Organic ingredients may not be a dealbreaker to most retail stores or customers, but for a dyed-in-the-wool natural grocer like Jimbo’s in Southern California, it’s exactly that.

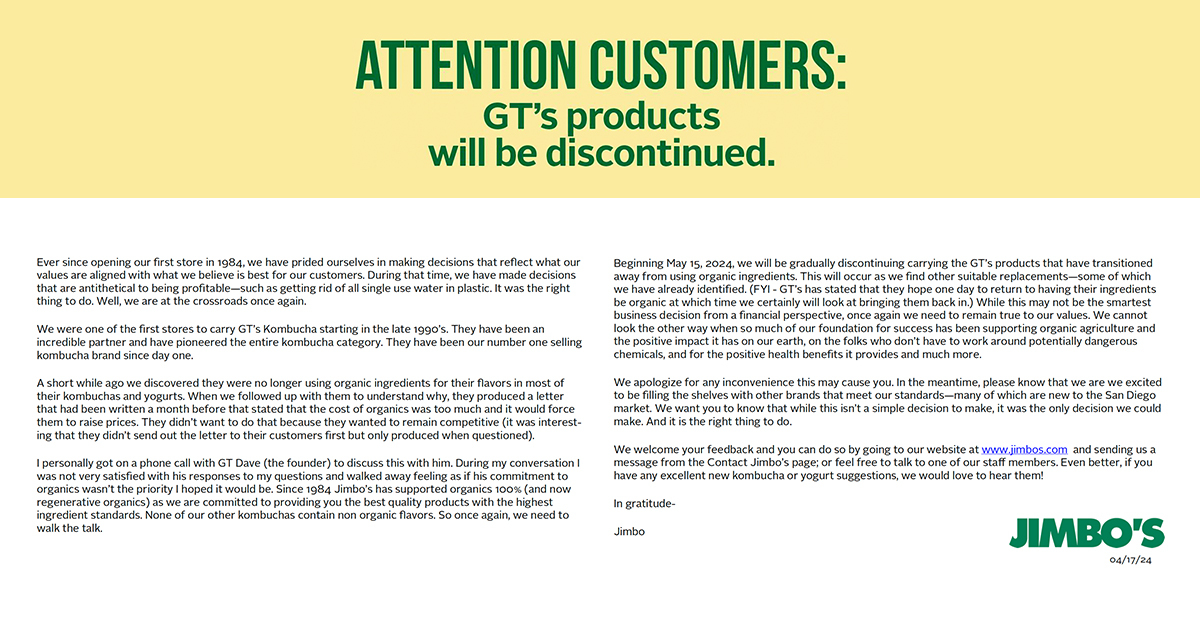

In a letter posted at the company’s four stores on April 15, Jimbo’s president and namesake Jimbo Someck explained that his chain of natural grocery stores was pulling GT’s Kombucha — a store staple for over 20 years and “far and away” its best-selling item in the category — from shelves after discovering that the company was adjusting its ingredients deck from 99% organic (“certified organic”) to 94% (“certified with organic ingredients”), with the aim of returning to its prior status sometime in early 2025.

“We’ve held to standards, even when it wasn’t in the best interest of our bottom line,” Someck told BevNET last week. “So when they made the decision based on their needs, we had to make a decision not to carry it.”

News of the pivot may not be received as dramatically outside of health conscious CPG circles, but Jimbo’s reaction serves to illuminate the difficult decisions natural brands may be facing in light of persistent inflation and rising ingredient costs. Upon addressing the issue with GT’s Living Foods, Jimbo’s received a letter from founder and CEO GT Dave referencing “a series of challenges that we have not encountered in the history of the Company.”

“Cost increases relating to freight, raw materials, packaging supplies, labor and many other operational expenses have forced us to raise our prices against our will,” he wrote. “These increases have pushed the retail price of our products to an all-time high — causing it to be inaccessible to those with a limited budget.”

Per GT’s, the organic ingredients in question are juices that constitute less than 5% of the overall product in select flavors of Synergy, GT’s Classic Kombucha, Agua de Kefir and CocoYo. Synergy Pure and Classic Original will remain “certified organic.”

Following the store’s discovery of the change, a follow-up phone call with Dave left Someck “not very satisfied with his responses to my questions” and feeling “as if his commitment to organics wasn’t the priority I hoped it would be.”

When asked to elaborate, Someck responded: “I want to be clear — GT is making decisions that are in the best interest of GT’s (Living Foods). But for us it was really like — the percentage of organic fruit in (drinks) is so low, it’s got to be like a penny or two — I can’t imagine how much it’s going to increase the price. So to say you’re removing the organic ingredients because it’s going to cost a couple pennies more just is in conflict with everything we do.”

Yet even the risk of losing an influential key account wasn’t enough to spur serious consideration of further price hikes, said a spokesperson for GT’s Living Foods. “As some of our products now hit prices as high as $4.99, the thought of further raising costs and limiting access for consumers was simply inconceivable.”

The move comes against the backdrop of stabilizing but persistent inflation; COVID-era supply chain gridlock has eased, though climate change, global conflicts and events like the collapse of the Francis Scott Key Bridge in Baltimore have thrown further spanners in the works lately. With grocery prices remaining high post-pandemic, consumers have increasingly turned to private label goods, which now account for 15% of total U.S. CPG sales, according to NielsenIQ.

GT’s sales and distribution teams have been engaging with retail partners about the ingredient changes, said a spokesperson. “While most have shown support and acknowledged the industry’s broader inflationary trends, we recognize our communication process has been slower than ideal. We apologize for any delays in reaching out to our retail partners.”

For Jimbo’s, the conflict between the company’s ethics and its bottom line presented an uncomfortable situation, but customers have received its decision well, said Someck.

“If we didn’t say anything or we didn’t do anything, I don’t know if too many of our customers would have made an issue about it. But part of what we do is try to take a close look at the products we carry to make sure that they reflect our own standards,” he said.

But in the meantime, other organic, local brands – including Howling Moon Kombucha, Babe Kombucha, Bambucha and Mighty Booch in San Diego – have moved to fill the space on shelves.

While Jimbo’s departure is unlikely to severely impact GT’s overall business, it’s undoubtedly a bummer for both sides. A spokesperson of the kombucha maker said it was “genuinely saddened” by the store’s decision, calling its over 25-year relationship with the grocer “a source of pride and gratitude.”

“I value the relationship we have,” said Someck, recalling how Dave used to do store demos himself in the brand’s early days. “I’m sure we’re a small drop in the bucket, but I think he values our business and relationship which I appreciate. In the same vein that I can respect the decision he made, I hope he understands that we had to make a decision that was in the best interest of Jimbo’s.”