Making Waves: Nestle Resets Busy Markets with Essentia Deal

One year on from the outbreak of the COVID-19 pandemic, bottled water has rediscovered its flow.

Of course, there’s no denying it: sparkling water is where growth is truly exploding, as compared to incremental gains in the much bigger still water segment. The former grew 22% year-over-year through March 12, according to data from IRI, providing much of the push behind a 6.8% increase in the overall bottled water category. But with growth of 2.9% and 6% in convenience/PET and jug/bulk formats, respectively, still water carried its weight thanks to the strong showing from premium brands.

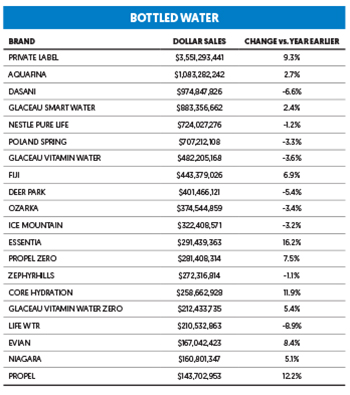

While sales under the Vitaminwater banner stumbled, falling 3.6% year-over-year, Coca-Cola’s smartwater continues to be a strong bet, growing sales 2.4% to over $883 million. Fiji (+6.9%), CORE Hydration (+11.9%) and Evian (+8.4%) have also outperformed, each with a different positioning. According to data from Nielsen cited by Nestlé, premium waters grew 7% during the pandemic, in contrast to a 2% drop for non-premium brands.

As the country begins to enter the post-pandemic era, bottled water brands are looking for new ways to integrate themselves into consumers’ everyday healthy habits. And, thanks to a wave of new functional innovations this spring (see Brand News), along with Nestlé’s recent acquisition of Essentia, the forecast looks promising.

Earlier this year, Nestlé reshaped the bottled water market in just a few deft moves, offloading its North American Waters (NWNA) portfolio — Poland Spring, Deer Park, Ozarka, Ice Mountain, Zephyrhills and Arrowhead, plus the Nestlé Pure Life and Nestlé Splash brands and the delivery service ReadyRefresh — for $4.3 billion in February before taking one of the category’s biggest independent pieces, Essentia, off the proverbial chessboard a few weeks later. The lasting impact of that deal on the overall segment is likely to be one of bigger issues to watch in 2021.

For Essentia, the deal, rumored to be in the vicinity of $700 million, is validation for the execution-first strategy that helped propel the Bothell, Washington-based brand as the poster child for “premium hydration.” As bottled water ascended to the top of beverage category sales, Essentia found space to build a dynamic lifestyle oriented brand rationalized under a single, straightforward SKU — with an unremarkable bottle to boot. According to data from IRI, the brand’s MULO dollar sales grew to over $291 million year-over-year through March 12, 2021, but also led the category in volume sales growth (+5.1%) during that time.

Much of that cumulative growth can be attributed to the robust nationwide DSD network that Essentia has built over the past decade; how Nestlé leverages that system and its existing synergies moving forward remains a big question. On the other hand, Essentia should quickly benefit from Nestlé’s global industry expertise and experience, along with its own distribution prowess.

At the time of NWNA’s sale in February, Nestlé CEO Mark Schneider said the move would enable the Swiss conglomerate to “create a more focused business around our international premium brands, local natural mineral waters and high-quality healthy hydration products.” And for the Swiss conglomerate, the deal says as much about its overall water strategy as it does about Essentia itself. In divesting itself of Poland Spring, Arrowhead and its spread of regional source water brands, all of which saw sales declines this past year, Nestlé is betting that a single, significant high performer in the $2 billion-plus premium water sub-category will be strong enough to make up the difference when efficiencies and cost savings are factored in.

Some of the trends which Nestle had previously attempted to integrate into its regional brands — i.e. caffeine and other flavor innovations — have been shifted to its premium sparkling brands Perrier and San Pellegrino; the former introduced Perrier Energize, a three-SKU line of flavored sparkling waters with caffeine from green coffee and Yerba mate, earlier this spring. Elsewhere, Vital Proteins, which Nestlé acquired last June, markets collagen waters, shots and other types of on-trend functional beverages. With its bases in other growing beverage segments covered, it’s unlikely Nestlé will ask Essentia to change its winning formula.

Amidst all the cash changing hands, the question of sourcing shouldn’t be overlooked either. For years, Poland Spring had gone out of its way to promote and defend its Maine spring source as emblematic of purity and quality, the apex coming with the introduction of premium subline ORIGIN in 2019. At the time, Nestlé indicated that the brand enjoyed high awareness and acceptance outside of the Northeast, yet in offloading it and other source brands for Essentia’s ionized tap water, that calculus seems to have changed. There’s more than one potential cause: Rising concerns over carbon output may have played a role in that evolution, while at the same time the enthusiasm for building a scientific case for alkaline water’s superiority seems to have waned (see Gerry’s Insights). Even some of the more recent success stories in sourced water — Flow, Liquid Death, Icelandic Glacial — have come from brands that have been more vocal about their sustainable packaging and environmental mission than where the water originated.

Even Voss, which has loudly and proudly touted its Norwegian aquifer source since the brand’s inception, has shifted to domestic production for certain products in the U.S. and China in an effort to cut costs and carbon output. Slotting in Nestlé’s water portfolio alongside premium sourced brand Acqua Panna, which is mainly geared toward fine dining and hospitality, Essentia won’t be tasked with shouldering more than it can handle.

Essentia’s deal with Nestlé makes sense for a variety of reasons, but there’s also another factor at play: amidst the deep-pocketed strategics for whom the acquisition was financially feasible, their respective water portfolios are already pretty set. Coca-Cola, PepsiCo and Keurig Dr Pepper (KDP) have all spent heavily to assemble their respective still and sparkling water portfolios over the past 15 years, and look more likely to fund their ambitions in the category by supporting existing brands rather than shopping around for new names. Considering Essentia’s slow development into a major player and the time it took to secure an exit (the brand had been working with Credit Suisse since around 2017 – although Piper Sandler ultimately closed the deal), the prospect of another significant exit in the premium water space feels like it could be some ways off — though the recent jockeying for space in non-alcoholic beverage between beer giants Molson Coors and Anheuser-Busch InBev could add an interesting wrinkle to that plotline.

With Essentia under new management, where does that leave the rest of the field? Toronto-based Flow looks eager to step in, having raised $45 million in private funding in 2020 before announcing plans to take the company public with the goal of adding a further $50 million to its war chest. The brand hasn’t been shy about its aggressive approach, from offering deep promo discounts to chasing DSD houses to adding splashy names to its cap table — Gwenyth Paltrow, Shawn Mendes, Post Malone and most recently NBA superstar Russell Westbrook — but has backed that up with ownership of heavy assets, including two artesian springs and co-packing subsidiary Planet A, with a further two additional North American production sites currently being explored.

In January, Flow chief revenue officer Tim Dwyer told BevNET that the company aims to have 65% ACV in the grocery channel by next year, and to double its current presence in 30,000 U.S. doors over the next 18 months. Leading the charge will be former Nestlé Waters chief Maurizio Patarnello, who joined the company as CEO in March.

Other brands are teasing a different approach — instead of shying away from discussions of single-use bottle waste, they’re embracing it. Zen WTR, with its bottle made from plastic recovered from the ocean, is on the higher-tech side, opposite brands like Liquid Death that are simply putting water in easy-to-recycle cans. Somewhere in the middle is the fast-rising Path (formerly Pathwater). In touting its reusable bottle as its point of differentiation, the brand has made the package a strong visual symbol of its sustainability mission, and is set to deepen that level of engagement with the introduction of add-on accessories such as sleeves and swing caps. Extending that symbolic appeal to brands, events and organizations with custom designed co-branded bottles has also provided another source of revenue and visibility.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe