Spirits group Brown-Forman reported 8% organic growth in its fiscal 2023 year, fueled by its major whiskey brands Jack Daniel’s Tennessee Whiskey and Woodford Reserve, as well as the launch of Jack & Coke ready-to-drink cocktail, the company reported in its Q4 earnings presentation today.

Spirits group Brown-Forman reported 8% organic growth in its fiscal 2023 year, fueled by its major whiskey brands Jack Daniel’s Tennessee Whiskey and Woodford Reserve, as well as the launch of Jack & Coke ready-to-drink cocktail, the company reported in its Q4 earnings presentation today.

Net sales increased to $4.2 billion for the Kentucky-based company, with growth across portfolios reflecting a “normalization in trends” compared to the double digit increases enjoyed by major brands last year. For the fourth quarter, reported net sales increased 5% to $1 billion. Despite price hikes, the company struggled with higher expenses due to supply chain challenges, raw materials, and packaging.

Net sales in the U.S. grew 3% driven by higher volumes of Woodford Reserve, higher prices across the portfolio led by the Jack Daniel’s family of brands including the launch of higher-end bonded series, and the debut of the Jack Daniel’s & Coca-Cola RTD. Lower volumes of the standard Jack Daniel’s Tennessee Whiskey line partially offset the growth.

Globally, the company’s premium bourbons, propelled by strong double-digit net sales growth from Woodford Reserve (26%) and Old Forester, delivered 23% net sales growth fueled by stronger consumer demand in the U.S. Gains for Woodford Reserve were partially due to the estimated net increase in distributor inventories, while Old Forester’s growth was driven by higher volumes and pricing.

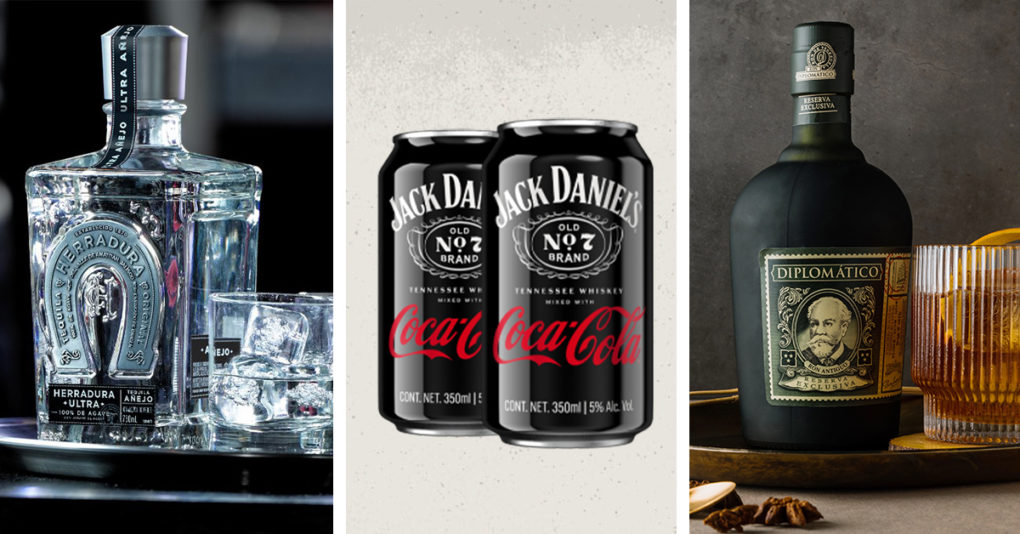

The Jack Daniel’s family of brands’ reported net sales growth of 4%, led by Jack Daniel’s Tennessee Whiskey in international markets and the travel retail channel. Jack Daniel’s RTD portfolio earned double-digit net sales growth (11%) fueled by the launch of its collaboration with Coca-Cola. After debuting in Mexico last fall, the RTD rolled out in the U.S. in March. Tequila RTD New Mix, which launched in Mexico over 20 years ago, gained market share in the country with sales growth of 53%, driven by higher volumes and prices.

“RTD has also served as a consumer recruitment vehicle: they bring new consumers of legal drinking age into the Jack Daniels family, which we believe will have a positive impact on the full strength family of brands,” said Lawson Whiting, Brown-Forman president and CEO. “We will continue the product launch and additional markets around the globe throughout the 2023 calendar year.”

Tequila portfolio growth was also positive, increasing 10% thanks to gains made by El Jimador (13%) and Herradura (11%). El Jimador experienced broad-based growth across all geographic clusters, led by emerging markets and the U.S., while Herradura’s sales were driven by higher prices and volumes in Mexico and growth in the U.S. The company recently announced a $200 million investment in its Casa Herradura distillery.

“We believe the strong consumer interest in tequila will continue for the foreseeable future and we are investing significantly behind these brands,” Whiting said.

Last year the company also made other investments in its premium and above portfolio, with acquisitions of ultra-premium gin, Gin Mare, and the Diplomático Rum family of brands, which hold top placements for super and ultra premium rums.

“Given the timing the brands only impacted reported net sales in fiscal 2023 by approximately half a point,” Whiting said. “However, as we continue to integrate these brands and teams in your organization, we expect them to be meaningful contributors to our growth over the long term.”

The company expects net sales growth for fiscal 2024 to be in the 5% to 7% range.