Tall Order: Large Format Singles Offer Craft Growth Opportunities Amidst Industry Headwinds

When you’re in danger of losing, you tend to lean on your biggest hitters: Just ask the 2004, 2007, and 2013 Boston Red Sox (we still miss you, Big Papi).

The going is certainly tough for craft brewers right now, as the industry tackles a marketplace that is more crowded than ever (nearly 10,000 craft breweries and a host of beyond beer challengers), growing anti-alcohol narratives and regulatory efforts, increased supply costs that could only steepen with impending tariffs, and ever-fluctuating consumer habits.

But in the midst of these headwinds and continued off-premise declines, craft beer has its own heavy hitter coming up to bat: large-format singles.

Between 2021 and 2024, off-premise volume of Brewers Association-defined* craft beer declined 18%, BA staff economist Matt Gacioch shared in the trade group’s annual packaging report. In 2021 the industry was still heavily relying on off-premise sales and overstocking retail accounts in response to the COVID-19 pandemic and on-premise shutdowns, so declines are somewhat expected.

(*The BA defines craft brewers as those who hold federal brewers’ permits, make fewer than 6 million barrels annually and are not more than 25% owned by a bev-alc producer that is not also a craft brewer.)

However, the pandemic cannot explain recent losses, including a 4% decline in BA-defined packaged craft beer volume in 2024. NIQ-tracked packaged craft beer – which includes breweries such as Molson Coors-owned Blue Moon, Anheuser-Busch InBev-owned Kona, Kirin-owned New Belgium and others outside of the BA’s definition of small and independent craft breweries – recorded a 4.2% volume decline in off-premise channels last year.

Both craft groups’ losses were greater than total beer, which recorded a 3.1% decline in off-premise volume in 2024, and were on the lowest end of the BA’s estimates for total craft declines (between 2% and 4%), which were shared during a December webinar.

Meanwhile, BA-defined craft off-premise dollar sales declined 2.4% in 2024, according to the trade group. The gap between volume and dollar sales suggests that “prices are going up over time as volumes are decreasing, bridging some of that gap,” Gacioch wrote.

The average price per case of BA-defined craft increased 2.5% between 2021 and 2024, while the price of NIQ-tracked craft increased 2.6% in the period.

“Let’s not ignore the fact that some of the volume decline could be driven by the increase in price,” Gacioch wrote.

Despite declines, single-serve offerings are bucking trends.

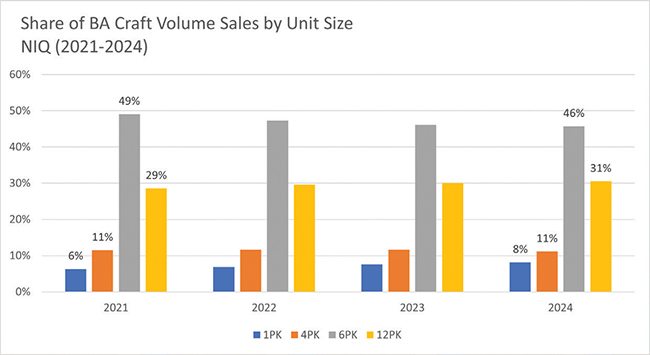

Four “unit sizes” made up nearly all (96%) of BA-defined packaged craft beer volume in 2024, Gacioch reported:

1-packs or single-serve (8% share, up 2% versus 2021);

4-packs (11% share, flat versus 2021);

6-packs (46% share, down 3% versus 2021);

And 12-packs (31% share, up 2% versus 2021).

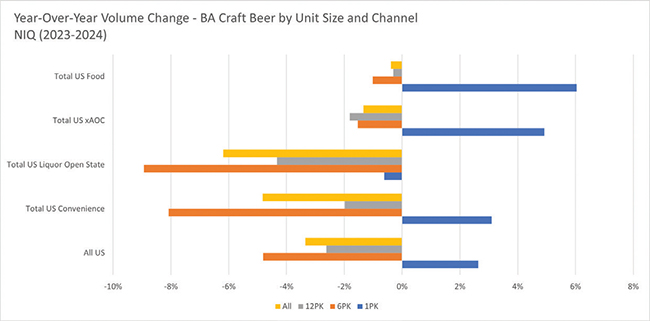

Single-serve packages were the only unit of the four to increase both volume and share in 2024, according to Gacioch. The largest year-over-year (YoY) volume decline was recorded by 4-packs (down 8%), which also recorded a 0.5 percentage point decline in volume share, followed by 6-packs (volume down 5% YoY, share down 0.4%). Twelve-packs recorded slight share gain and volume decline.

The growth of single-serve offerings was primarily due to 19.2 oz. cans, which accounted for more than half (54%) of BA-defined single-serve craft beer volume in 2024, a 6.6% increase YoY.

The package format had an even larger share of NIQ-tracked single-serve craft beer volume (72%), in part due to the inclusion of New Belgium and its Voodoo Ranger brand.

Total craft 19.2 oz. can dollar sales increased 23.2% in 2024 – the largest percentage increase of any package format in craft, according to data shared by Bump Williams Consulting president Dave Williams during a March presentation at the New England Craft Brew Summit.

The packaging format has also had a “rapid proliferation” in craft beer, gaining 4.1 share points of total craft beer dollar sales from 2022 to 2024, now claiming 9.2% share, Williams said. Nearly half of that share gain – 1.9 share points – occurred in 2024.

Single-serve craft offerings were also the only package format to increase volume in nearly every off-premise channel in 2024, with the exception of open state liquor, where the package unit was flat. The largest volume growth was recorded in grocery (6%), followed by total U.S. xAOC (5%) and c-stores (3%).

Williams acknowledged that “sets are evolving.” While large format single-serve offerings have been primarily a c-store play over the past few years, the offerings are now gaining traction in grocery.

“With a consumer shift to the food channel comes a consumer shift to purchasing for occasions, and it seems as though the occasions are meant to be enjoyed 19.2 ounces at a time,” Gacioch added in his report.

The shift also goes beyond just craft beer. Nearly 14% of all beer dollars are sold through large-format packaging now: 11.3% in 24 and 25 oz. cans (up 2.3% since 2021) and 2.5% in 19.2 oz. cans (up 1.5% since 2021), according to Williams.

However, not all single-serves are recording positive returns. Beyond 19.2 oz. cans, all other single-serve packaged offerings of BA-defined craft beer were in decline in 2024, including “the once-mighty 22 oz. package,” which now accounts for just 1% of BA-defined craft single-serve volume, according to the BA.

“I suppose you could say the bomber is bombing,” Gacioch wrote.

How Long Can Price Hold?

Part of consumers’ shift to larger formats is undoubtedly due to economic pressures, according to Williams. Single-serves allow consumers to “try a lot of things for a much cheaper price” than a 6- or 4-pack. And in a bev-alc age where there is no shortage of variety and new innovations, cheaper trials are hailed by consumers.

How long large-format offerings can have a competitive price edge – particularly canned offerings – is uncertain, as the beer industry also weighs the impact of aluminum tariffs.

On March 12, President Donald Trump enacted 25% tariffs on all aluminum and steel imports. No countries are exempt from the tariffs, meaning the price of aluminum will “likely increase,” the BA warned (whether those tariffs are in place as of press time is as predictable as anything else coming out of the current administration).

Cans now account for 73.8% of NIQ-tracked packaged craft beer volume, a 3.2% increase versus 2023, Gacioch reported. Cans have been steadily increasing share of packaged craft beer volume between three and four percentage points every year since 2021, when cans accounted for 62.8% share of packaged craft volume. Meanwhile, bottle share declined from 37.2% to 26.2% in the same period.

“To drive this growth in cans, brewers across the country have invested significantly in aluminum packaging equipment over the past few decades,” Gacioch wrote. “Obviously, brewers can’t switch package types on a dime, so I expect this is driving much of the anxiety around the aluminum tariff conversation.”

As Gacioch mentioned, craft beer may already be feeling the effects of high prices on the segment’s sales. However, that hasn’t stopped producers from raising prices.

For the four-week period ending February 23, the average price for a case of beer increased $0.52, to $30.69, according to market research firm Circana. Craft beer – which has the second highest average case price of all beer segments, following hard cider – increased average case prices by $0.48 in the period, to $44.03.

In 2024, the average case price of craft beer in Circana-tracked channels increased $0.66 versus 2023, outpacing total beer (+$0.63), and posting the third largest increase behind non-alcoholic beer ($1.56) and hard seltzer ($1.47).

Cider Wants in Too

Large-format single-serve cans aren’t just an opportunity for craft beer makers; hard cider producers are hoping to get their share of the growth too, thanks to new standard of fill guidelines from the Alcohol Tobacco Tax and Trade Bureau (TTB).

In January, the TTB approved 13 new standards of fill for wine, hard cider and mead offerings 7% ABV or above, including 16 oz. and 19.2 oz. packages. The cider industry and the American Cider Association (ACA) had been fighting for the new standards for years, and celebrated the milestone, noting in a press release “large-format cans in convenience channels have been a critical source of growth for craft beverages since the COVID[-19] pandemic.”

“Now we will see single-serve regional cider succeeding in more convenience-oriented craft beverage spaces,” former ACA CEO Michelle McGrath said in the release. “That’s a big win for cider.”

Previously, hard cideries had been able to package products in 16 oz. and 19.2 oz. cans, but only offerings below 7% ABV. Higher ABV cider – and wine and mead – could be sold in-state with a TTB-approved certificate of label approval (COLA) exemption, but those exemptions were challenging to obtain and limited, according to the ACA.

“The COLA-exemption route was a Band-Aid,” ACA government affairs committee chair and Portland Cider Company co-owner Jeff Parrish said in the release. “It proved that there is demand for higher ABV cider in these packaging volumes, but it wasn’t opening the market in a meaningful way.

“These new packaging volumes will be a game changer for regional cider in 2025,” he added.

Oregon-based 2 Towns Ciderhouse has had packaging done for large-format single-serve cans for about two years, in anticipation of standards of fill changes, co-founder Aaron Sarnoff-Wood told BevNET’s sibling publication Brewbound.

“Cider in general under-indexes in convenience and it’s a place where we’d like to put a little bit of focus in ’25,” Sarnoff-Wood said. “There’s some solid opportunities, especially now that we have some applicable, larger format, single-serve that we can target that channel with.”

2 Towns also has the advantage of size to give it the resources and attention needed to make a mark in the increasingly crowded single-serve market. 2 Towns is now the second-largest cidery by year-to-date grocery sales, and has a large key accounts team at its disposal, allowing the cidery to work with major c-store chains directly and “not relying on our distributors to do that.”

Sarnoff-Wood believes that regionally, there is “room for each of us to have a significant showing” with single-serve offerings, but nationally, the push won’t be so easy.

“People might try to enter the space, but really, realistically, there’s a minimum economy of scale that’s needed in order to be effective in that space,” he said. “And that limits the players to just a handful in the nation.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe