Frothed Function: Can Added Benefits Compete With RTD Coffee’s Sweet Addiction?

It wasn’t that long ago that the ready-to-drink cold case offered minimal coffee options. But after years of mostly being dominated by familiar names, the set has swelled with cold brews, nitro infusions and alt-dairy lattes, providing numerous choices for the on-the-go coffee drinker.

With that increasing competition, lots of high-end or innovative coffee brands have come and gone; meanwhile, recognizable names like Starbucks, Monster, and relative newcomer Dunkin’ have continued to dominate share with sweet, calorie-dense offerings. So how should new brands battle the Vanilla, Caramel, Mocha varieties?

Some aren’t – they’re just taking their otherwise high-quality ingredients and mixing them in with those sweet profiles. Others are taking a different route, however, iterating on coffee’s caffeine-centric functionality and either doubling down on enhanced energy or focus propositions, or other functions, like protein, hydration or vitamins.

Here, the sweetness is paired with cross-category value propositions for health-conscious consumers that go beyond lower calories or higher caffeine. Still, with the divide so strong between beverage giant distributed brands and the rest, even brands bringing functional ingredients packaged as indulgent treats need patience, scale and a segmented growth strategy to brew success in RTD coffee.

Light And Sweet

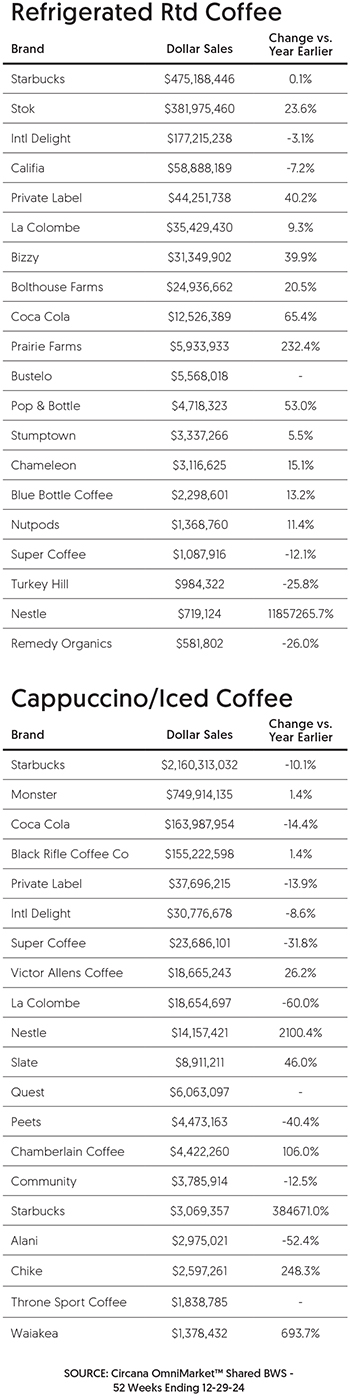

Starbucks, as it has for years, still sits comfortably at the top of the RTD iced coffee category, dominating about 63% of cappuccino/iced coffee dollar sales in the last 52-week period ending December 29, according to Circana’s most recent MULO+C data. Monster trails Starbucks in the set with nearly 22% of dollar sales.

Leveraging their respective names’ weight in coffee and energy, the two companies have leaned into what consumers are demanding: dessert as an on-the-go coffee drink.

“Leaning into indulgence is a very viable play with coffee,” said James Watson, Rabobank senior beverage analyst.

In March 2024, Starbucks introduced canned coffee drinkers to updated packaging of some of its RTDs. The refreshed labels called out higher caffeine levels while also going after sweet-toothed consumers with new flavors like Caramel Waffle Cookie, Dark Chocolate Brownie, Vanilla Sweet Cream and Oatmilk Brown Sugar.

In the last two years, The Coca-Cola Company has attempted to pull share in coffee by pushing deeper with its two licensed brands: Dunkin’ and Costa Coffee. On the one hand, the Dunkin’ Bakery Series screams ‘sweet-treat’ with flavors like Cake Batter Donut or Coffee Cake Muffin. On the flip side, Costa offers a more toned-down approach with familiar offerings like Mocha or Caramel that are 150 calories or less and claim to have 40% less sugar than leading RTD coffee drink brands.

Meanwhile, Wisconsin-based Trilliant Food & Nutrition’s Victor Allen’s brand made its own licensing moves starting with Snickers- and Twix-flavored coffees and adding in Breyer’s Cookies and Cream ice cream and Cinnamon-Toast Crunch branded drinks. The strategy appears to be paying off with dollar sales up 26.2% and Victor Allen’s edging out La Colombe in MULO.

It could be the pendulum swinging back after specialty roasters flooded shelves with pricier products or it could be price-conscious consumers looking for something satisfyingly sweet, but “people just want good flavor and they are willing to sacrifice some health benefits for that,” said Los Angeles Distributing Company president Arthur Flores.

How Cold Brew Is Rewarming

Cold brew, once seen as a big opportunity in RTDs, has seen numbers return to growth. Dollar sales were down 35.5% to $163.1 million in Circana’s January 2024 MULO data; in the latest 52-week period, cold brew dollar sales hit $221 million up just over 1% year-over-year. Unit sales were down 0.5%.

Part of that recovery might be coming from following the caffeinated indulgence playbook.

With a nod toward familiar sweet treats, Bones Coffee brought its playful style to five new cold brew latte flavors – Sinn-o-bun, French Toast, Holy Cannoli, S’morey Time and Electric Unicorn Fruity Cereal. While still trailing far behind category leaders, Bones is now just behind RISE Brewing and Stok in cold brew with sales up 57,818.3% to $6.1 million in the last year. Unit sales also skyrocketed to 91,858%.

While Chobani’s $900 million acquisition of La Colombe signaled the yogurt and creamer brand’s confidence in expanding the cold brew set further into premium RTDs, La Colombe has also brought sweeter innovation into its portfolio as well.

La Colombe has launched seasonal cold brew latte varieties like Strawberry Mocha for Valentine’s Day or Peppermint Mocha during the holidays. As a whole, La Colombe continues to grow its dollar sales, posting a 212% increase as unit sales were up 279.5% in MULO.

Some of La Colombe’s success comes from its “consistency” in the category, Watson said. “They have a novel approach which includes a differentiated taste to other [RTD] coffees. They have experimented with oat milk, other flavors and caffeine levels, but their overall portfolio has been fairly narrow.”

The company has also been “pretty aggressive” with its distribution, first with Molson Coors and now with Keurig Dr Pepper (KDP), Watson added.

Importantly, they have a price point that resonates with RTD coffee drinkers, Watson said.

“[RTD coffee] is a hard category to execute on,” he said. “When we’re thinking about startups coming in, the hurdle of technical production is much higher and takes more time, more money, and maybe more luck to get right.”

Whether it’s JAB Holdings’ Stumptown or Nestlé’s Blue Bottle, specialty roasters that have gone deeper in RTDs have benefited from the deep pockets and distribution networks of their ownership groups

Yet for L.A. Distributing, it has become harder to sell another premium canned coffee.

“There is no more room in the high-end coffee category,” Flores said. “If we brought on another cold brew right now, our retailers would say: ‘What are you doing?’ Every coffee shop wants to start a cold brew to compete with Stumptown and Groundwork but you would be like fifth or sixth in line. You missed the boat.”

Adding Functional Value To Flavors

If the cold brew set has become too competitive and the top of the category has gone all-in on flavor-first indulgence, where does that leave insurgent brands to innovate?

One set of brands is looking across the beverage landscape towards the growing functional space. Consumers will pay a little more for the added benefits, Watson said.

“Canned coffee is not the best place to get a true craft coffee aficionado experience,” he said. “But it’s much easier of a place to get protein, mushrooms or adaptogens and everything else. And that’s why this is worth a little bit more.”

Four Sigmatic, Laird Superfood and Clevr have all stayed out of RTDs despite the rise of mushroom coffees. The few success stories in fungi-infused java are Taika and Pop & Bottle, which have positioned around adaptogenic lattes formulated with functional mushrooms like reishi and lion’s mane.

CBD had its moment with Altitude Beverage which tried its hand at the early enthusiasm around the cannabinoid but discontinued the CBD coffees in 2023, opting to go after infused mocktails instead.

When it comes to functional it might just be about leaning into an understandable trend like high-protein that is playing out across food and beverage. According to data compiled by Brightfield Group, 22.8% of coffee-consuming survey respondents were on high-protein diets.

“From our perspective, the future of the category is definitely in better-for-you,” said Jordan DeCicco, co-founder and CEO of Super Coffee, an early adopter of functional lattes.

When the business launched in 2015, the focus was on protein-fortified lattes with less than 100 calories per 12-ounce bottle. Early enthusiasm for the brand’s core product led it to move quickly with channel expansions and new flavor variations.

“That turned out to be the wrong strategy,” DeCicco said. “We learned that you have to segment by channel, customer and usage occasion. This is what Starbucks has done really well over the years. They always relied on frappuccinos, but they’ve differentiated their portfolio and given different consumers different need states, especially within different channels. We’ve followed that approach.”

Although Super Coffee has tested other formats like packaged grounds, pods, creamers or sparkling drinks it has moved deeper with its core value propositions: protein and energy.

With protein, Super Coffee is currently launching a Protein+ line in Mocha and Vanilla Latte flavors with 25g of protein per 12 oz. bottle. Aside from a brief foray fully into energy drinks, the brand expanded with Super Coffee XXTRA, with 200mg of caffeine and 7g of protein as well as a Double Shot Espresso And Cream line that doesn’t contain added protein or MCT oil.

Other brands like Stok are doubling down on the opportunity to cross over into energy. The brand just launched Cold Brew Energy, which calls out its focus-supporting attributes on front-of-pack by incorporating ginseng and guarana in the formulation. Black Rifle Coffee took a similar approach to “focus” by fortifying its RTDs with MCT Oil and amino acids. The brand also went directly into energy with a portfolio expansion of coffee-free caffeinated drinks this year.

Hydration is the latest functional trend to make its way to coffee. Former Coke executive Michael Fedele launched Throne Sport Coffee last year, leveraging the high name recognition of key investor and Super Bowl-winning quarterback Patrick Mahomes.

The electrolyte-infused canned coffee has targeted the “limited options” for “active consumers” seeking an RTD brew “before, during and after athletic exertion,” Fedele told BevNET Magazine.

The brand went so far as to get NSF Certified for Sport status and trademark “Coffee PLUS+,” signaling the added benefits of B vitamins, electrolytes and BCCAs (branched-chain amino acids). Although the brand is going after the fitness-oriented energy drinks consumer in the convenience channel, Throne is “coffee at the end of the day” and prefers placement in that section of the cold case, Fedele said.

“Active adults and athletes consume a lot of coffee, and oftentimes they want something with very little sugar or dairy because they’re mindful of what they’re putting into their bodies,” he said.

After initially hitting the market with 4-SKUs (Black, Mocha Java, Salted Caramel and French Vanilla), the brand recently unveiled a Mint Mocha variety and has gone chainwide in QuikTrip, adding to 1,100 locations to its over 4,000 store footprint. It is also readying to launch into about 250 Whole Foods Markets in March.

The jury is still out on the marriage between sports drinks and RTD coffees but Rabobank’s James Watson does believe that the category’s future lies in bringing more functional ingredients and new value propositions to consumers.

“RTD coffee is waiting for a virtuous cycle,” he said. “There comes a point in the development of a category where you should have a bunch of new entrants that generate a bunch of new shelf space and a bunch of new eyeballs from consumers. It won’t last forever, but it’s a wonderful growth phase and although [RTD] coffee has grown wonderfully without all of that, it would really benefit from a couple of years of it.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe