West World Grows Down South: Can a $300 Million Mega-Plant Make Westrock Coffee the New Kings of RTD?

Over the phone, the faint noise of activity can be heard in the background. On the other end is Will Ford, Westrock Coffee Company’s Group President of Operations, speaking about his company’s crown jewel: a new 524,000 square foot, $300 million facility, itself located on a 45-acre campus in Conway, Ark., that promises to be the largest coffee roasting-to-RTD operation of its kind when it goes online this spring. Realizing that vision means bringing in a crop of top talent – and these arrivals have generated the feeling that something special is brewing in the city of roughly 65,000 residents located about 30 minutes north of Little Rock.

“I’m here today and every time I walk in, there’s new people and I’m like, ‘Tell me your story,’” Ford said. “And they’ll say ‘well, this is my fourth plant startup and I was at this plant before and I was in charge of this and then I learned that part here and I learned not to do this with these guys.’ And I’m like, ‘I’m so thankful you’re here!’”

Anecdotal for sure – but storytelling is just part of what’s helped to create the sense of a company on the cusp of an exciting new chapter. After a decade of growth, Westrock is preparing to solidify its position as a dominant force in North American coffee production, capable of serving all channels of trade. The timing appears to be fortuitous as well; Americans are increasingly favoring cold coffee over hot, RTDs are still growing and a new crop of celebrity and influencer-led brands have joined the fray. Westrock is poised to feed that demand with its high-volume, cross-format capabilities.

It’s a high-stakes experiment for the company, which went public via a SPAC merger in 2022. After suffering from a down year in 2023, it’s one that needs to work.

Roots & Rise

Like Lavazza, Massimo Zanetti and other global coffee giants, Westrock’s path to success began as a modest family business — but it has developed on a much accelerated timetable.

When launched by Joe T. Ford, a former CEO of telecom giant Alltel, and his son, Scott Ford, in 2009, Westrock was set up as a premium exporter specializing in coffees from Rwanda, which remained its calling card for its first years. Over time that competency developed and expanded; Westrock currently has offices in 10 countries and sources coffee, tea and extracts from 35 origins across all channels of trade. From its Arkansas roasting facility, it makes branded and private label coffee for global retailers (Walmart, Sam’s Club) and hotel chains.

But the company’s most recent evolution began with its $405 million acquisition of S&D Coffee, a U.S. leader in custom coffee roasting serving the convenience and foodservice channels, in 2020. One year later, with liquid beverages continuing to vastly outpace traditional coffee in share of company sales, Westrock announced its intent to build the nation’s largest RTD coffee production facility in Conway, along with plans to expand its North Carolina extracts plant and build another roaster in Malaysia.

To execute that vision, new financial mechanisms were needed. In 2022, Westrock went public in a $1.2 billion SPAC deal, then picked up another $75 million in equity funding from HF Capital and Texas oil baron Herbert Hunt the following summer.

That hasn’t done much, however, to stem the immediate pain felt while awaiting the Conway plant’s opening. After reporting a $10.7 million loss in Q3 2023, CEO Scott Ford acknowledged that Westrock has prioritized the success of the facility over short-term earnings, while promising that the plant will “radically alter the overall profitability and trajectory of the company.” Against the backdrop of rapid collapse in demand for traditional ground and roast coffee, Westrock downgraded its FY 2023 outlook for Adjusted EBITDA in November to below its previously issued guidance range of flat to 10% over 2022.

Within the mix, though, Beverage Solutions has been a bright spot, generating over $176 million for Westrock in Q3. The company has been eager to meet demand for cold coffee formats in foodservice and retail, unveiling a suite of frozen and RTD products aimed at the segment at last year’s NACS show in Atlanta.

Under the Hood

As you might expect, Westrock’s new facility aims to be the ultimate coffee factory.

It all starts in the central “kitchen,” the “heartbeat and center” of the plant, which spokes out to the manufacturing lines. Liquids – anything from standard RTD cold brew to extra-strength concentrates for use as ingredients in other finished goods – can be packaged in glass bottles, cans, bag-in-box, pumps, totes, drums and single-serving pods, and other formats.

The facility has also been designed with the future in mind. The space has been pre-plumbed to house an additional four to six packaging lines (depending on size), and while initial demand has been driven by its traditional coffee partners, it can also produce teas and juice-based products. Having an FDA-approved product development lab on the premises should also help to create, test and produce new beverage offerings.

Ramping up scale also requires a significant investment in warehousing and distribution, which comes in the form of a just-completed 530,000 sq ft facility just two miles from the manufacturing center in Conway. All finished products shipped from its 72 dock doors will be ambient, with cold chain storage and distribution housed at the production center.

Its very existence underscores the fast-moving and changing nature of Westrock’s expansion strategy: the production center was originally slated to devote about 25% capacity towards liquid packaged products, another 25% to roasted and ground coffee, and the rest for distribution. But within 48 hours of the plant’s announcement in 2021, it was already oversubscribed with demand for liquid products. Switching to a 100% wet capacity required the construction of the separate warehousing hub, at the cost of $70 million.

“It wasn’t until we made that announcement that we realized this market is much, much bigger,” said Ford.

A bigger market doesn’t necessarily mean only bigger clients, though. Through its acquisition of Richmond, Calif.-based roaster Kohana Coffee in 2022, Westrock picked up a roasting facility that’s been designated as an RTD incubation center that can offer low minimum orders, all the better to develop and graduate young brands to one of Westrock’s other locations. Last year’s purchase of Bixby Coffee, the Los Angeles company that had been gaining traction as a partner for celebrity and influencer-driven startups, most notably Emma Chamberlain’s eponymous brand, also provides Westrock with a pipeline to more specialized (and higher priced) RTD coffees to balance its portfolio of large-scale clients.

The numbers back up that approach: per Mintel, 60% of Gen Z consumers – the demographic driving much of the push from hot to cold – agree that TikTok is a great source for learning about coffee.

“We are now able to provide the whole breadth of different sized companies, which has been a great opportunity for making us remain flexible and keeping us on the forefront of new product launches and innovation, and then also sheer scale for those who need to be commercially competitive,” said Ford. “It has brought forward, I guess, the [opposite] poles of the industry and we’ve found a good sweet spot in providing for those in the middle as well, which I can’t say that we originally foresaw trying to do.”

Westrock’s new chapter also involves the aforementioned influx of new talent or, in some cases, new skill sets.

“Where we have changed and grown is really adding to the depth of the bench,” said Elizabeth McLaughlin, Westrock’s EVP of Sales. “Because these products are new, we have really spent time developing and hiring good talent, and through that learning, some of us who haven’t necessarily been knee deep in ready-to-drink or concentrate products are learning and understanding the products and technical details around that, so we’re more informed when we talk to our customers.”

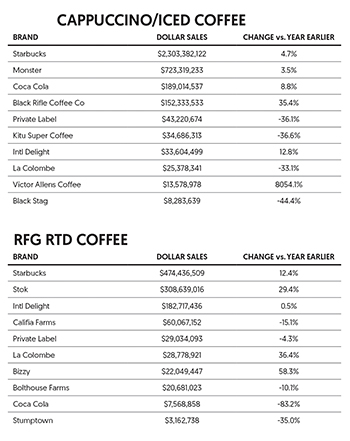

That understanding will be critical in a tightening retail RTD coffee market in which large strategics like Coca-Cola (Costa), Monster and Chobani (La Colombe) are putting their thumb on the scale. Spiking demand for more function, flavor and dairy alternatives in the category, as highlighted in Mintel’s Future of Coffee report from May 2023, is further shaping the space, and Westrock aims to be ready for anything.

“There’s going to be new unique things to come out which we think that we’re in a great position to capitalize on. But we’ve got to turn on this plant first,” said Ford. “I think we’ve got five- and ten-year plans that people would blush at, but we know that we have to start here.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe