Along with record levels of funding from both private and corporate entities, the rise of plant-based protein and new products and services that combine convenience and health were identified as two of the major disruptive trends reshaping the food and beverage space during strategic data analytics firm CB Insights’ “Dining on Disruption” webinar on Tuesday.

Zoe Leavitt, Retail & Food Technology Analyst at CB Insights, led the online presentation, which explored recent investments, current trends and forward-thinking innovations in the food and beverage industries.

PRIVATE & CORPORATE INVESTMENT

Leavitt began the webinar by reviewing the last several years of mergers and acquisition activity, noting that the competition amongst investors was increasing after a record high 338 deals made in 2016. She pointed out that as the space has become more crowded, the environment has given rise to new investment firms focused solely on food and beverage startups, like CAVU Ventures, New Crop Capital and S2G Ventures.

Since 2012, 1,300 deals involving private food and beverage companies, valued collectively at $5.9 billion, have been completed. With 72 deals worth a combined $485 million already completed, 2017 is on track to be a record year in private market funding.

In food, startups working with condiments and spices have had the most deals since 2013, while enhanced waters — such as plant-based waters and electrolyte-infused ‘performance’ waters — have been the subject of the most deals in beverage. Over 80 percent of all investment has gone to U.S.-based startups.

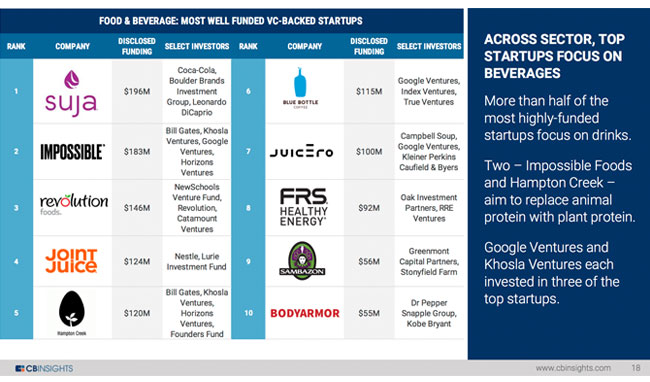

Leavitt noted that while food has attracted the greater number of deals since 2013, more than half of the top ten most well-funded startups in that period are in beverage. On that list, Coke-backed cold-pressed juice brand Suja claimed the top position with $196 million raised. Other notable inclusions were Joint Juice, backed by Nestle, at $124 million, Blue Bottle Coffee ($115 million), Juicero ($100 million), FRS Healthy Energy ($92 million) and BodyArmor ($55 million). New York-based All Market, maker of Vita Coco, is the most well-funded beverage startup in the U.S. with $208 million raised, though not from venture capital.

While private investment has increased, large corporations have hardly been ignoring M&A activity. Acquisitions of startups by major companies have increased every year since 2013, hitting a new record with 17 deals in 2016, including acquisitions by Hormel Foods (Justin’s peanut butter for $286 million), PepsiCo (KeVita for $200 million) and Dr Pepper Snapple Group (Bai Brands for $1.7 billion).

Deals in which large corporations have participated hit a new high of 24 in 2016, worth a total of $235 million. With 9 deals already completed in 2017, the full-year projection is set to break that record with 42 deals valued at an aggregate amount of $321 million.

Since 2015, several corporations have also launched their own venture funds, often with different strategic philosophies. 301 Inc., the investment arm of General Mills, has looked toward vegetable and plant-based products through brands like Kite Hill and kale-based snack company Rhythm Superfoods, which has raised over $16 million in total, including a $6 million Series D in January. Meanwhile, Acre Venture Partners, whose sole limited partner is Campbell’s Soup, has focused on the technologies behind food distribution with funding for home cold-pressed juice machine Juicero and Spoiler Alert, which aims to reduce food waste.

TRACKING TRENDS

Assessing the current trends impacting food and beverage overall, Leavitt described plant protein as possibly the most significant.

She pointed to high activity in the category amongst 24 investor groups that CB Insights has classified as “smart money” due to past performance and exit history, as well as plant protein’s ability to reach the type of returns that smart money VC firms might expect. At the top of its disruptive capabilities is the potential to fundamentally alter the entire beef and dairy industries; that opportunity dwarfs those from packaged goods startups offering new flavors or new brands.

As an example, Leavitt cited Impossible Foods, which uses molecular engineering to create meatless hamburgers that have a similar texture to real beef and can even bleed. The company has raised $183 million from investors such as Google Ventures, Khosla Ventures and Bill Gates, with plans to roll out a new production facility and expand to over 1,000 restaurants locations in 2017.

Meanwhile, CPG giant Tyson Foods made plant-based meat-substitute brand Beyond Foods the first investment from its Tyson New Ventures division in 2016.

Beyond meat substitutes, ingredients such as peas and chickpeas have pushed into the plant-based protein space. Chickpea-based pasta company Banza has raised $5 million in funding thus far, while Ripple, a dairy-free milk alternative made with peas, has raised $43.6 million.

For a truly alternative protein source, Leavitt said that crickets were beginning to make some noise. Exo, which makes snack bars made with cricket-based protein, has raised $5.3 million, and Leavitt noted that the total global market for insect-based protein could expand to $371 billion when other applications, such as livestock feed or industrial uses, are considered.

As the popularity of once-hot ingredients like kale and coconut water have plateaued, Leavitt pointed to maple water, chia and moringa as the next wave of “superfoods” with high ceilings for growth.

Probiotics has been another busy category for investment, as $32 million went into brands in the category in 2016, including a $6.5 million investment in fermented products company Farmhouse Culture led by 301 Inc.

The industry is also actively looking for ways to combine healthy eating with convenience. Few companies have attracted as much attention for their efforts as Soylent, which sells ready-to-drink and powdered meal products that could theoretically replace all other food items in a person’s diet. The brand has raised $21.5 million from investors including Index Ventures and Andreessen Horowitz.

Others companies are repackaging established items, such as jerky, to emphasize convenience. Krave, for example, raised $22 million and reached $35 million in annual sales before being acquired by The Hershey Company for a reported sum of $200 to $300 million. That deal was followed by General Mills’ acquisition of meat bar maker Epic Provisions in 2016 and ConAgra’s purchase of Thanasi Foods, the makers of Duke’s meat snacks, earlier this year.

FURTHER INNOVATION

Disruption in food and beverage goes beyond consumer packaged goods, however. Leavitt said that new methods of discovering and purchasing products — such as meal-kits, online grocery ordering services and next-generation vending machines — were offering brands new opportunities and synergies within the industry.

After soaring to a record high $455 million in funding in 2015, meal kit startups fell by over 50 percent last year to just $135 million raised. Leavitt said that the startups that have been most successful have been those with a strong appeal to health; the largest raise in the category this year, for example, has been a $15 million Series C for Sun Basket, a meal kit startup that focuses on paleo-friendly and gluten-free options — and is reportedly considering an IPO as well. Leavitt added that meal kits are also showing potential as strong sales vehicles for food corporations.

Looking further ahead, Leavitt explained that the growth of alternate distribution channels like meal kits, on-demand grocery delivery and placement in co-working spaces, will likely force CPG brands to adapt new strategies for getting product into consumers’ homes.

And as new “smart home” technologies are developed, the possibility of home appliances that can automatically order items — which would then be delivered via drone, naturally — could herald the death of the grocery store.