar.

The brand’s early success — it sold out almost 10,000 cases within four hours of launch, according to Davis — has inspired confidence that those results will translate over when the brand launches at retail, which could happen as early as October.

“We understand the significance of a consumer being willing to make a purchase online of a case of juice, which is relatively heavy, and to pay a little bit more to receive it,” he said. “We knew that if we could demonstrate a consumer response to buying just by the influence and the branding itself, we knew we would have a story to tell to retailers. It was a true test with true results.”

Along with its own social media presence, which includes over 249,000 Instagram followers, the brand’s online visibility is heightened thanks to Austin and Catherine McBroom, who serve as co-founders alongside David Langer of Langer Juice. The husband and wife team have amassed over 19 million subscribers for their YouTube account The ACE Family, which chronicles their lives and experiences raising two daughters and a son.

“Since starting our social channel four years ago, my husband Austin and I have always dreamed of creating a feel-good product for our fans that is uniquely ACE,” said Catherine McBroom in a press release.

Though a return to pre-pandemic normalcy still feels far away, Davis believes that the elements in place with Silly Juice — particularly the months spent brainstorming ideas and gathering feedback on the product from kids — put the brand in a strong position to continue growing on the other side of COVID-19. Unlike brands in many other categories, the influence of health trends that have emerged in response to the pandemic, such as immunity ingredients, has been less pronounced here: none of the brands who spoke to BevNET reported adjusting product design due to the coronavirus. For Silly Juice, forthcoming releases like multi-serve bottles and naturally sweetened (no added sugar) versions instead echo trends seen across CPG.

“We really stuck to what we felt the response that we were getting from kids that we have and kids that we know to really help us determine what the others would appreciate and want,” said Davis. “We know we have a sugar level that some people may be concerned about, but we see it as an opportunity for people to really expand their juice buying.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe