Ready-to-drink products have built their brands around different cocktails: some are sessionable seltzers or old classics, others are obscure cocktails that haven’t yet hit mainstream. But Gin & Juice By Dre and Snoop, so far, is the only one that has emerged from a 90s rap anthem.

The cocktail, named for the iconic “Gin & Juice” by West Coast rap legends and business moguls Dr. Dre and Snoop Dogg, launched in February. To get the product off the ground, the duo tapped the creators of RTD On The Rocks (OTR): Patrick Halbert, now CEO; Andrew Gill, chief strategy officer; and Rocco Milano, executive vice president of sales. The team has since been on an aggressive sales push, aiming to leverage over 30 years of pop culture relevance to build Gin & Juice as the RTD gateway to gin, the spirit base for any future innovations from the team.

Suntory Spirits bought OTR in 2020, and Milano stayed on, building the brand into the 5th highest-selling RTD brand family in the latest off-premise data from NIQ. Founded in 2015, OTR was ahead of the RTD curve by boasting bartender-level on-the-go cocktails with premium ingredients. Initially inspired by conversations with Virgin America’s food and beverage team, former bartender Milano found a niche in airline and hospitality channels, which Suntory still prioritizes.

The OTR team eagerly reunited when Halbert was approached by the famous duo to bring the track to life. Snoop and Dr. Dre had ideas about the branding and goals, and Halbert said it was the group’s reputation as a “scrappy, aggressive and impatient” bunch with experience from startup to exit that led them to get the call.

The team spent about seven months developing the product in time for the brand’s targeted launch — a Super Bowl launch party that coincided with the 30th anniversary of Snoop’s 1993 debut album, Doggystyle, produced by Dr. Dre. To celebrate, the marketing team recreated their own version of the opening scene from Martin Scorsese’s 1990 mob classic, Goodfellas, a hint at future playful spots to come.

The 5.9% ABV canned cocktail is available in four flavors: Citrus, Melon, Passionfruit, and Apricot. Rollout began via Southern Glazer’s Wine and Spirits at chain grocery stores and on-premise establishments, and has since depleted 135K 9-liter cases through 15,000 accounts across 41 states. It has also launched in the U.K.

Premium State Of Mind

It’s 30 years since the track debuted, though – so why is now the time for Gin & Juice? For starters, there’s the booming RTD market, which thus far is one of the few sectors of the spirits business that has not yet been overwhelmed by celebrities. Now Gin & Juice is among the celebrity-backed RTD ventures making their mark: revenue numbers have just about doubled for celeb-backed RTDs since May of last year.

Also, Snoop and Dr. Dre have separately built booming business careers outside of the studio. For the near-ubiquitous Snoop (see: Olympics), the RTD represents another foray into beverage; he’s also launching brands in cannabis, coffee, wine (with buddy Martha Stewart too) and spirits. Dre, meanwhile, partnered on the Beats Electronics audio line, which was sold to Apple for more than $3 billion. The RTD project represents the duo’s first company together.

Gin & Juice’s flavors aim to reflect the founders’ stage in life as cultural icons, said the team. (The brand has started leveraging “Culture in a Can” as a tag.)

“Now that these guys are in a premium state of their business careers, we didn’t want to do something that was cheap and a sugar bomb,” Halbert said.

The crew aimed to cast a wide net, not too sugary or high in ABV to make it accessible, while pushing the boundaries of flavor. The product needed to be all-natural, Whole Foods Market-compliant, with balanced flavors that deliver “something different and interesting.” Apricot won out over, say, the more common black cherry, Milano mentioned as an example.

The packaging design also fits into that premium ethos, which comes from Switzerland-based, Nigerian-American designer Ini Archibong, who has produced collections with brands such as Hermès, Knoll, and Logitech. On-pack branding elements have allowed retailers to create case stacks crafting the full car together across flavors and build floor displays.

Creating A “Gin Gateway”

Hitting the desired flavor notes was especially important for a gin-based cocktail, which ranks as one of the least popular cocktail bases in canned cocktails. One of the leading RTDs, The Finnish Long Drink, is made with gin, but that brand has focused its marketing on other attributes over its ingredients. Gin & Juice is taking a different approach.

“The idea of encouraging a gin-aissance and encouraging more consumers to try gin through the ready-to-drink product is step one,” Halbert said.

The gin market is “due for a rebirth,” and partnering with Snoop & Dre on a portfolio of American gin is an opportunity to shake up the category, said Gill. After luxury spirit sales took off during the pandemic, growth at the top-end of many spirits categories – namely tequila, vodka and cognac – has slowed over the last year. But gin’s premiumization run seems to be the spirit’s only bright spot and have a longer life: ultra ($35+) was the only segment to experience sales growth (+15.2%) in the 52-week period ending June 15 in off-premise outlets, according to NIQ. A few other players are also betting on a coming ‘gin-aissance’ in the U.S. although many of them are hedging their bets on global offerings: this year Spirit of Gallo backed a Mexico City’s Condesa Gin and Emma Watson’s Renais Gin entered the U.S. this summer.

The team was tight-lipped about the upcoming gin launch, but said they are planning to approach the category by staying away from its medicinal roots (the gin and tonic was first invented as an antimalarial agent) and will encourage showcasing the spirit on-premise in a variety of cocktail styles and techniques.

The RTD has already pushed into the U.K. market, where gin hit its peak a few years ago, but the team is betting on its founders and “outside of the box” marketing plans to continue pushing sales on both sides of the pond.

“We’re Loud and Aggressive”

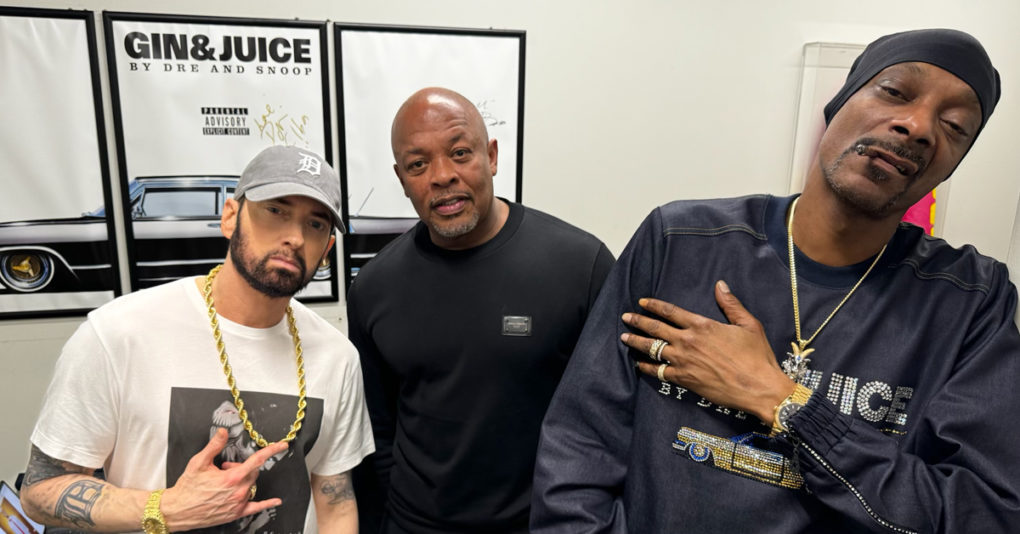

Since launch, Snoop and Dr. Dre have been busy leveraging their names on behalf of the brand, particularly into sports partnerships. Those deals include a World Wrestling Entertainment sponsorship, deals with the Mets, Yankees, and a college tailgate tour across universities. In December, the “Snoop Dogg Arizona Bowl Presented by Gin & Juice By Dre and Snoop,” will represent the first alcohol partner as the presenting sponsor in an National Collegiate Athletics Association Bowl Game. The duo has also teamed up with fellow rappers: the brand was one of only three brand sponsors to be involved with Kendrick Lamar’s ‘The Pop Out’ concert, and recruited Eminem for its U.K. launch party performance.

On the ground, 18 members of the former On The Rocks team have reunited behind Gin & Juice, and the sales team is aiming to use the momentum generated by its famous founders and its track record with OTR to get into retailers.

Company culture has been built around “putting everyone in a position to be successful,” said Halbert, with Milano adding that the company aims to fuel an environment of camaraderie and support while embracing the style of being “loud and aggressive.”

“I want people who are going to be supportive of their teammates,” Milano said. “But if someone posted last week that they got a 300 case display, I want someone else to say they’re going to go out and get a 350-case display.”