Skill Set: Sports Drinks Get Specific

For sports drinks brands, every day is looking like game day.

The category’s evolution has been well-documented up to this point: once considered an almost medicinal format used exclusively for fueling athletic performance and high-intensity thirst-quenching, traditional isotonic sports drinks are now part of the greater beverage diaspora, available everywhere from c-stores to soda fountains. As legacy brands have seen their products transcend sports, they’ve been joined by a new generation of companies that look to more intentionally migrate the category into new areas via callouts to hydration, immunity, energy and plant-based ingredients. When placed alongside each other, it can be difficult at times to see where the sports drink category ends and the broader functional water or healthy refreshment segment begins.

But maybe that’s the point. Over the years, the concept of exercise and fitness has moved beyond activities like weight lifting and jogging to include everything from yoga to high intensity interval training (HITT) to Cross Fit and Peloton — and sports drink makers have responded. Rather than offering a unified, one-size-fits-all solution, brands are expanding their range of options to meet users across multiple day parts and use occasions, delivering targeted functional benefits and product experiences that can be part of a daily routine.

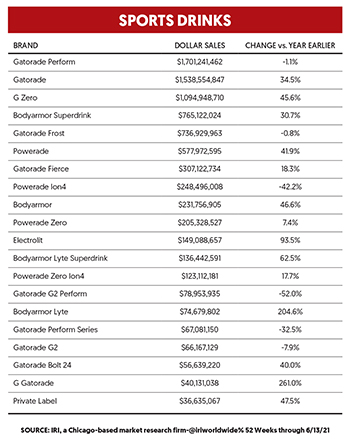

Regardless of the individual strategy, the good news for any sports drink brand is that the category continues to expand. According to data from IRI through June 24, 2021, MULO (including c-store) sales for the segment grew 15.9% year-over-year, surpassing $8.4 billion in total dollar sales. That includes both RTD products and powders.

A “Solution for Any Occasion”

As the category’s dominant player, Gatorade has both the advantage of a front-runner position and the added pressure of meeting the expectations of a changing consumer base. Over recent years, the company has sought to expand beyond its core line with a variety of innovations — added protein, zero sugar and caffeine among them — designed to keep consumers interacting with the brand over the course of multiple day parts and use occasions. In the words of Gatorade’s senior Vice President and general manager Brett O’Brien, the brand’s widening suite of products allows consumers to make their own choices about if and how they fit into that individual’s specific schedule and routine.

“For us, it’s all about options,” said O’Brien. “The future of sports fuel is centered around personalization – the notion that what I need is different from what my teammate needs. In other words, there isn’t a one-size fits all approach for today’s athletes. Our portfolio represents that – personalization and choice.”

At its core, Gatorade’s product development strategy has centered around layering ingredients (and functional benefits) on top of the base offering of “electrolytes for hydration (and) carbohydrates for fuel,” according to O’Brien. From there, the brand can create products that “represent the spectrum of use cases an athlete can have”: so after downing a Gatorade Endurance mid-game, there’s the option for consumers to move to sugar-free Gatorade Zero for recovery or caffeine-added BOLT24 for a quick energy boost, for example. Meanwhile, the brand’s “smart bottle” system, Gx, takes that personalization to the next level by offering a reusable bottle, which can be customized online to feature pro team logos or individual user names, that can be reloaded with single-use flavor pods from across Gatorade’s various product lines.

Yet O’Brien noted that the company has been careful in how explicitly it guides users on how to use its various products. Rather than using package labels text or marketing campaigns to shape consumption behaviors, the idea is rather to leverage Gatorade’s credibility within the athletic community to tailor an experience that feels more personal. The recently launched Gx smartphone app is part of that strategy: developed in collaboration with the Gatorade Sports Science Institute (GSSI), it combines workout analytics and physiological profile to establish a customized preparation and recovery plan, complete with a schedule and targeted progression goals.

“We don’t instruct athletes on how and when to use our products,” O’Brien noted. “We’re developing new products based on what athletes are asking for and trust them to optimize their personal nutrition plan. Again, two athletes on the same team may consume a completely different set of products based on their nutrition needs, flavor preferences, recovery protocol, and other factors].”

But as Gatorade continues to tick the boxes for various callouts — organic ingredients and antioxidants being two others — its room for further growth may eventually grow limited. In May, the company launched Gatorlyte (think Pedialyte-type products) , a three-SKU line of rapid hydration sports drinks aimed at the convenience channel. According to Carolyn Braff, head of brand strategy at Gatorade, the product is designed to serve short-duration exercise occasions or individuals who may sweat heavily, as opposed to drinking the core Gatorade line when “fueling” for high intensity sports. The difference? The latter contains more carbohydrates — 36 grams, compared to just 8 grams per 20 oz. bottle for Gatorlyte.

While that may seem like a slight difference to the casual consumer, O’Brien noted that Gatorlyte was developed based on insights and feedback from athletes who were actively searching for a rapid hydration product. In fact, Gatorlyte was already being used in powder form on “NFL sidelines and in the top endurance races in the world” for years before being adapted into a ready-to-drink format.

What drives our innovation pipeline is athlete testing, direct feedback and usage with the best athletes in the world. It informs everything we do, from new products to new flavors, to new form factors,” he said. “Knowing every athlete is looking for something a little different, we strive to offer a solution for any occasion.”

Elsewhere, Gatorade’s chief rival BODYARMOR — now the category’s second largest player, surpassing Coke’s Powerade — has taken a slightly different tactic in its efforts to reach users throughout the day. The brand’s latest innovation, BODYARMOR Edge, introduced in February, showcases the brand leveraging its credibility in the space to expand its platform and transcend the category’s traditional boundaries. The 4-SKU line features 100 mg of natural caffeine and over 1,100 mg of electrolytes per 20 oz. bottle

Though Edge isn’t BODYARMOR’s first platform extension, the product’s performance thus far suggests that consumers are buying into the brand’s vision. During a fireside chat in April with Bonnie Herzog, managing director at Goldman Sachs Equity Research, BODYARMOR co-founder and chairman Mike Repole said the line is expected to generate between $125-150 million in sales and is on pace for around $93 million in revenue in its first year; for comparison, he noted, it took seven years for core line to reach $100 million. Alongside the company’s other lines — reduced sugar Lyte is projected to sell between $300-350 million and BODYARMOR Sports Water is expected to reach $150 million — the performance of Edge thus far is fueling the company’s projections that the sports drink segment will surpass $10 billion by 2024 and $15 billion by 2030.

“There’s been an awakening in this category where it had been flat for many years and now it is growing in double digits,” BODYARMOR president Brent Hastie told Herzog: “Brands like BODYARMOR have come in and reshaped how you can address those needs, and drive incremental growth. One of the strongest data points we have about our brand is that 75-80% of growth is incremental.”

Outside of RTDs, targeting specific use occasions has also been a boon for powdered products like nuun, Hydrant and Liquid I.V. When combined with a convenient and travel-friendly form factor, the concept of using throughout the day becomes more intuitive, i.e. throwing a sleep-boosting powder stick in your travel bag, or keeping a tube of dissolvable tablets in your gym bag.

One Solution, Multiple Occasions

While building products around specific use occasions is one approach, it’s not the only way to go.

For Pennsylvania-based brand ROAR Organic, the strategy has been the opposite. In June, after gathering feedback and conducting extensive consumer research, the company debuted a new formulation for its flavored hydration drinks that features 100% daily value of vitamins B5, B6, B12 and C, plus antioxidants in the form of vitamins A and E. Billed as a “complete hydration solution,” the four-SKU line aligns with broader health and wellness trends — organic ingredients, low sugar, reduced calories — rather than specific sports or athletics-related callouts. The motivation? ROAR’s core consumers were already using the product for refreshment and hydration throughout the day on their own. Post-makeover, the drink’s formulation and its packaging, which has also been revamped, is meant to emphasize “anytime” use.

According to CEO Alexandra Galindez, the brand has no plans to start adding targeted SKUs or attempt to change consumer behavior. Rather, by diverting from the approach taken by others in the general sports drink category, ROAR stands out simply by being different. It’s not necessarily a path that brands like Vitaminwater or Bai have gone down previously, but with ROAR’s targeted female demographic, it’s an identity that the company has room to grow with.

“That’s just not who we want to be,” Galindez said in reference to the category’s isotonic giants during an interview earlier this year. “If you take a look at the brand now, you can see that it’s a beverage that you would drink all day.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe