It takes creativity, timing and a touch of luck to challenge Big Soda in a channel it has long dominated: professional sports partnerships.

The opportunity in this space varies depending on the size of the stadiums or arenas as well as the popularity of the sport or franchise, but an average deal size across major pro sports is about $935,000, according to a July State of the Market report from sports partnership data analytics company SponsorUnited.

The Coca-Cola Company spends an estimated $20 million every year maintaining its sponsorship of the Olympics. In the beverage industry, Coke carries the most sponsorship deals with 1,346 across sports and entertainment, dwarfing its direct competitor PepsiCo’s 684 deals. In 2023, sports team sponsorship revenue rose 17.5%, as tracked by SponsorUnited.

Locking in multiyear on-premise deals at arenas or stadiums is about offering an alternative to the status-quo in beverage concession, but also brings new value to the business ecosystems that have developed around professional sports franchises.

But having already taken on soda’s big brands on-shelf, Olipop believes it can find a way to compete in live sports venues. Starting with its sponsorship of the National Women Soccer League’s (NWSL) Kansas City Current, the prebiotic soda brand has in the last 12 months signed 27 partnerships with pro sports teams, an 8% increase from 2023 and seven more deals than its direct competitor Poppi, according to data provided by SponsorUnited.

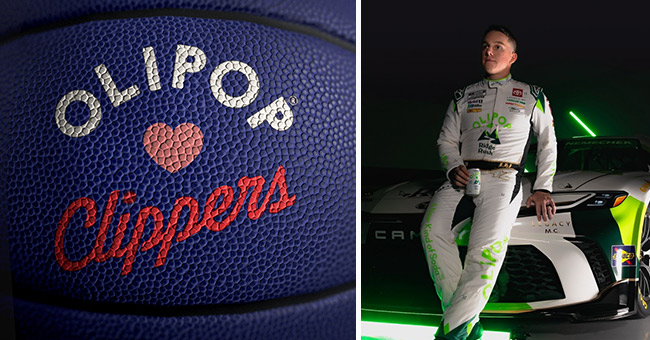

The Oakland, Calif.-based soft drink maker is currently partnered with WNBA’s N.Y. Liberty at The Barclays Center in Brooklyn, the L.A. Clippers at the new Intuit Dome and Major League Soccer’s FC Cincinnati in a three-year deal at TQL Stadium.

The brand has also lined up deals with e-sports team FlyQuest, Nascar’s Legacy Motor Club and sport fitness organization United Grid League.

Olipop’s positioning across recognizable professional teams, rising sports leagues and non-traditional competitions mirrors its broader approach to disrupting the three established leaders in soda, said SponsorUnited president Bob Lynch.

“By investing in these growing properties, Olipop can cultivate loyalty and build a presence in spaces where larger soda brands may be less nimble or willing to take risks,” he said. “Brands that are coming into the space in a unique or disruptive category are doing lower-tier revenue deals often as a starting point.”

The growing popularity of women’s sports has led to a meteoric rise in sponsorship deals with an average of 42 deals per WNBA team thus far in 2024, accounting for an 8% increase year-over-year and 43% increase since 2022, according to SponsorUnited. The National Women’s Soccer League (NWSL) averaged 35 deals per team this year, a 22% gain year-over-year.

Start Small, Build Up

For major venues, the prospect of an independent brand replacing Coke or Pepsi is a non-starter. Instead, partnering with emerging sports leagues like women’s basketball or professional soccer could pay off in the long-term and are cheaper to land than a NFL or MLB deal, Lynch said.

The strategy also aligns with Olipop’s mission to disrupt Big Soda and parallels a familiar trope of the underdog story. Disruptive brands can bring a “challenger” ethos to their marketing approach at live sports events while building a story around it, Lynch said, standing in contrast to “larger soda brands…often tied to traditional, legacy messaging, which may not resonate as strongly with newer, tech-savvy and health-conscious audiences.”

Olipop’s move into professional sports started with an introduction to Kansas City Current’s president in 2022 by brand ambassador and investor Lynn Williams, who was playing for the team at the time.

When Olipop signed its three-year deal, the KC Current was playing home games at MLS Sporting Kansas City’s Children’s Mercy Park stadium but were in the process of constructing their own CPKC Stadium (the first single-purpose women’s stadium). Although Olipop couldn’t sell drinks at Children’s Mercy Park, the brand was grandfathered in as the beverage partner at CPKC.

“I’ve learned over the years, if you want to do one thing in a space and you make some noise about it, then the powers that be will start to reach out to you,” said Olipop director of strategic partnerships Steven Vigilante. “And that is exactly what happened.”

The professional women’s soccer partnership led to Vigilante being approached by Intuit Dome consulting group CAA Icon. Vigilante realized that partnering with the L.A. Clippers would be the “right place, right time” to jump into a bigger, high-profile sponsorship because the new arena is focused on grab-and-go concessions and is shifting away from reliance on plastic containers. Coca-Cola products are also offered at the Intuit Dome.

By complementing without replacing Coke, Olipop has created a model where it can provide a different value proposition to a different consumer demographic in the same places where CSD strategics operate, Vigilante said. Under its deal with the Intuit Dome and the L.A. Clippers, Olipop is the Official Functional Beverage while at the same time holding the title of Official Prebiotic Drink sponsor of FC Cincinnati.

What’s In A Name?

Olipop is not the only brand carving out new terrain by using a nuanced approach to naming rights.

Performance drink Barcode is the “Proud Fitness Water Partner” for the Brooklyn Nets. That deal helped pave the way for the brand to become the Official Performance Drink of the San Antonio Spurs and the Miami Heat, replacing the teams’ respective deals with Gatorade and BioSteel.

Congo Brands-owned PRIME has lined up a series of deals that span a number of professional athletics from international soccer and baseball to wrestling and mixed-martial arts.

“Ownership groups that are a little bit more forward-thinking understand that they’ve got about 40 NBA games a year, 22 WNBA games and anywhere between 80 to 100 concerts,” Vigilante said, referencing the Olipop deal at the Intuit Dome. “That’s a massive swath of different types of humans going to these events. An Olivia Rodrigo fan who skews much younger is probably going to be more inclined to pick up Olipop at this point than some of the legacy brands.”

This perspective is illustrated in Olipop’s partnership with WNBA champions the N.Y. Liberty. Announced on October 1 as the team began its successful run through the playoffs, the deal became a “hat-trick” for the brand, Vigilante said, as it helped secure the brand Proud Sponsor status at Barclays Center and with the Brooklyn Nets. This means that the soda will be offered at not just the Liberty’s home games but at all events in the arena.

Indoor arenas like Intuit and Barclays host a variety of events where the brand is offered. In contrast, soccer stadiums don’t do as many — if any — live performances because it damages the turf, Vigilante said.

“It’s a bit of a different math equation on those soccer deals than it is in an arena,” he added.

The value for an arena or team is simple; providing more variety and choice brings added concessions revenue.

“It allows sports venues to change or increase the number of product offerings and thus drive sales,” said Euromonitor International analyst Erwin Henriquez. “With multiple choices, consumer behavior changes from getting or not getting one drink to selecting what drink you will buy, which helps drive those sales up.”

The trade-off for brands is visibility and building brand awareness. Arena or team sponsorships often come with activations, advertising opportunities and can be viewed as “underwriting” a sampling demonstration, said Lynch. “The selling of these products is not going to be a huge money maker, but it essentially gets a product in the hands of consumers that never would have grabbed it in a store environment.”

Emerging energy brand Yerbae have focused on Name, Image Likeness (NIL) deals not only with collegiate athletes but also with collectives like Penn State University’s Happy Valley United.

Unlike athlete brand ambassadors, NIL collective deals and team partnerships play on communal identity by bringing new consumers to a brand through shared belonging. Most importantly, concession sales and in-stadium visibility play into a familiar beverage industry trope: Getting cans in hands.

“They can get a captive consumer and hopefully create repeat customers outside of the venue,” Henriquez said. “More than anything it’s going to help the small brands solidify in the minds of consumers.”