Proud Source Water Acquired by SOURCE Global

As the doors opened at Natural Products Expo West 2023 yesterday, renewable drinking water technology company SOURCE Global announced it has acquired sustainable bottled water brand Proud Source Water.

Speaking at Proud Source Water’s booth in Expo’s North Hall, Neil Grimmer, Global CPG President for SOURCE Global, described the acquisition as a natural decision as the two companies aligned on multiple points: Both businesses are certified B Corps, both emphasize sustainability and access to water as key values, and – yes – they both have “Source” in their names.

“You’ll walk around the show, and you’ll see brands with a cool graphic design on the pack and edgy marketing campaigns; Proud Source is different,” Grimmer told BevNET. “And now with SOURCE Global as the parent company, it’s very, very different. Because the sustainability of our water now has always been really strong … and now we’re actually bringing out renewable water from hydro panel technology, which means it’d be the first of its kind to be truly sustainable inside and outside of the bottle itself.”

SOURCE Global is the manufacturer of the SOURCE Hydropanel, a renewable technology that sources water from vapors in the air and converts it into drinking water. To date, the company has placed its panels around the world to help provide easier access to water to dry and impoverished regions, as well as selling its own line of bottled waters under the SOURCE name.

Proud Source president CJ Pennington will remain on the brand’s leadership team, reporting directly to Grimmer.

Based in Idaho, Proud Source Water produces a line of aluminum-packaged bottled waters in bottles and cans. Its water comes from naturally alkaline springs in Mackay, Idaho and Marianna, Florida, and SOURCE Global has acquired the company’s two manufacturing facilities at those sites as part of the deal. The brand is distributed nationwide, including a partnership with PepsiCo Beverages North America it entered in 2021.

Proud Source will now be the sole bottled water brand for SOURCE Global, dropping its previous aluminum-packaged product, and the company will use both its hydropanel-derived water and the acquired springs to supply its bottled water.

“It’s going to be renewable water inside that bottle,” he said. “It’s going to be sustainable packaging in a way that for the first time ever, that bottle actually is guilt free.”

Just Ice Tea Becomes Eat the Change’s New Anchor

When The Coca-Cola Company announced last May that it would discontinue the Honest Tea brand it had acquired in 2011, Honest founder Seth Goldman sprang into action by sourcing, manufacturing and launching a new organic bottled tea brand – Just Ice Tea – as a new line under his vegan snack company Eat the Change in only four months.

Now, six months after its September rollout, Goldman and co-founder Spike Mendelsohn said that Just Ice Tea has become Eat the Change’s new anchor line – making up about 80% of sales – with much of the business now focused around growing its beverage operation.

“If there’s a question if Coke made the right move or a wrong move, over the last couple of months we quickly found out that they made a bad decision,” Mendelsohn told BevNET at its North Hall show booth.

However, Goldman added, the choice to launch Just Ice Tea was “a great decision” for Eat the Change, which has now expanded distribution to “several thousand” doors nationwide with expectations to be in roughly 10,000 locations by the end of the summer.

At Expo West, Eat the Change introduced three new flavors to the Just Ice Tea line – Unsweetened Original Black Tea, Lemon Ginger Herbal Tea, and “Just Sweet Enough” Mango White Tea.

Although other bottled tea brands like Shaka Tea and Hrbvor have sought to expand the options for clean label ready-to-drink teas, Goldman said he doesn’t believe there is much competition in the category for Just Ice Tea’s particular positioning as an organic option with a range of unsweetened and low calorie drinks. The brand, he said, was also quick to secure partnerships with retailers who were losing Honest Tea and the decision by bagged tea brand TAZO to discontinue its RTD line last year also opened shelf space for Just Ice Tea to take over.

Just Ice Tea is now looking to grow its partnership with a tea supplier in Mozambique, and in addition to developing additional SKUs around teas from this new partner, it will update the formulation of some existing products with these teas as well, Mendelsohn said.

The beverage brand is also helping to lift Eat the Change’s carrot chews and mushroom jerky. Retailers have agreed to carry both lines, Goldman said, with the brand introducing promo deals to drive trial, such as offering discounted prices on snacks with every bottle of tea purchased.

“We were meeting with a tea buyer yesterday, and they said ‘We just quadrupled your order’ – they thought it was a mistake, they were like ‘Is this real?’” Goldman said. “It’s real. It just really shows we have a team that knows what they’re doing.”

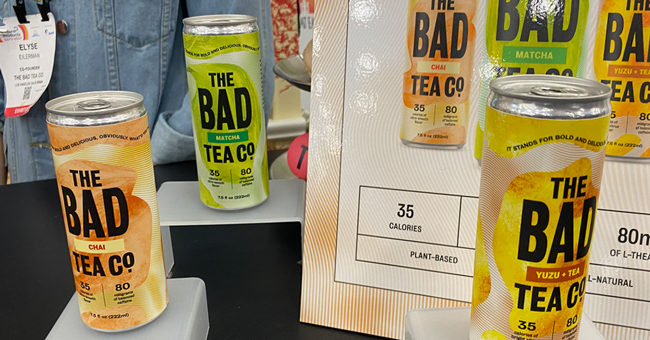

Chatty Matcha Rebrands as The BAD Tea Co.

Canned nitro matcha brand Chatty Matcha came to Expo West with new flavors, a new look, and a new name, letting consumers know that its products are BAD.

Founded last year by Rohan Tangri and Elyse Eilerman, The BAD Tea Co. debuted an expanded product line at the show yesterday, including nitro chai and Yuzu + Tea flavors, the latter intended as a unique a riff on a classic Arnold Palmer, alongside the original nitro matcha product. Each 7.5 oz. can contains 35 calories and 80 mg of caffeine.

The BAD Tea Co.’s new name stands for ‘Bold And Delicious’ and Eilerman said the acronym was meant to be ironic and playful, intending to “turn ‘bad’ on its head.” She said the brand is intended to be “mainstream and accessible” and hopes to connect with consumers beyond the major coastal markets of New York and California.

“Why does tea have to be so stuffy?” Eilerman said. “With our Arnold Palmer, we’re working on some fun things with golf – like why does golf have to be stuffy? So the brand ultimately is really meant to kind of make you question some of the rules in society.”

Prior to co-founding The BAD Tea Co., Eilerman served as senior director of national accounts for cannabis-infused social tonic brand Cann. Luke Anderson, one of Cann’s co-founders, has since joined the brand as an advisor, along with former Naked Juice CEO Monty Sharma.

Tangri previously served as an investment banking analyst at Houlihan Lokey and also currently serves as M&A manager at Foundry Brands.

As Chatty Matcha, the brand was sold online and in 75 retail stores in California. The rebranded offerings launched at the show and Eilerman said the company hopes to quickly roll out to new accounts in the coming months.

“We got great data on that [initial launch] and we got great feedback,” Eilerman said. “It was like, okay, there is something to this idea of extra caffeinated teas, and that was what we chose to double down on.”

Tru Inc. Expands Team with Gavin Konkel as VP of Sales

As it works to expand across the country and build up its sales force, Natick, Massachusetts-based functional beverage maker Tru, Inc. has named Gavin Konkel as VP of sales.

Konkel comes to the Massachusetts-based brand from plant-based pizza, seitan and wing producer Blackbird Foods, where he served as director of sales. Prior to that, he worked as VP of merchandising at North Carolina-based grocer Earth Fare, where he first encountered Tru.

“I first came across Tru ~2.5 years ago when I was on my 3rd or 4th grand opening at Earth Fare and [Tru CEO] Jack McNamara had randomly sent me some samples of his product, shots of energy and focus,” wrote Konkel in a LinkedIn post. “I remember taking one of those shot[s] during my next GO and the sustained and heightened energy lit me up.”

The new addition comes on the heels of the brand’s recent $6.5 million Series A round led by BTomorrow Ventures, an existing investor and the corporate venturing arm of British American Tobacco. According to VP of distribution Sean McDonough, a majority of the capital will be allocated to expanding the brand’s retail footprint as well as doubling its sales force.

This week, the brand’s products will hit the shelves of two new major retailers: ShopRite and Stop & Shop. Both grocers will take on all seven of the brand’s flavors, including Power (watermelon), Energy (mango), Defend (pineapple), Focus (apple kiwi), Dream (cherry berry), Rescue (blackberry) and Beauty (raspberry).