Although growth has been slower than some have predicted, the U.S. cannabis beverage market is gathering steam as consumer trial rates and basket penetration increase, according to a recent study by market research group Headset.

Overall, the category has maintained around 1% share of total recreational cannabis sales, dipping below 0.9% during the outset of the COVID-19 pandemic before rebounding into growth in Q3 2020. Yet analysts for Headset indicated that “for the first time in a long time” they are “bullish” on cannabis beverages, which the group has been tracking since 2015. “Between advancements in THC infusion technology, and a myriad of new brands catering to the occasional, low-dose consumer, there is a lot of reason to believe in the growth potential of this category,” analysts wrote.

To support its conclusions, Headset highlighted the segment’s performance in several key metrics. First, basket penetration in the category has increased from 1.6% in January 2018 to 2.8% in February, an indication that consumer trial rates are gradually increasing. The percent of U.S. cannabis customers who have purchased beverages is also trending upwards, rising from 5.7% in 2018 to 6.5% in 2020; just three months into 2021, that figure is at 5.4% and projected to finish at around 7% at the current trajectory.

However, data collected by Headset indicates that beverages are still seeking their place within broader cannabis consumption habits. Only 23% of total beverage baskets contained just beverages, suggesting that drinks are more often considered add-on purchases rather than trip-drivers. However, 34.4% of beverage baskets also contained edibles (more than any other category) and only 2.4% contained capsules (the lowest of any category), indicating that consumers are looking for a range of experiences and formats within orally ingested products.

What products those consumers are able to find in stores depends on where they live: the report is based on recreational sales data from California, Colorado, Massachusetts, Michigan, Nevada, Oregon (including medical) and Washington. In California, the market is enjoying both growth and stratification, with a broad field of brands helping to diversify the category. In 2018, 32% of sales went to the category’s top three brands at the time; as of 2020, that figure had dropped to 22%. But there’s more dollars to spread between them: California reported $15.5 million in beverage sales for January 2021, nearly six-times the amount from the same period in 2018.

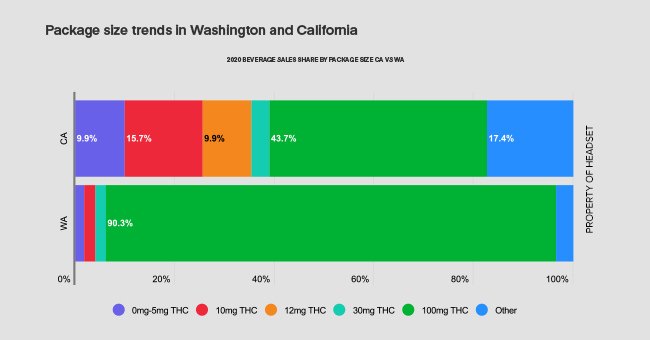

With a greater breadth of options to choose from, both new and experienced cannabis consumers have multiple entry points to the category. In California, where low-dose ‘social tonic’ CANN has emerged as the top-selling beverage brand, sales of products with 12mg of THC or less represent over 1/3 of the total market, split between 15mg (9.9%), 10mg (15.7%) and 12mg products (9.9%).

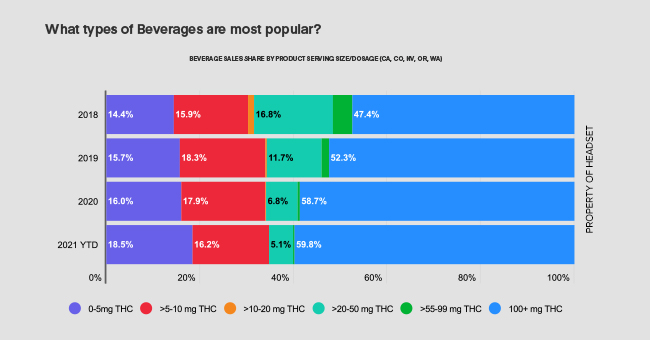

“Currently, the majority of sales is driven by the higher dose products,” said Cooper Ashley, data analyst at Headset, in an email. “However, the low or ‘micro-dosed’ segment of the beverage market is growing at a much faster rate. For example, from 2020 to 2021 YTD the proportion of sales to beverage products with 100mg or greater serving sizes grew from 58.7% to 59.8%, a relative increase of only 1.9%. The sales share to products with serving sizes of 5mg THC or less grew from 16% to 18.5%, a relative increase of nearly 16%.”

The breakdown also sheds some insight into how consumers in the Golden State interpret value in this category. CANN (2mg THC) has been one of the industry’s most highly visible brands through aggressive expansion, positioning as an alcohol replacement and endorsements from celebrity investors, despite having an average price per milligram of THC nearly eight times higher than the market average. In contrast, Keef Cola, California’s third best-selling beverage brand, offers value-priced 10mg and 100mg drinks at just slightly above market average.

Furthermore, the report found that female customers are more likely to spend more on beverages than their male counterparts across all age groups, suggesting that brands have room to tailor dosage and use occasions to specific demographics. According to Cooper Ashley, data analyst at Headset, the market should continue to see bigger gaps between average price per mg of THC in beverages.

“Brands like CANN are selling more than 2mg of THC in each beverage, they’re a lifestyle brand attempting to sell an experience,” said Ashley. “We expect to see the pricing landscape in cannabis beverages look just as diverse the beer or wine market in due time.”

Outside of California, the low-dose beverage market is changing as well: drinks with 5mg of THC or less grew from 14.4% to 18.5% of category sales from 2018 to 2021 YTD, while products in the 20-50mg range fell over 10% during that period. Yet nationwide, the biggest beverage category (59.8%) remains products with 100mg THC or more. Under federal law, all legal cannabis products must be produced in-state, meaning each individual market is being developed at a different pace and being influenced by different factors. In Washington, for example, 100mg-plus brands hold approximately 90.3% of the cannabis beverage market.

“With 9 out of every 10 dollars being spent on Beverages going to a 100mg product, there isn’t much room for anything else. Or perhaps this indicates a tremendous opportunity for Washington Beverage brands as, in contrast, sales to products of 12mg or less make up more than a third of the California Beverage market,” analysts wrote.

That cohort of lower-dosed products — which also includes drinks from Lagunitas Brewing, another one of California’s top-sellers — is growing at the same time as alcoholic “hard seltzers” continue to explode in popularity. Riding that same interest in intoxicating alternatives to traditional alcohol, the report noted that Cann, Lagunitas and others have emphasized their positioning as providing a booze-free buzz, while beer brands (Pabst Blue Ribbon) and winemakers (Rebel Coast) have also sought to get in the action.

“If the future of cannabis seltzer is as bright as its alcoholic inspiration, there will be room for quite a few brands going forward,” read the report.