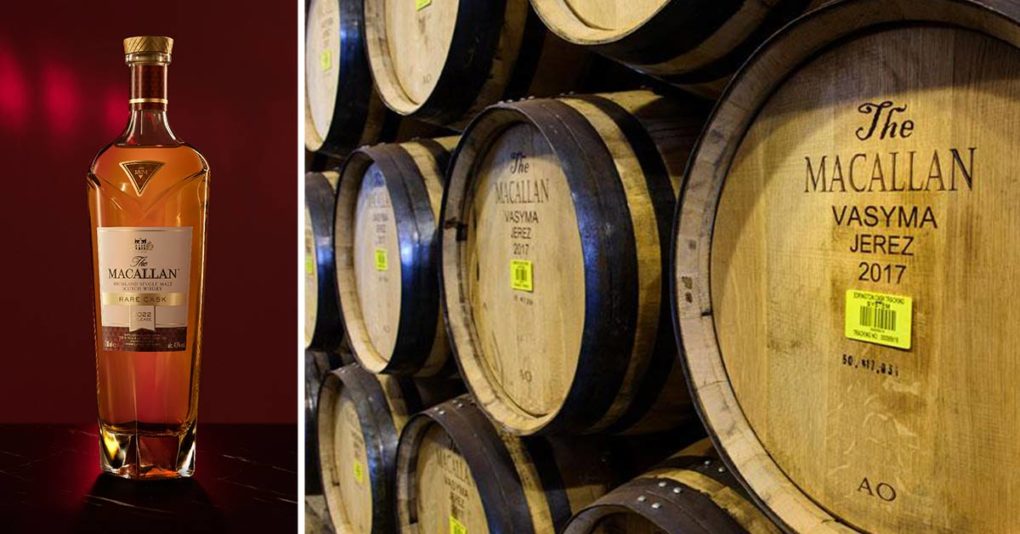

The well-known Edrington-owned Scotch whisky brand has completed an acquisition of the Spain-based Vasyma cooperage business, while also entering a joint-venture partnership with Ohio’s Coopers Oak to further deepen its supply chain.

Jerez-based Vasyma has supplied oak casks to The Macallan and Edrington for more than 30 years. Coopers Oak is Vasyma’s principal supplier of American oak staves, the long strips of wood that make up the sides of a barrel.

A shortage of staves and heading mills have been a concern of the whiskey industry, and the move comes amid increasing competition for whiskey barrels. High demand for oak, the dominant wood used to age spirits— and particularly white oak— has been exacerbated by labor shortages, climate change, renovation frenzies during the pandemic, and of course a high demand for bourbon and whiskey.

Other whiskey brands have found similar ways to shore up supply, but Brown-Forman, whose portfolio includes bourbon brands like Woodford Reserve and Old Forester, is the only major spirits company in the U.S. that produces its own barrels. It sold most of its stave and heading mills in recent years, but secured long-term supply contracts.

In March this year, The Macallan also purchased a 50% stake in Jerez-based Grupo Estévez to have an exclusive supply of new Sherry casks. The second acquisition was a “logical step,” according to Igor Boyadjian, The Macallan managing director. Founded in 1987, Vasyma has built a reputation as one of the leading cooperages in Jerez, specializing in crafting casks for the Scotch Whisky, sherry, and brandy sectors.

“Vasyma’s high quality casks, made from oak expertly sourced by Coopers Oak, have played an important role in the history and success of The Macallan,” said Scott McCroskie, CEO of Edrington. “We look forward to working closer than ever with these fine craftsmen in Jerez and Ohio as we continue to focus on the quality and resilience of The Macallan’s cask supply chain.”

Edrington has a 70% stake in The Macallan’s holding company, with Scottish family-owned spirits firm William Grant & Sons owning the remaining 30%.

In a recent report from Deutsche Bank, Edrington was listed as a contender for a predicted Campari merger or acquisition. The Italian spirits group increased shareholders’ voting rights last month, a move that may carve a path toward making a big acquisition. Analysts described Edrington as an attractive asset and a good fit for Campari’s objectives— despite the fact that it is owned by a charitable trust and has turned down prior buy-out offers.

The Macallan ranks in the top five Scotch Whisky brand families, but the category as a whole lags behind other leading sales drivers for whiskey/y, such as bourbon. Scotch exports by volume (-20%) and value (3.6%) declined during the first half of 2023, followed by a surge over the same period last year according to the Scotch Whisky Association. But scotch has benefited from the last decade of premiumization trends, with more than half of scotch revenues derived from high end and super premium categories. Single malts, like The Macallan, have also grown into a bright spot for the category— since 2003, super premium single malt scotch volumes have grown by 192% according to the Distilled Spirits Council of the U.S.